Entering the Earned Income Credit (EIC) & Child Tax Credit (CTC)

Empty space, drag to resize

These are the steps on how to enter Sch EIC

Empty space, drag to resize

A. How to add Form Sch EIC

Empty space, drag to resize

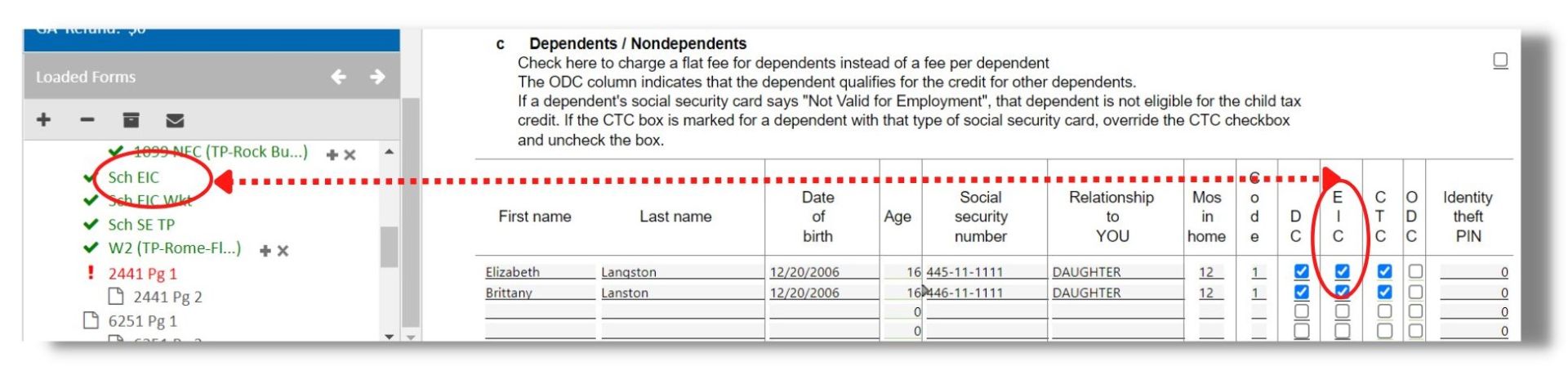

1. From the Main Information Sheet, under Dependends / Nondependents information, once you click the EIC (Earned Income Credit) column, you'll see that Form Sch EIC appears. Click it to open.

