Entering State Forms: Alabama

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter State Forms.

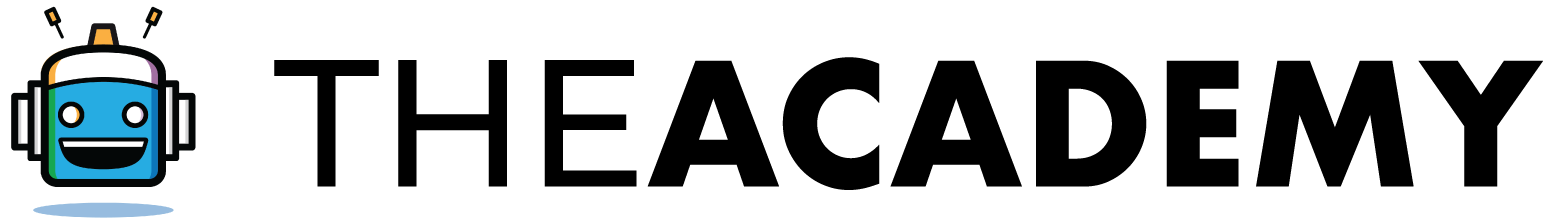

- Under 'State Information' details (from the Main Information Sheet), if you put a full-year resident in Alabama, you'll see the corresponding state forms you need to fill up appear in red.

A. How to Enter Form AL 40 Pg 1

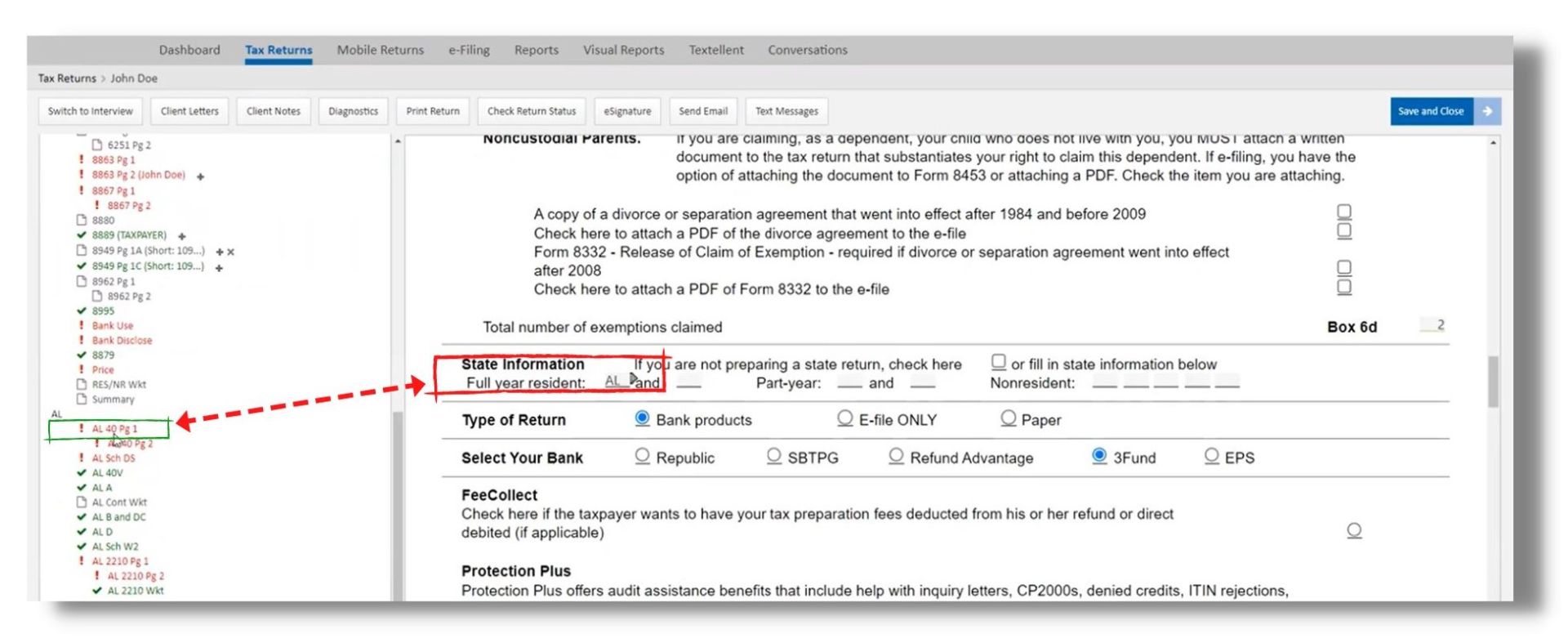

- For Form AL 40 Pg 1, all you need to do is to look for the red cells that need to fill in.

- The first question you need to answer is whether the taxpayer is the Head of the Family or not. So always know the qualifying requirements as head of the family status.

Here are the qualifying requirements;

- Must be unmarried.

- Have at least one qualifying dependent.

- Pay more than half the cost of maintaining a home for that dependent.

