Entering State Forms: California- CA 540

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to fill up Form CA 540 - California Resident Income Tax

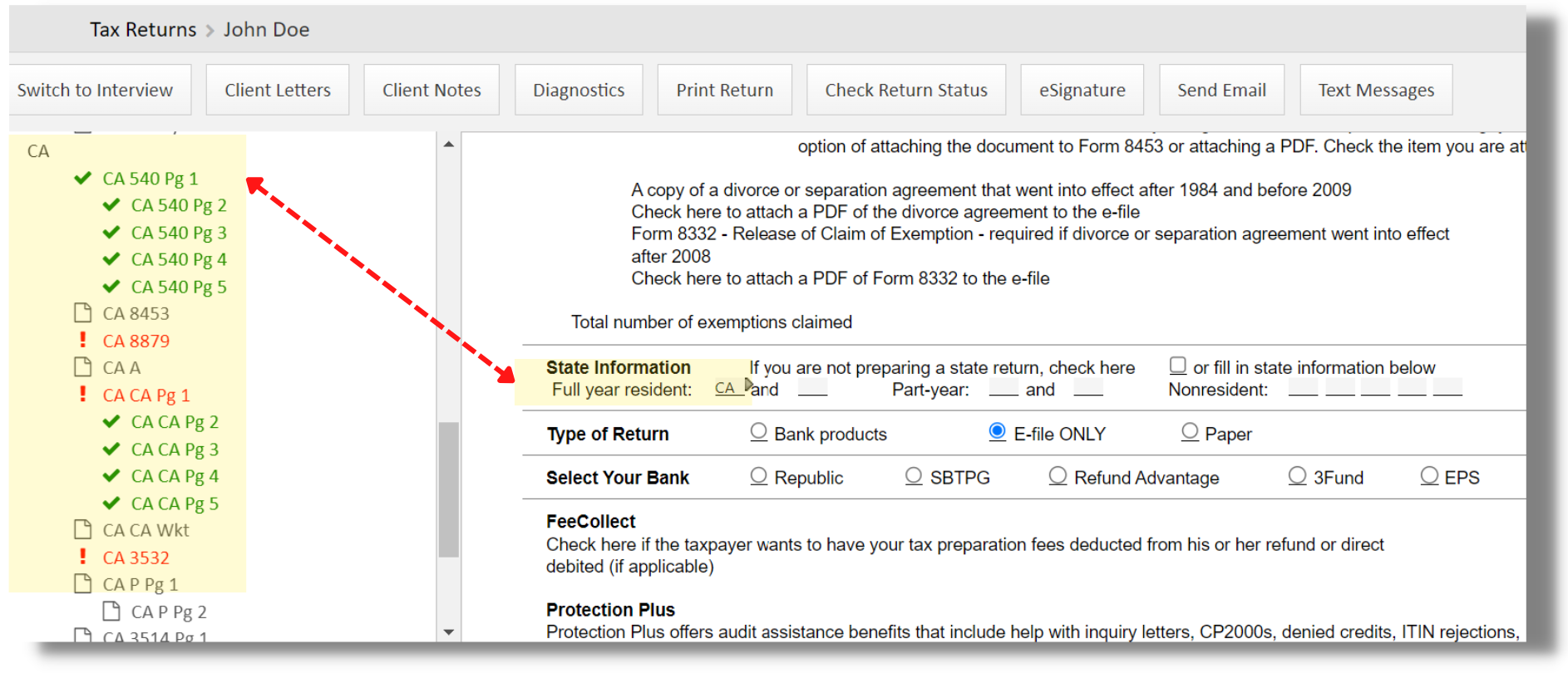

From the Main Information Sheet, once you fill in the State Information with 'CA' as, a full-year resident, you'll see the CA state forms appear.