B. How to fill up Form Sch EIC

Empty space, drag to resize

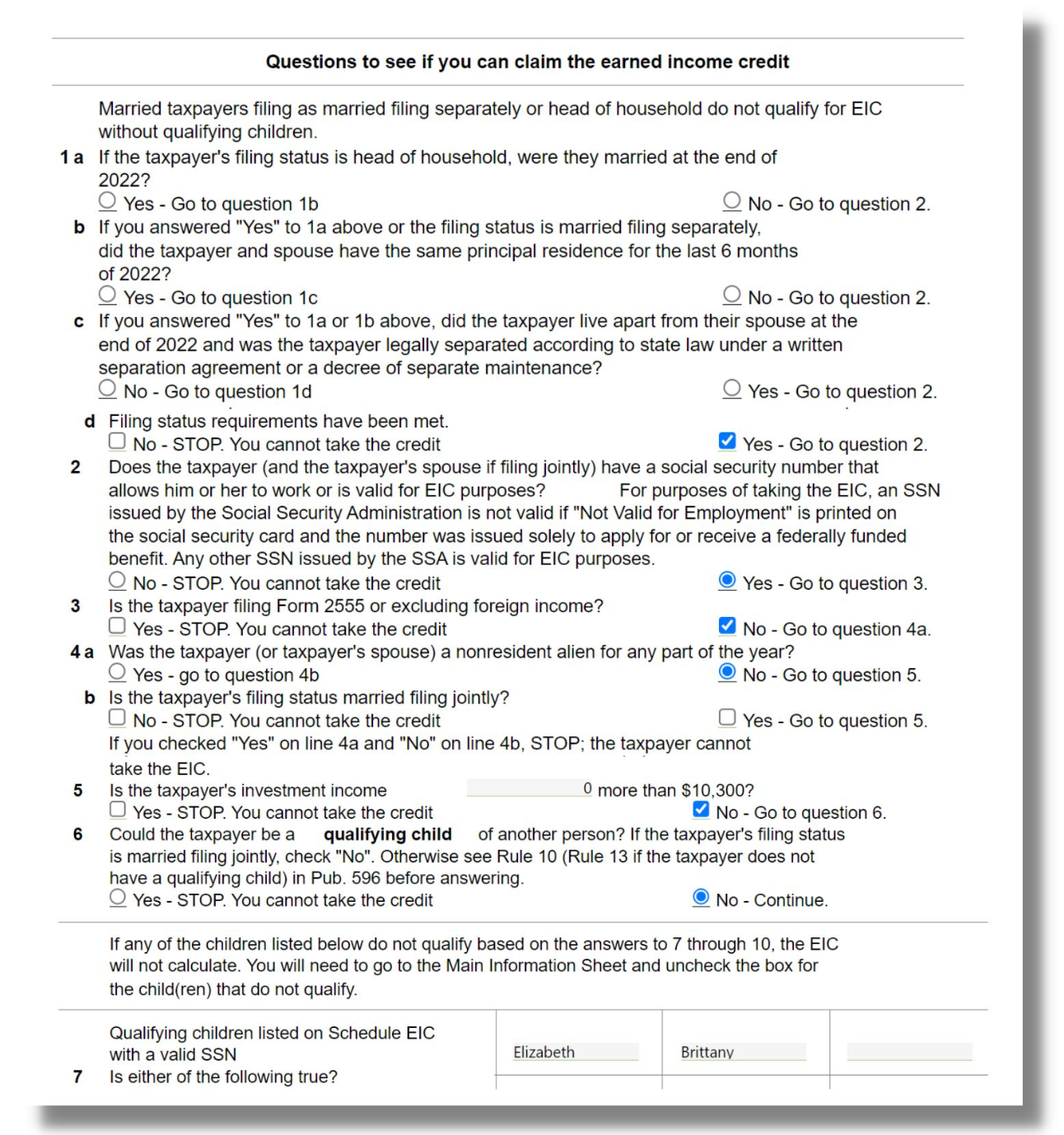

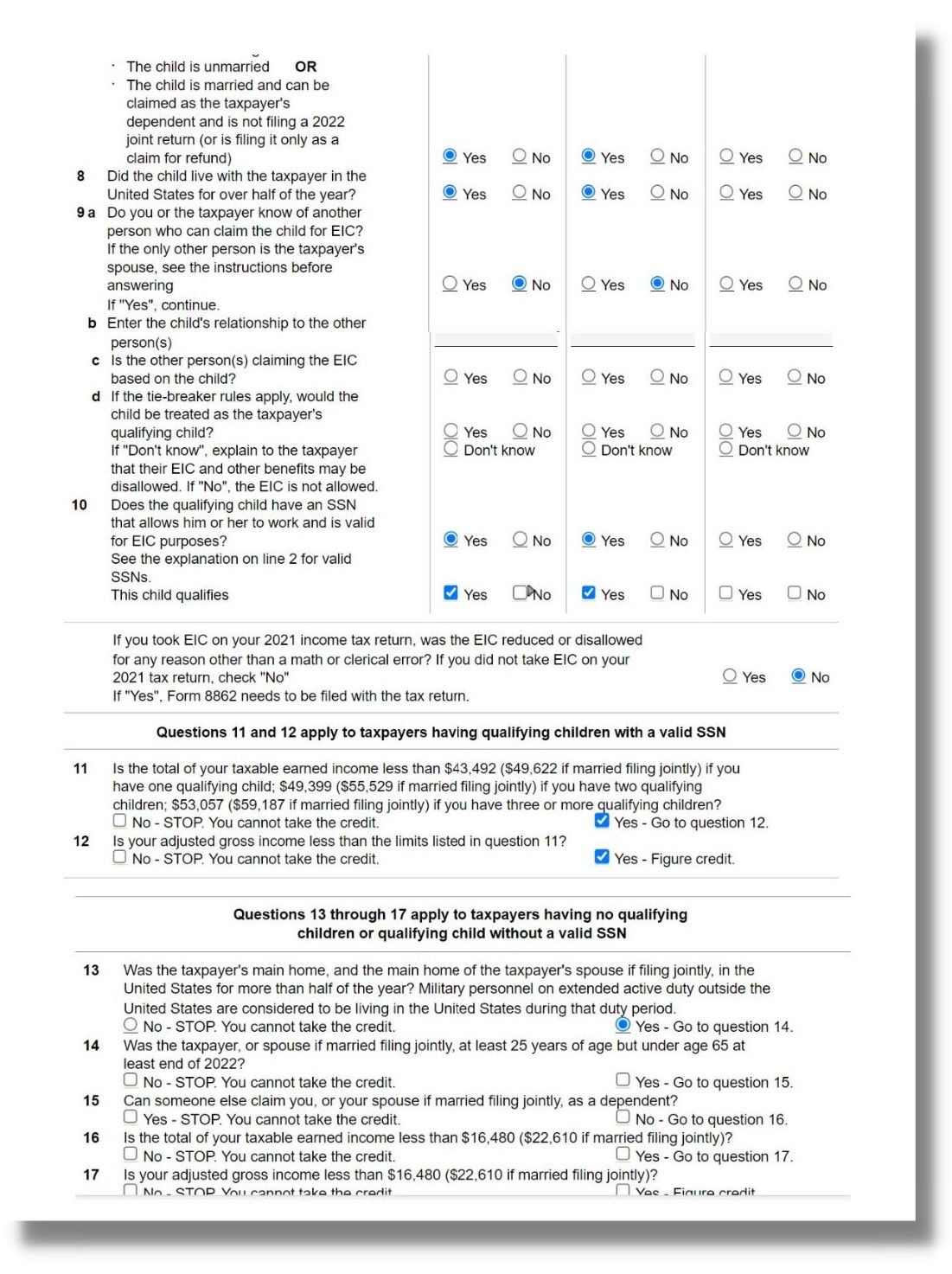

1. In this Form, you must answer questions to determine if the taxpayer has Earned Income Credit. Should there be an answer that ends with STOP or NO, then the taxpayer can't have the EIC. We want an answer that won't end with 'STOP/No.'

The below scenario has two qualifying kids and has EIC.

The below scenario has two qualifying kids and has EIC.