- Dependents can include children, grandchildren, stepchildren, nieces, nephews, or anyone under 19 (24 if a full-time student) who lives with them for over half a year.

- Dependents can also include adults supported by them, such as parents and adults children.

(See below example Form)

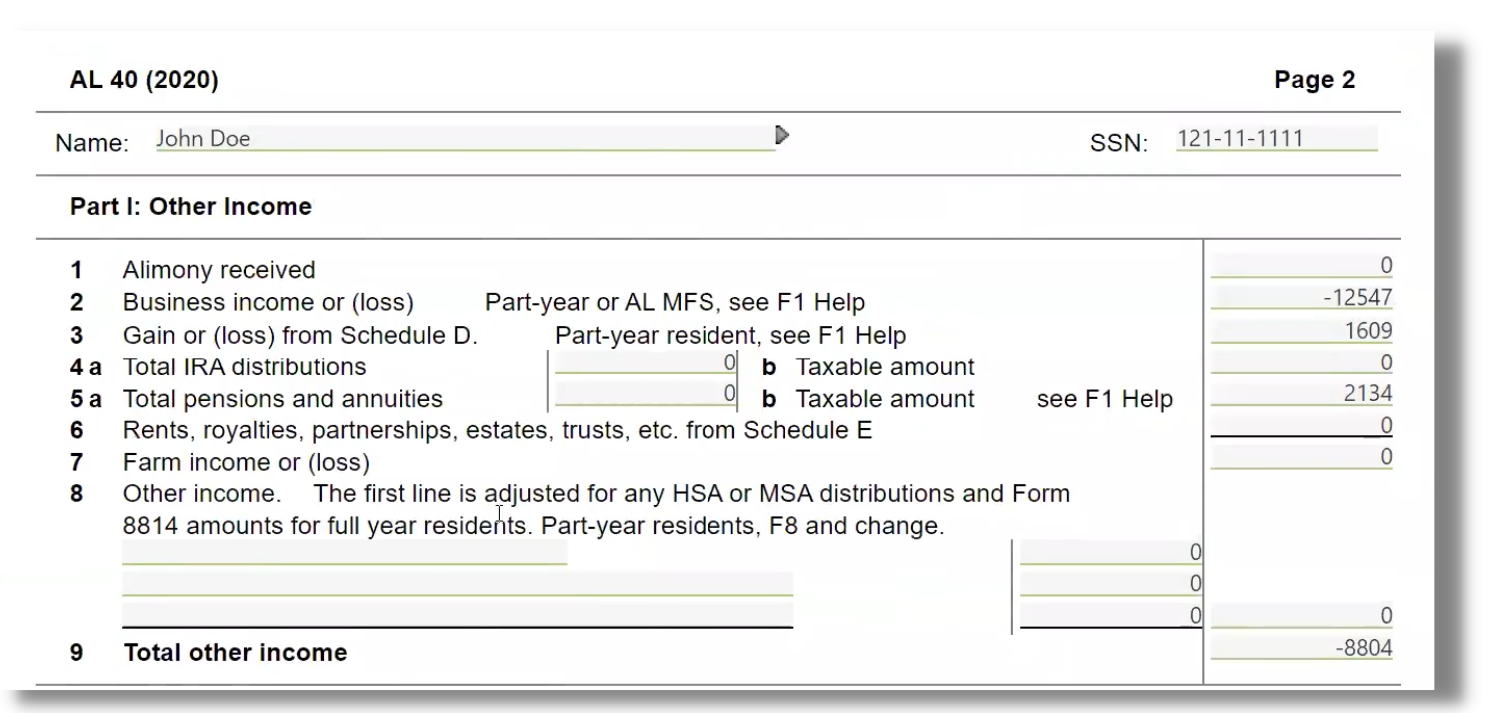

B. How to Enter Form AL 40 Pg 2

1. Next, click the Form AL 40Pg 2 and look for any red that needs to fill in. Mostly the cells are calculated.

( Below image is an example of the Form)