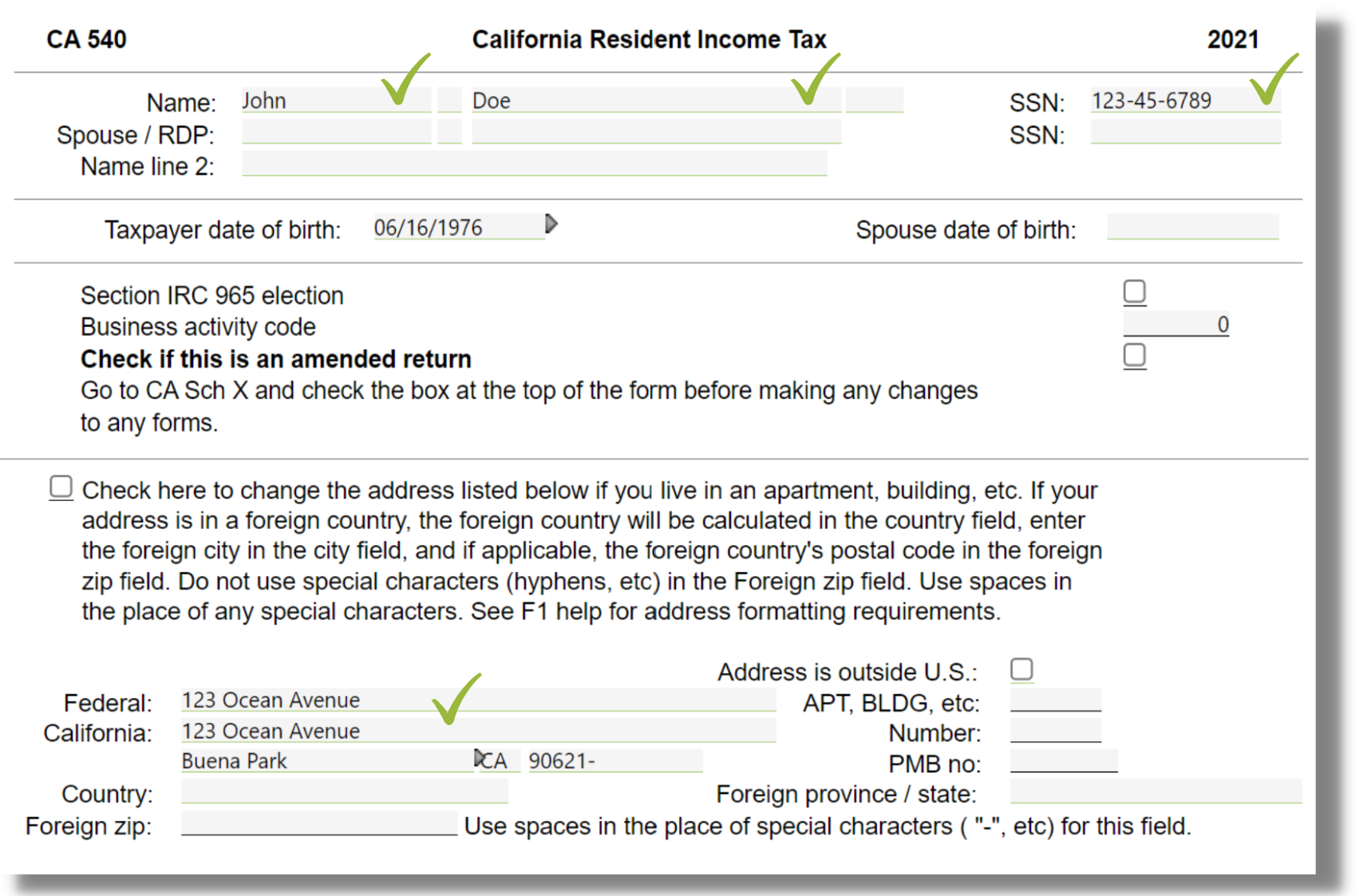

A. Entering Form CA 540 Pg 1

1. In this form, you need to check the taxpayer's name, SSN, and address to see if the details are correct.