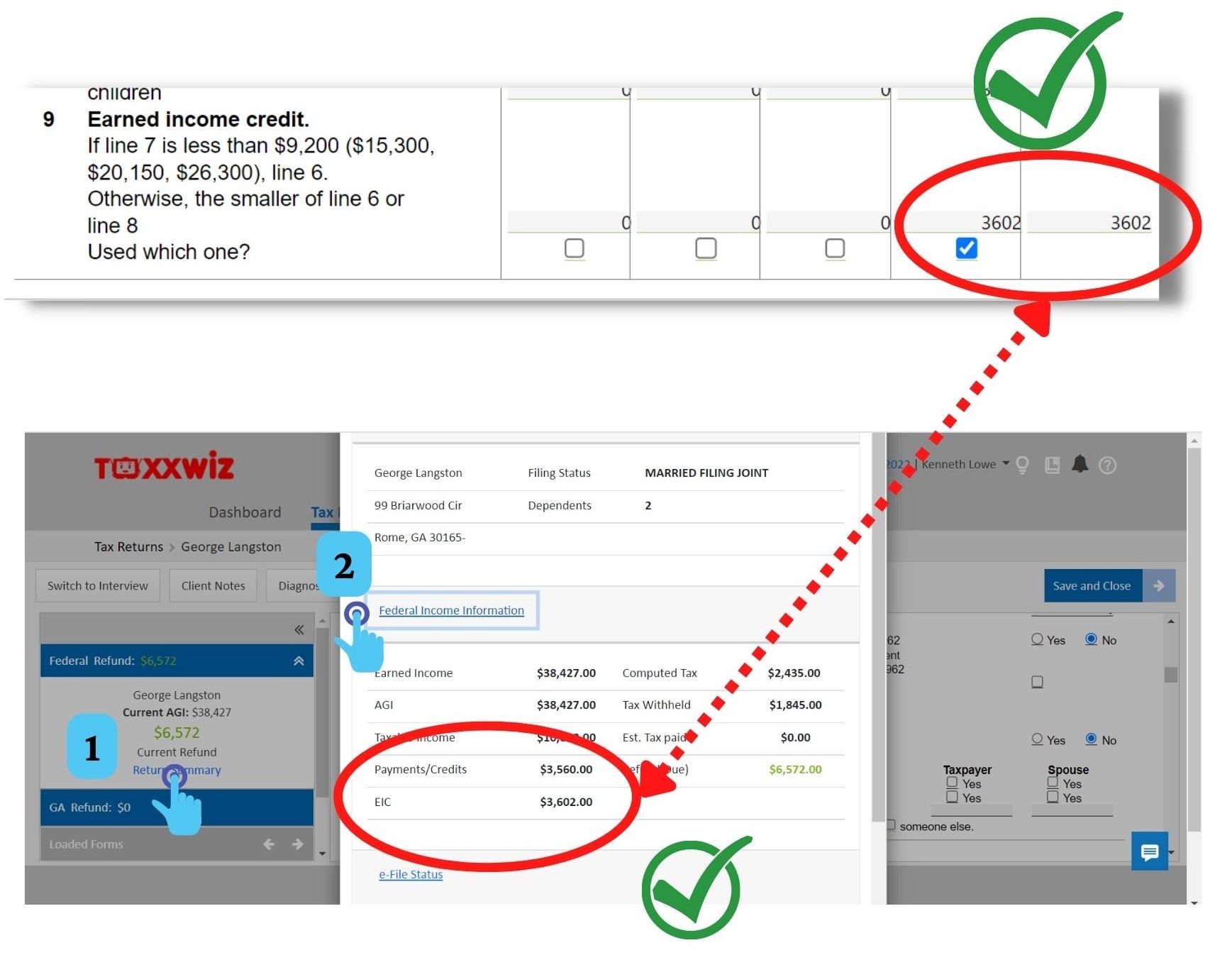

So, you'll see that the taxpayer has an Earned Income Credit of $3602 for two qualifying dependents. You can also check the EIC by clicking the Return Summary and then the Federal Income Information, as shown below.