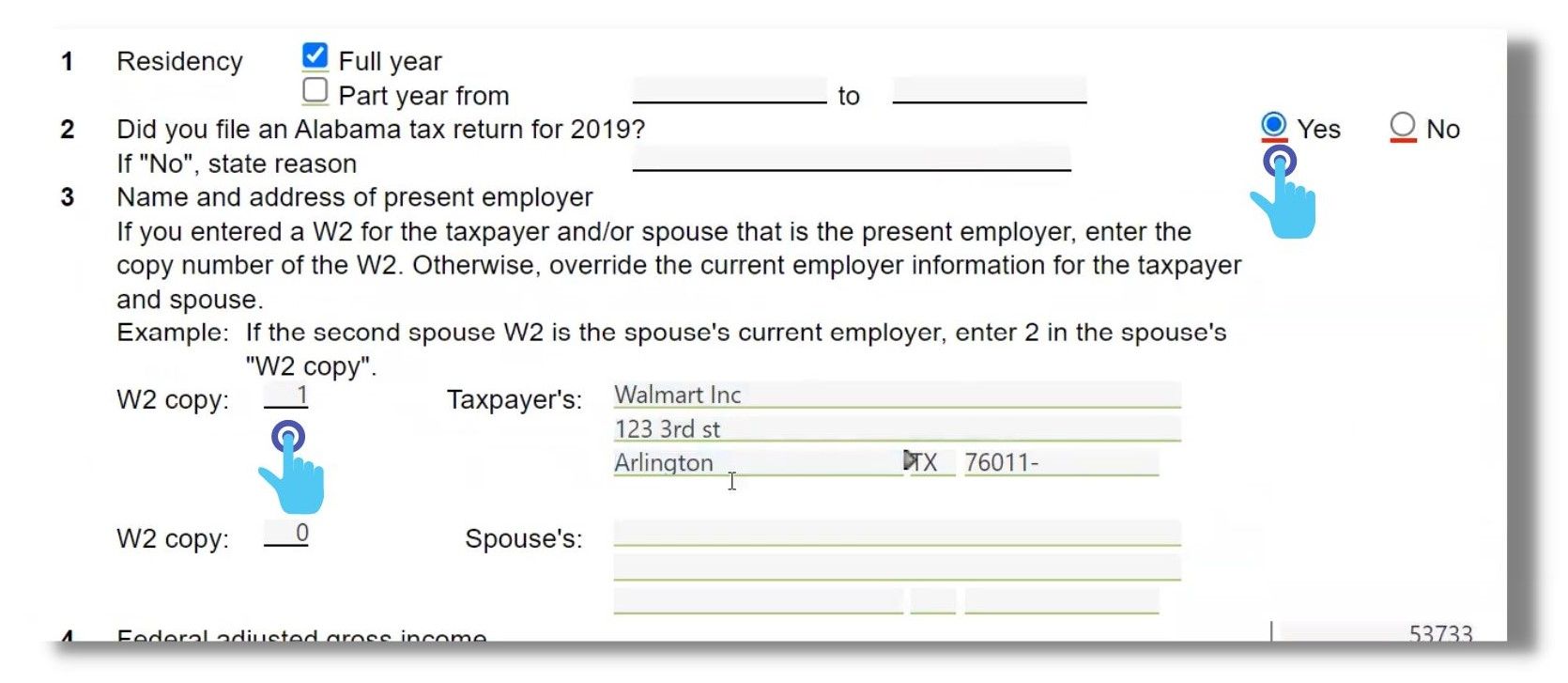

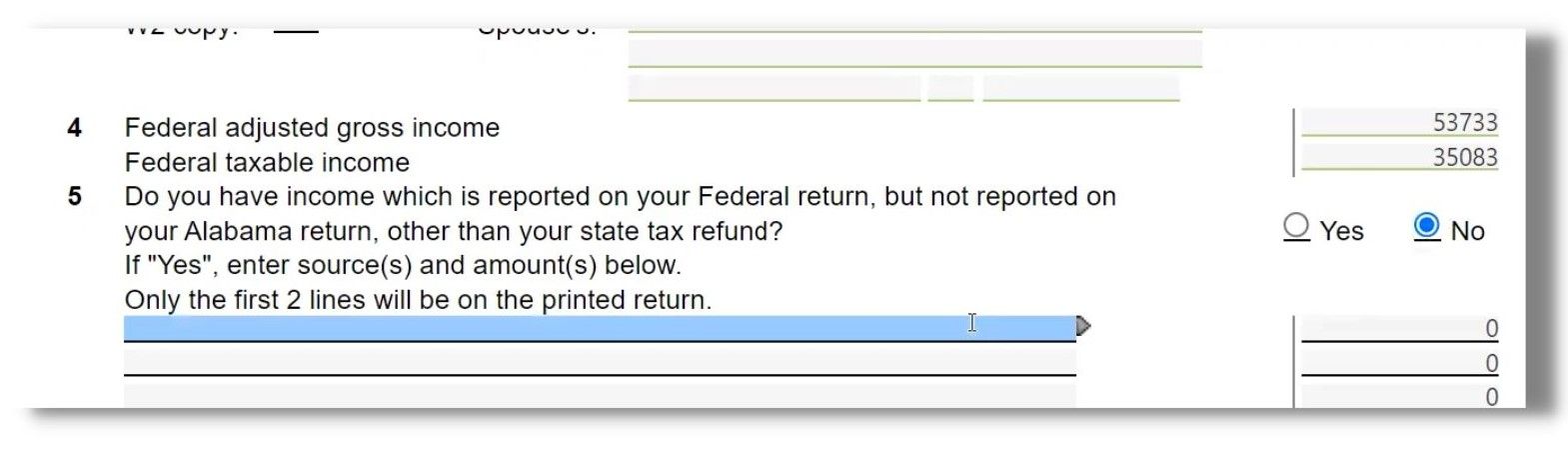

2. For the below example, assuming the taxpayer had only one W2, you click that one, and then the taxpayer's details will appear.

3. For the #5 question, assuming the taxpayer is a full-year resident in Alabama, it's a No. Otherwise, state the reasons.