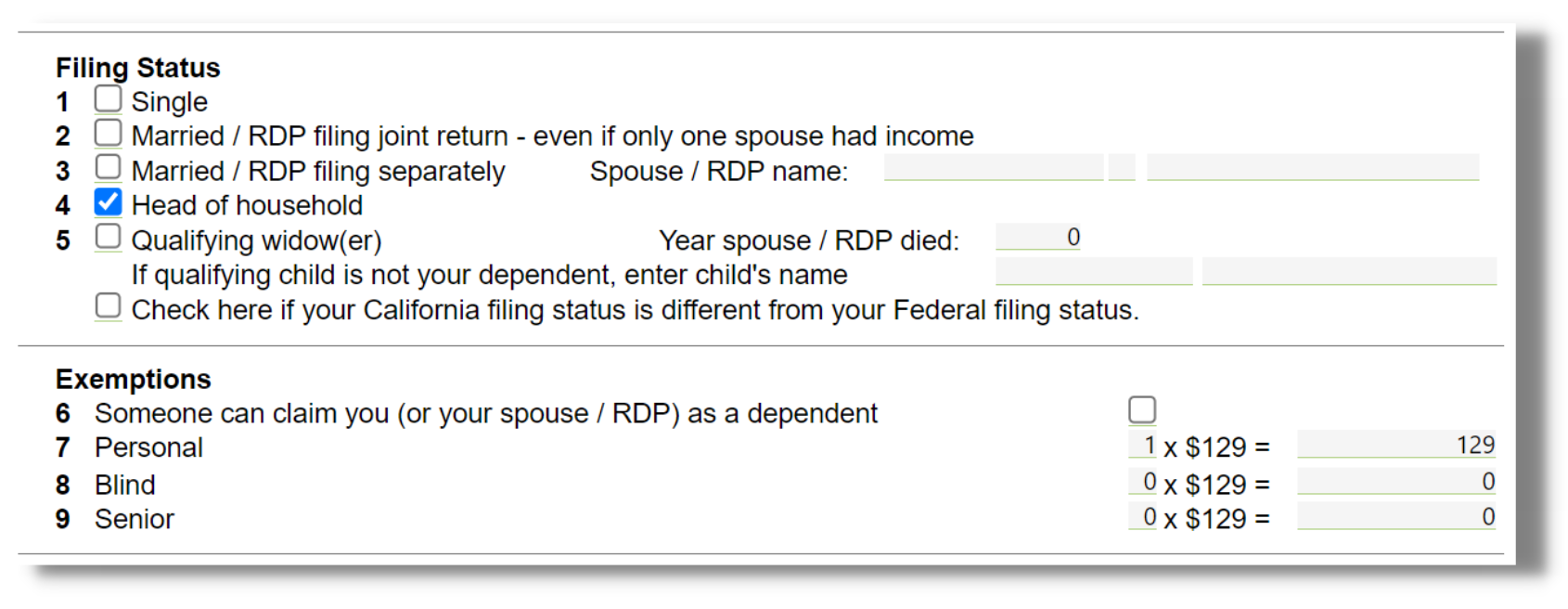

2. You need to choose the correct filing status. (Refer to ‘Main Information Sheet’ wiki page for the definition of each status)