C. How to Fill up the Child Tax Credit

Empty space, drag to resize

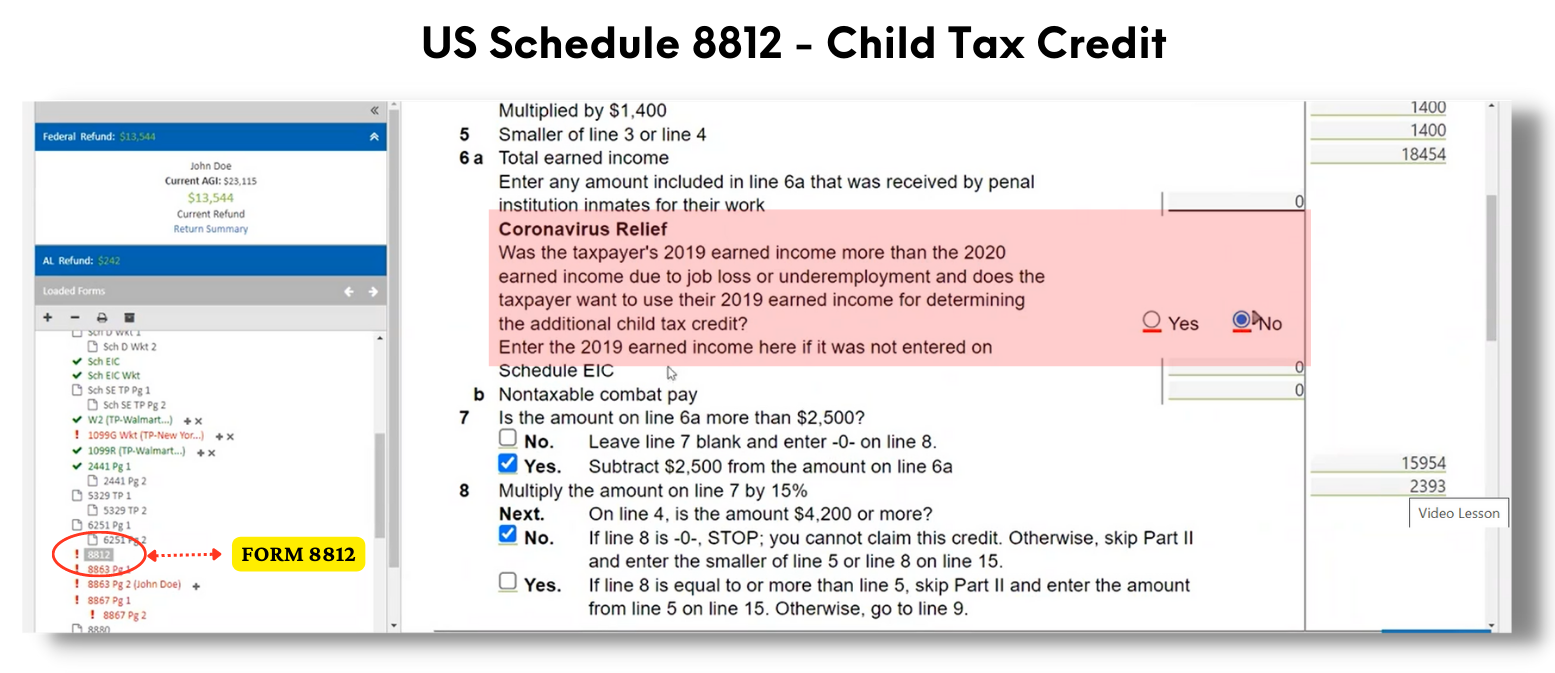

After entering EIC, next is entering the Child Tax Credit. Look for the Form 8812. The software will just lead you to where you need to fill in or answer a question. Mostly the cells are calculated already. So for this example, the taxpayer's income was not affected by the pandemic, so it's a NO. That's all for CTC form.