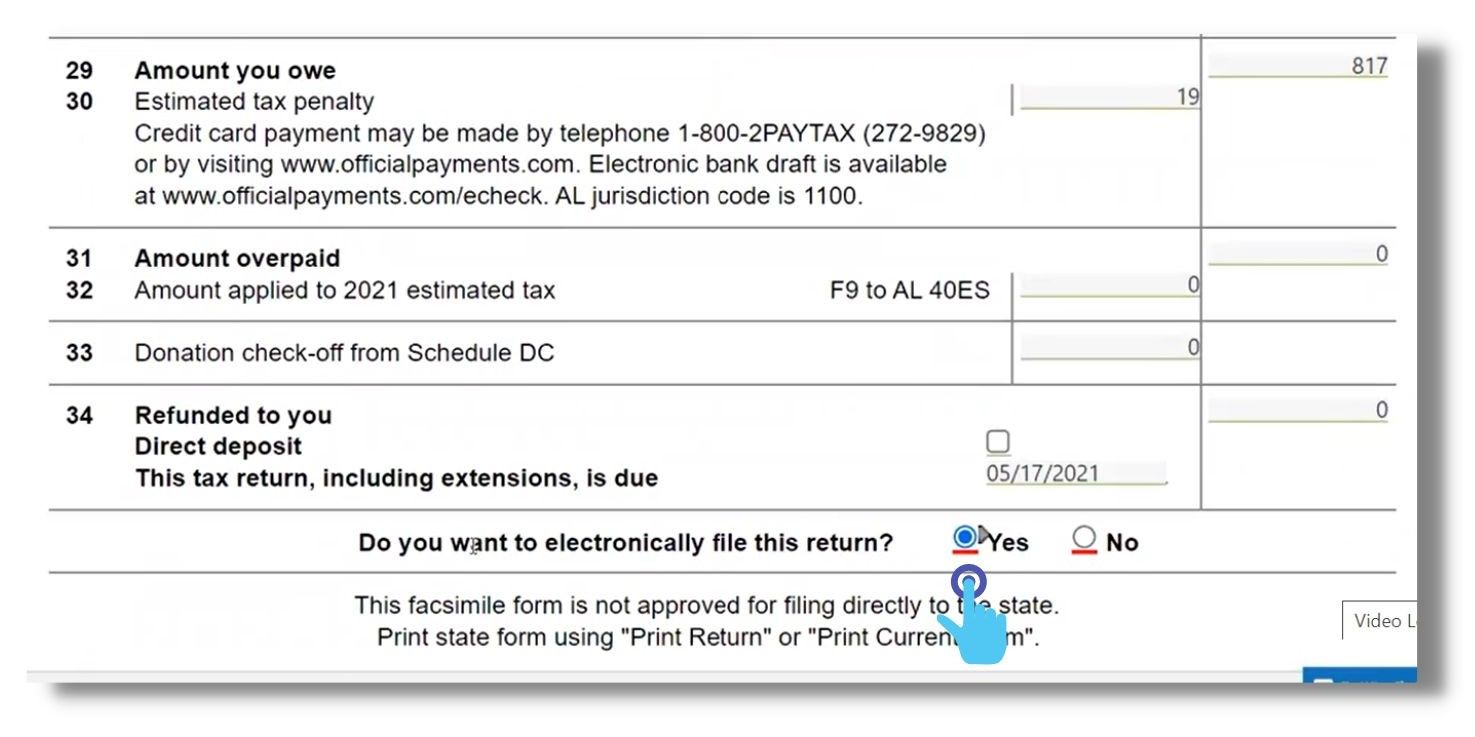

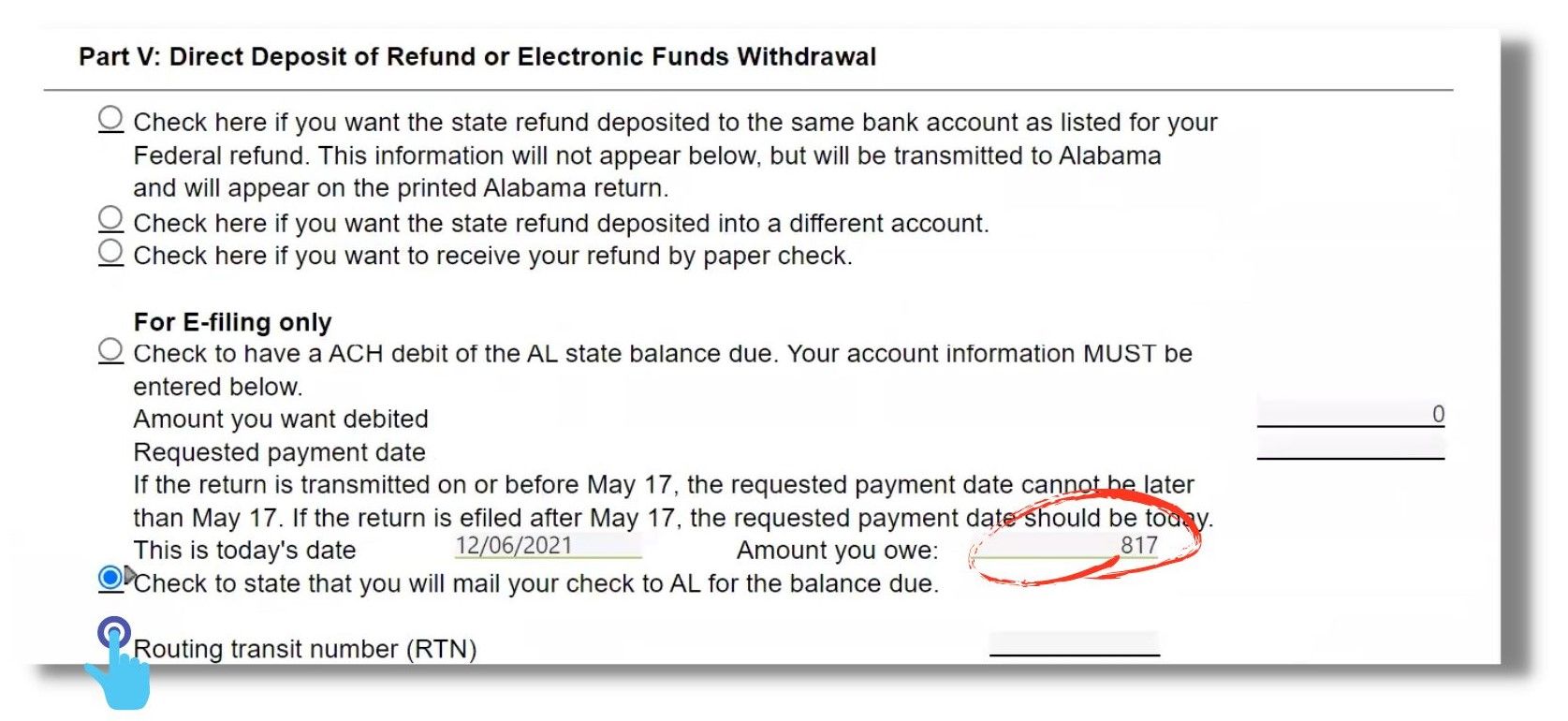

4. For the below scenario, the taxpayer owes $817, so you need to click 'Check to state that you will mail your check to AL for the balance due."