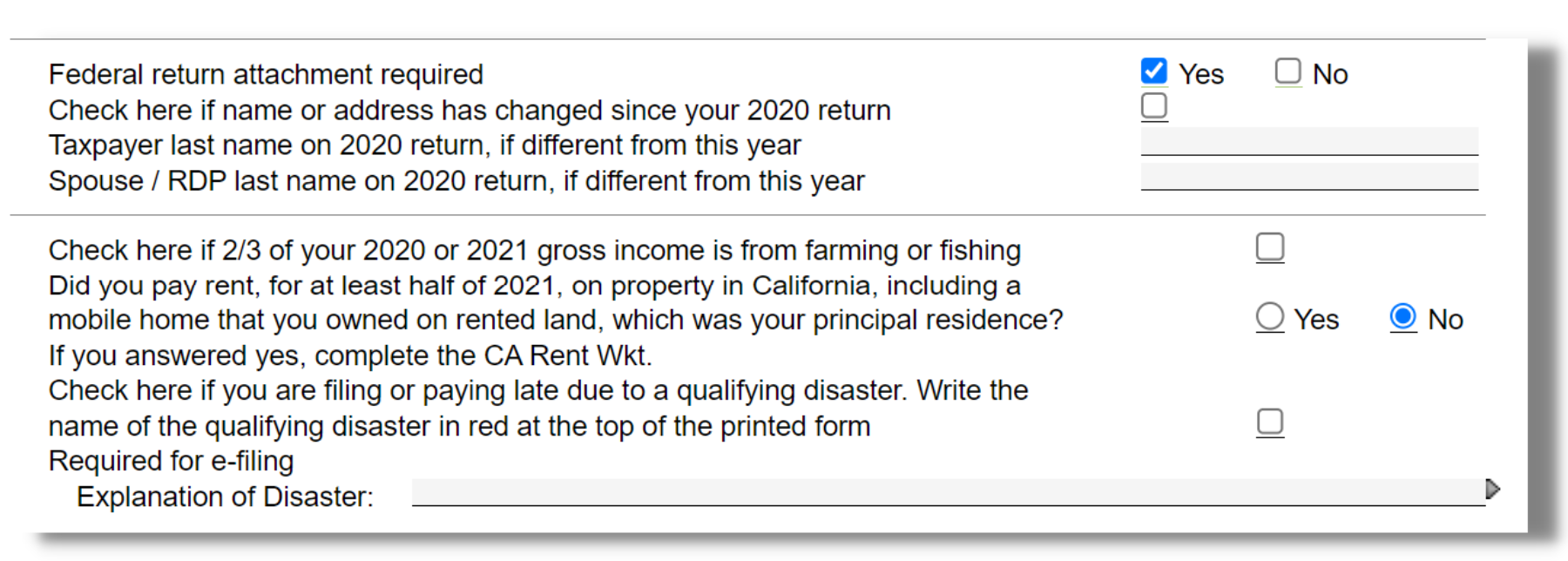

3. Then answer the following questions below accordingly.

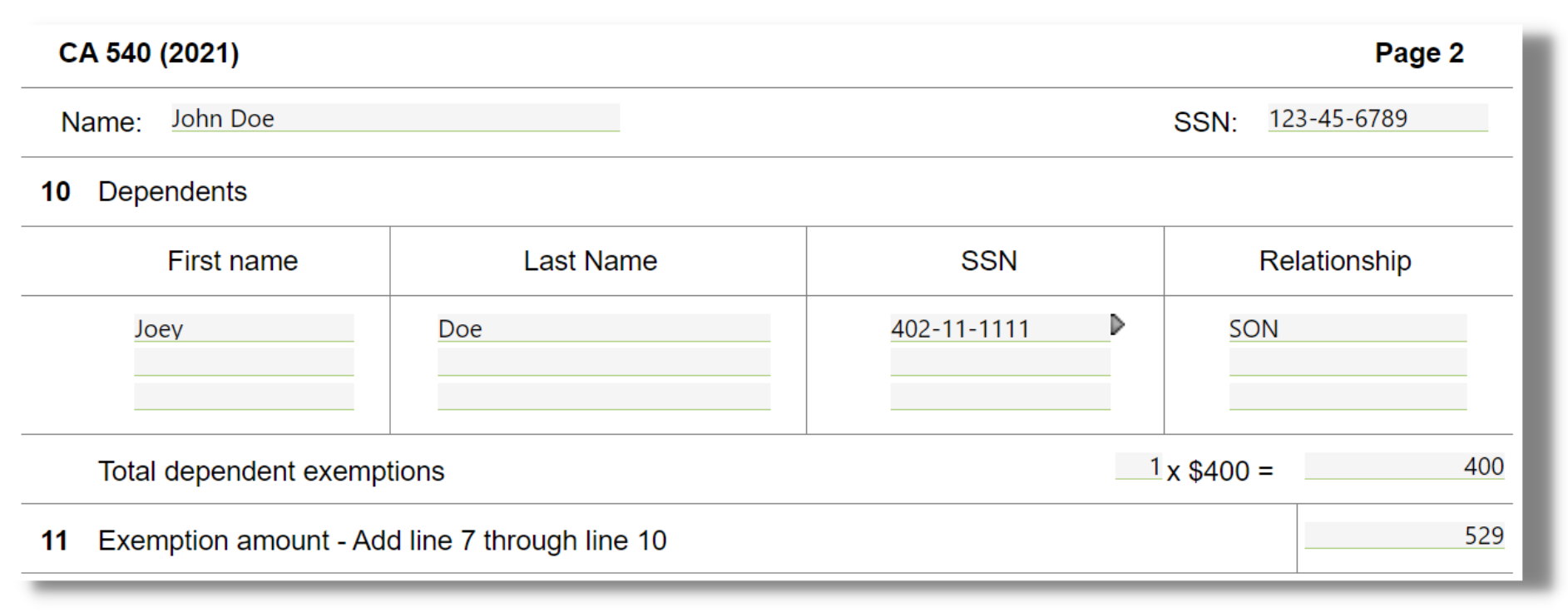

B. Entering Form CA 540 Pg 2:

For CA 540 Pg2, mostly the cells are calculated. You just had to run through the sheet to check for any discrepancies and answer correctly the cells that need to be answered.