D. How to Fill up Form 8867: Paid Preparer's Due Deligence Checklist

Empty space, drag to resize

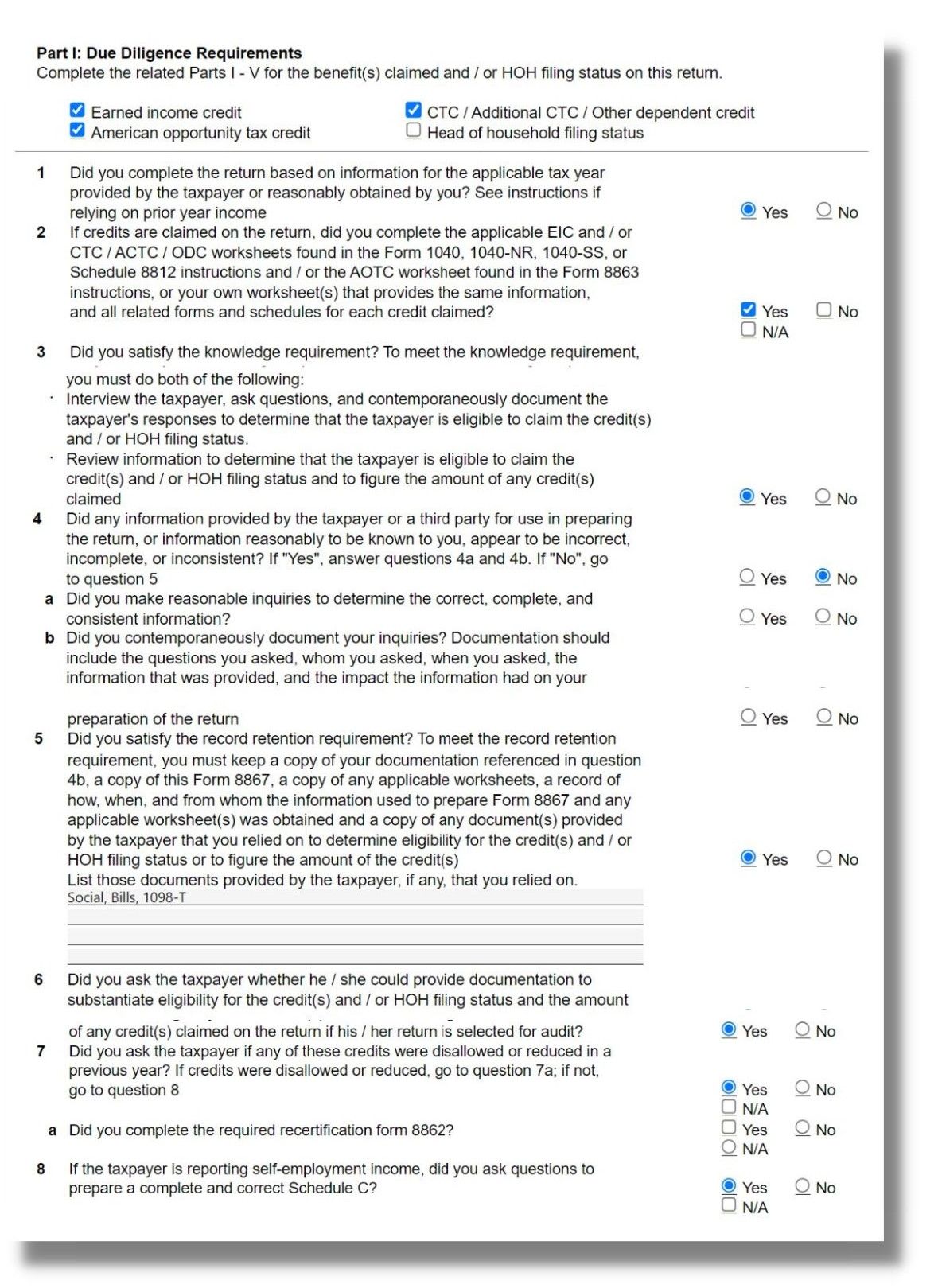

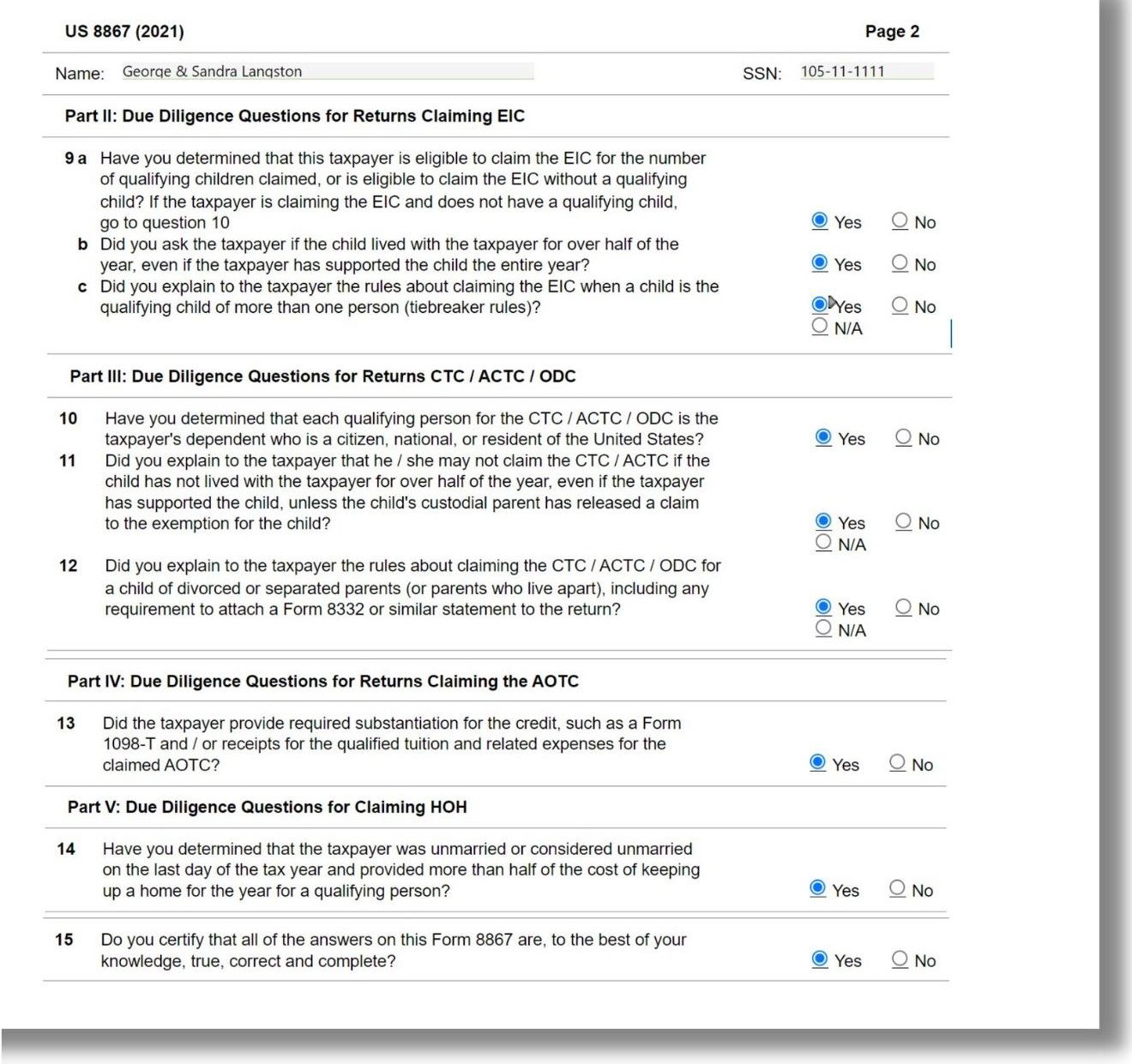

Another form to deal with when entering EIC and CTC is the Form 8867. Open the Forn 8867 Pg 1 and Pg 2. Please refer below on how to answer the questions accordingly.

And Finally, you're done!

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024