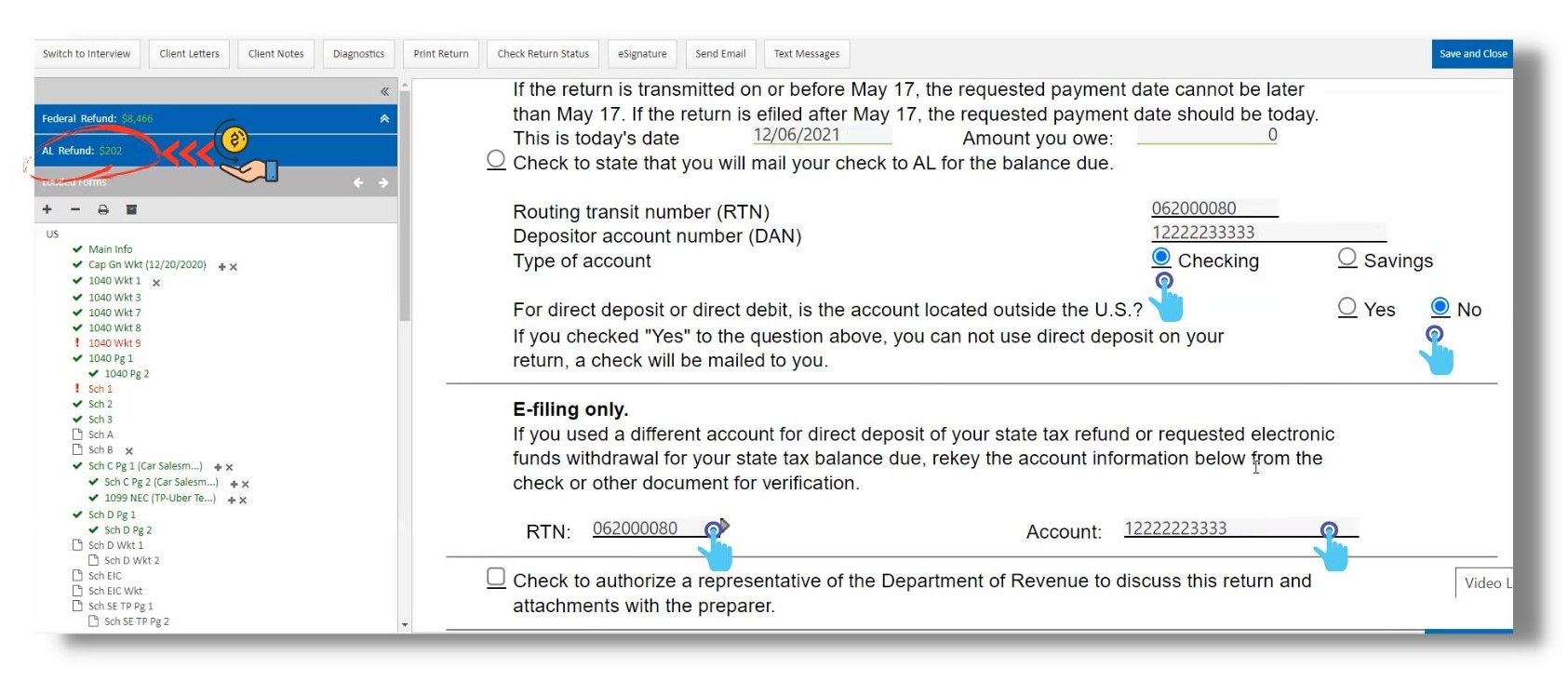

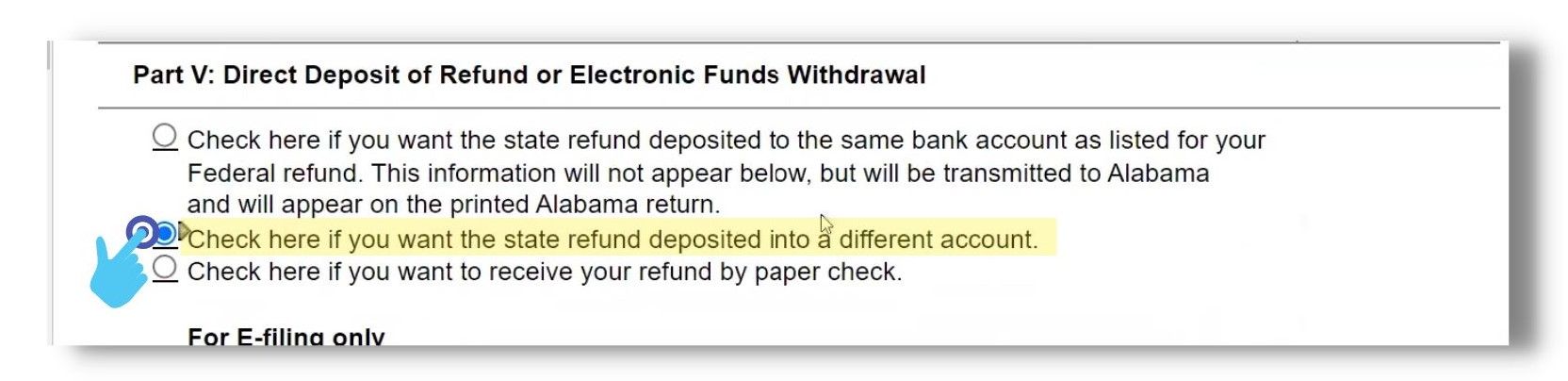

5. For the below scenario, the taxpayer has a state refund. You'll then be directed to choose an option under Part V. In this case; you always choose to deposit the state refund into a different account.

- Here, you will then input the bank details and make sure to enter the correct account number.