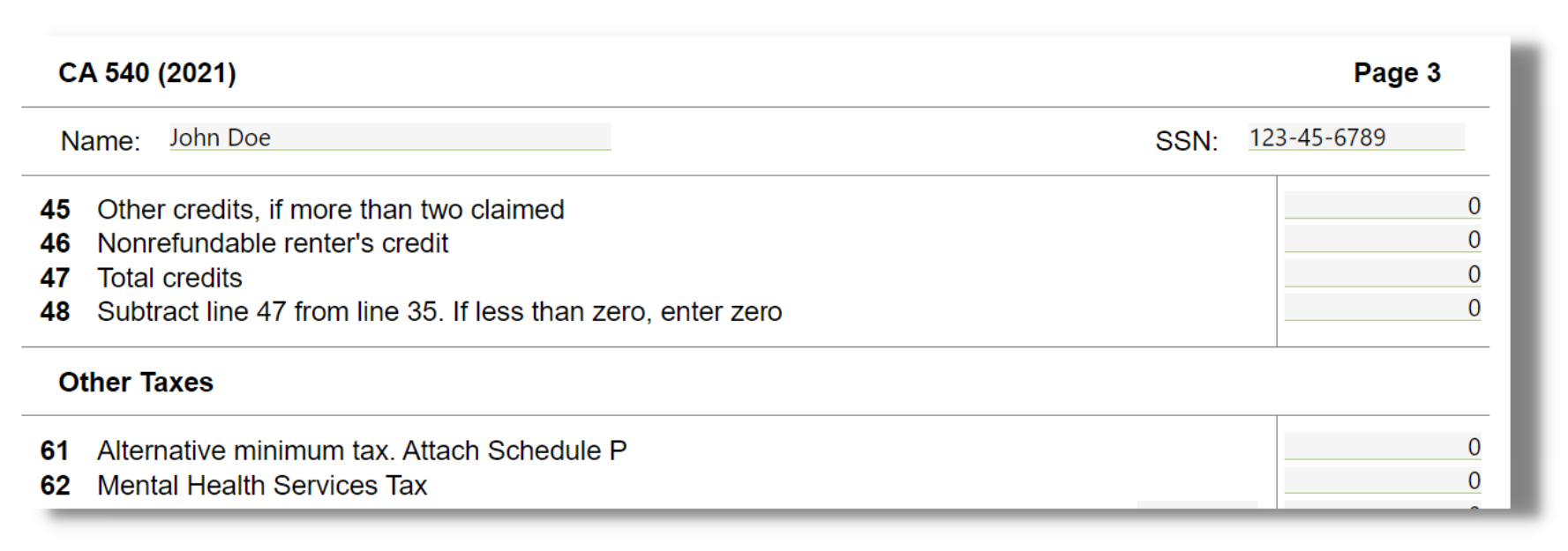

B. Entering Form CA 540 Pg 3:

Another form that is mostly calculated is this page 3. Just run through it and check for any details that are applicable to be answered.

Another form that is mostly calculated is this page 3. Just run through it and check for any details that are applicable to be answered.

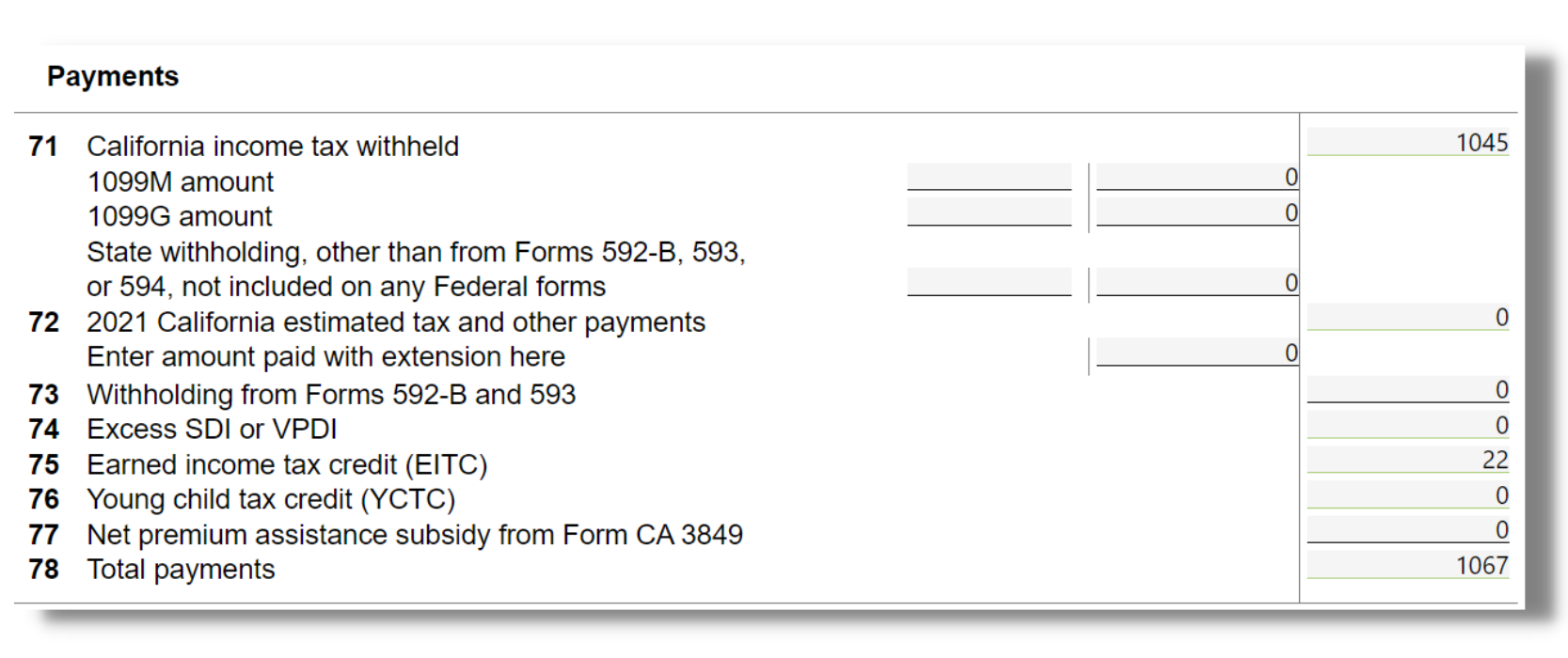

Look through under Payments table if there's a need to enter. If not, leave it blank if not red.