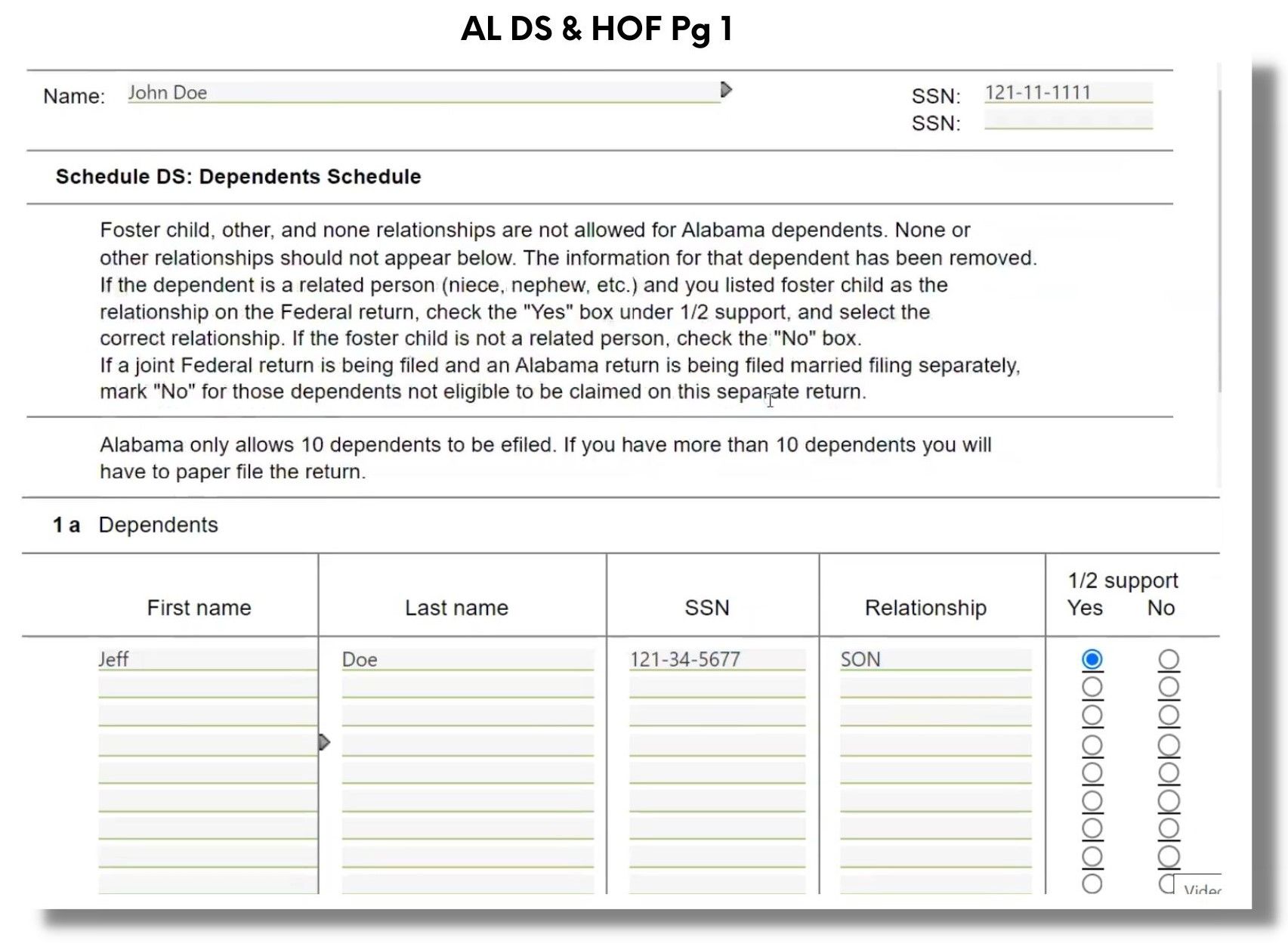

C. How to Enter Form AL DS & HOF ( Dependent Schedule and Head of the Family )

1. On Page 1, #1a, the answer should be a Yes.

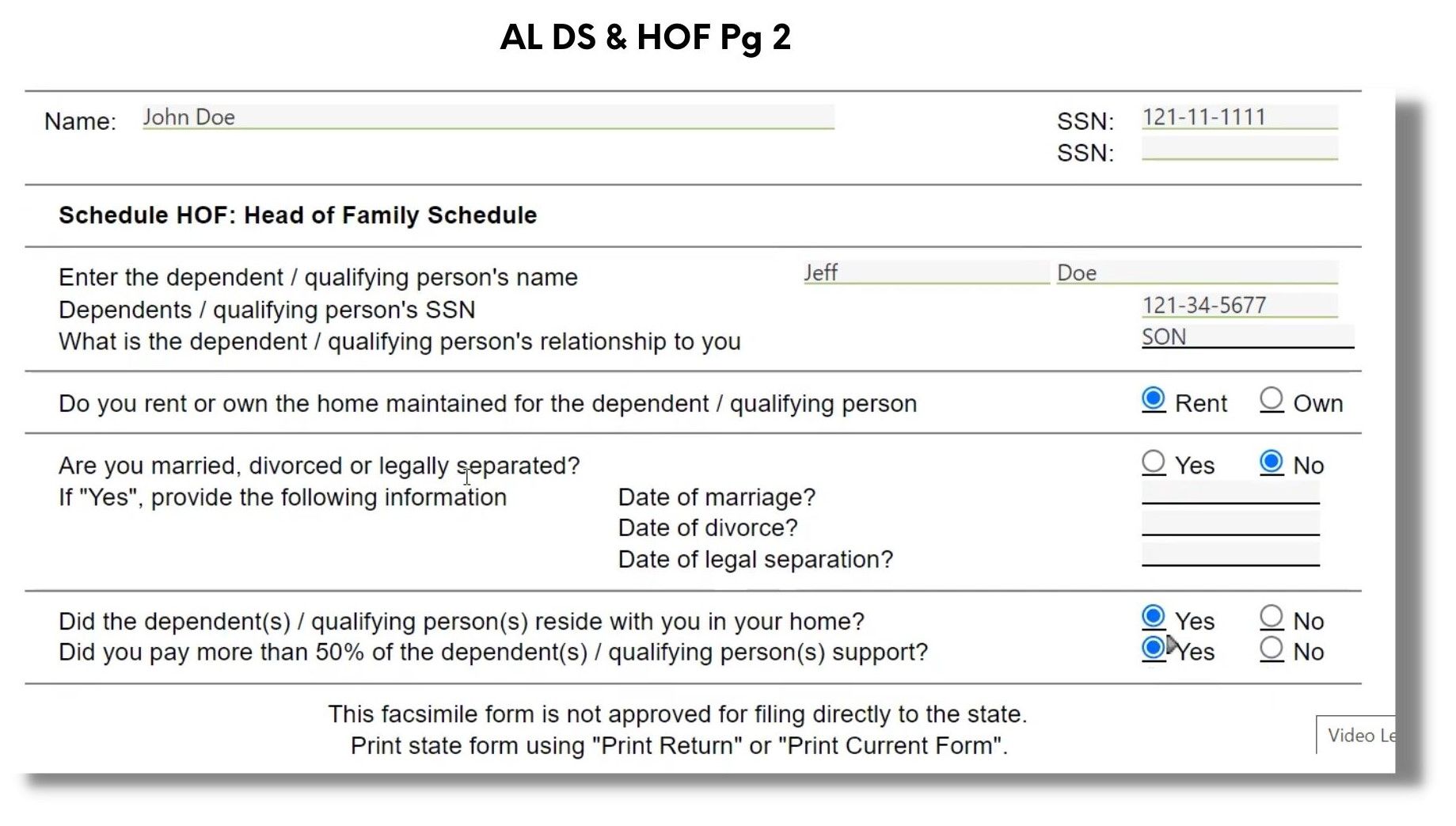

2. On page 2, you need to answer these questions accordingly.

Note: If the taxpayer has a Form 1098 or a mortgage form, that means the