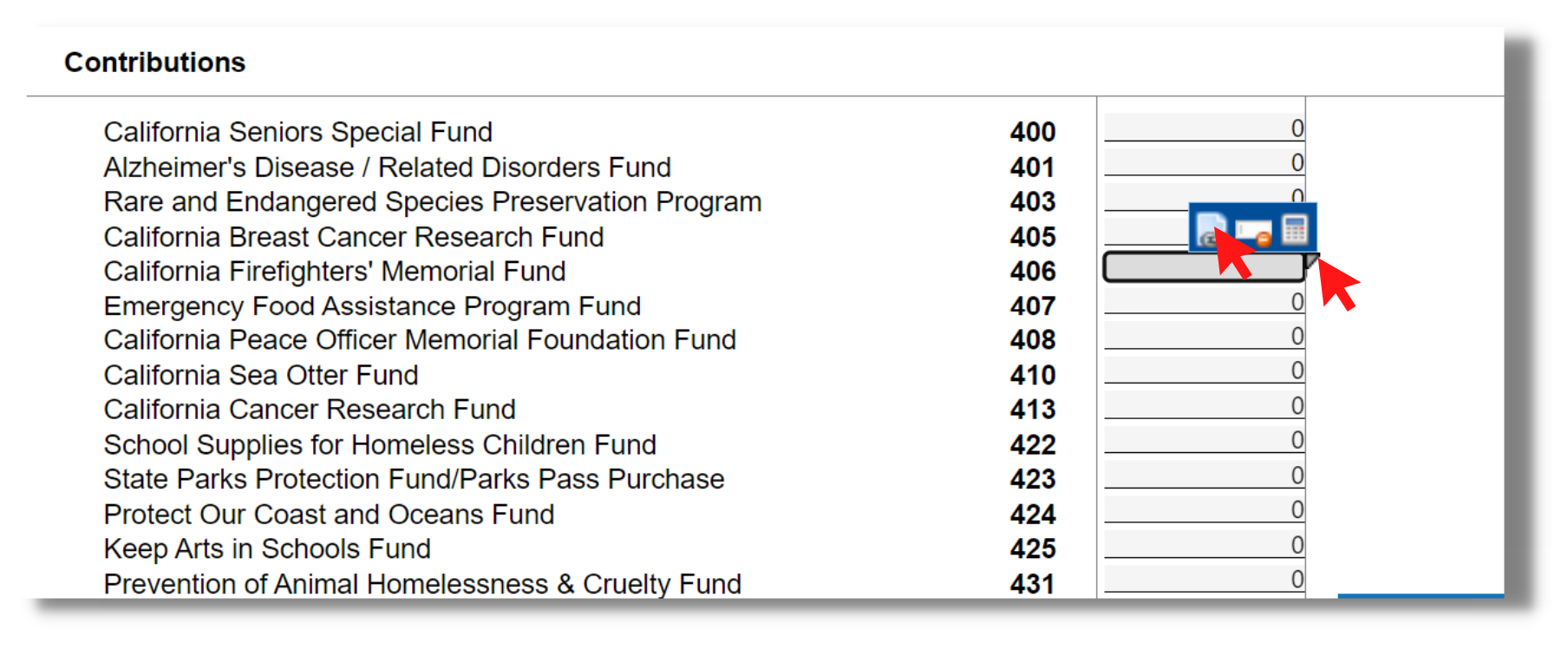

C. Entering Form CA 540 Pg 4:

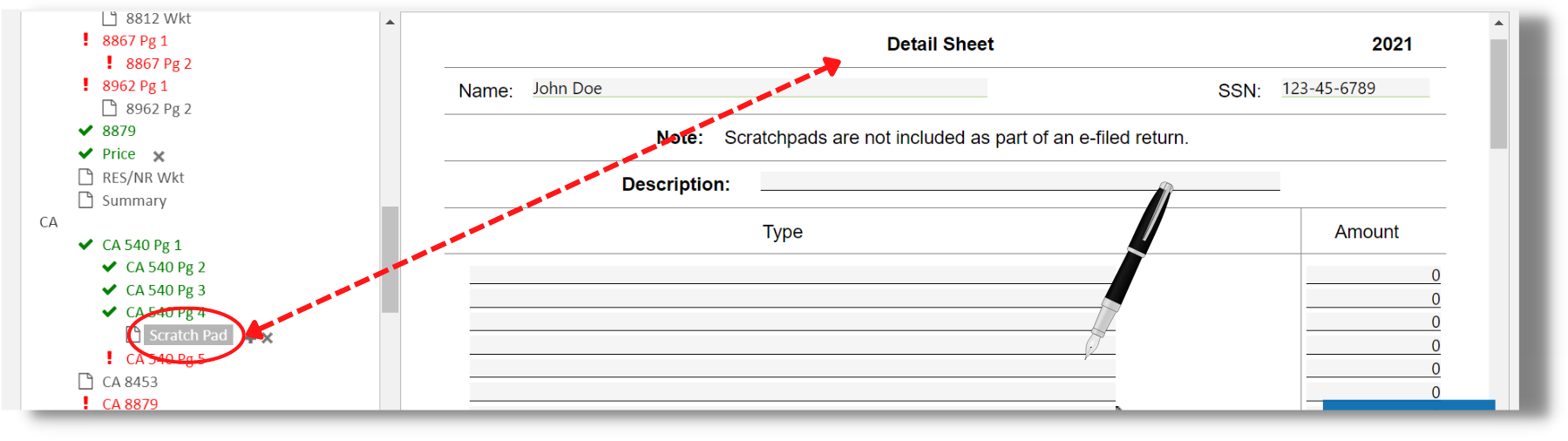

For this page, If you want to enter under 'Contributions,' you need to click the gray arrow in the corner and click the 'link form' icon. Then click New, then click Scratch Pad.

This is the new form that will appear under Pg 4. You can then input the details here, which is also linked to the Pg 4 sheet.

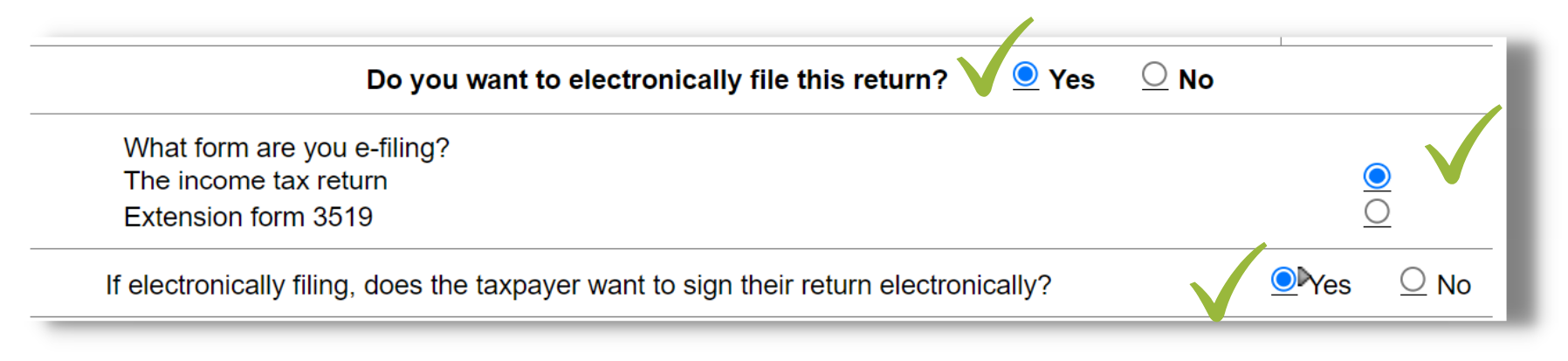

D. Entering Form CA 540 Pg 5

On this page, you need to answer the questions below. Answer it according to the taxpayer's choice.

On this page, you need to answer the questions below. Answer it according to the taxpayer's choice.