taxpayer owned a house. Else, they are renters or they live in a relative's house.

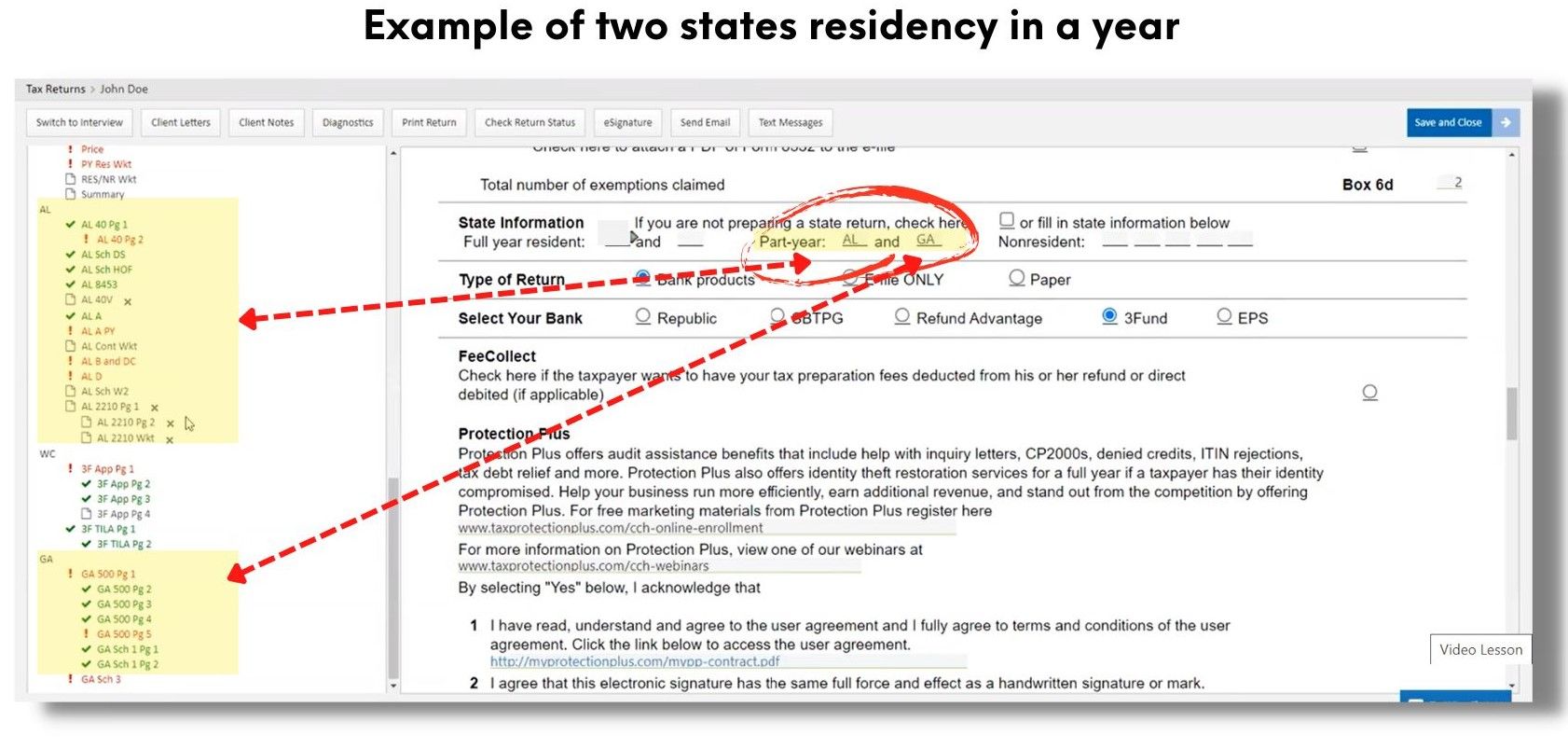

3. If the taxpayer has two states of residency in a year, so you need to fill it up as shown below, then automatically, the state forms you need to enter will appear.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024