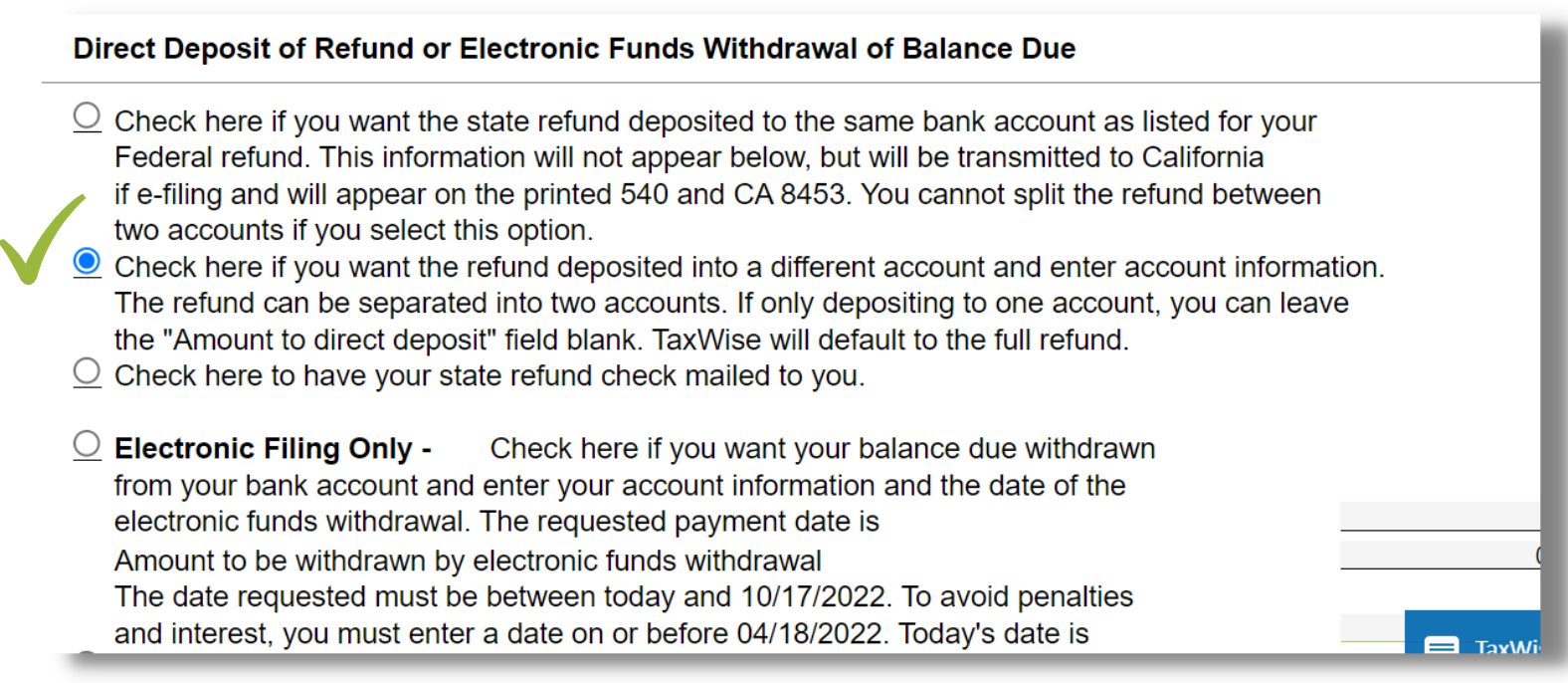

We always prefer to deposit the refund amount into a different account for the below options.

You will then enter the bank details. You need to triple-check that the account numbers are 100% correct.

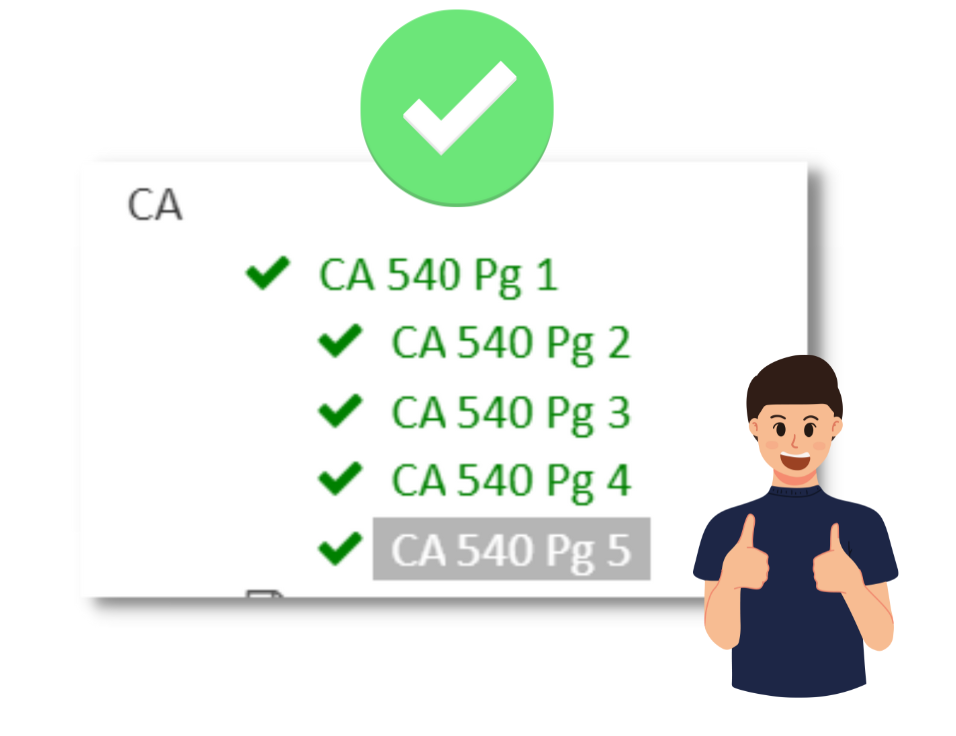

If all the forms are green, that means you are done with Forms CA 540.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024