Entering Main Information Sheet

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

The Main Information Sheet is the first form you will complete in every return or account you must enter.

Empty space, drag to resize

These are the steps on how to fill up Main Information Sheet.

Empty space, drag to resize

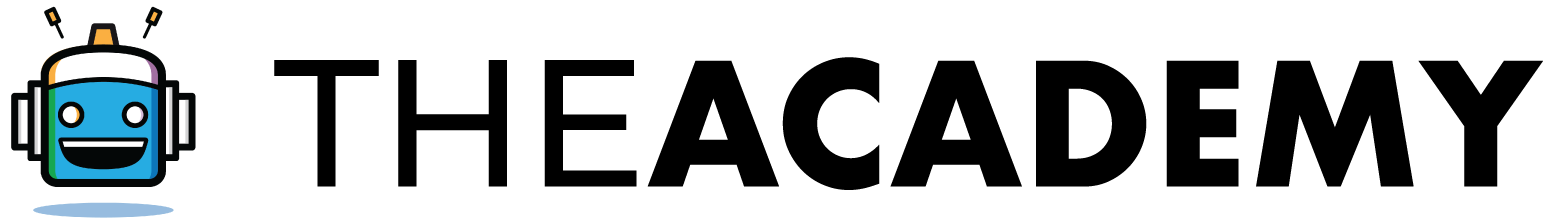

- Under the 'Tax Returns' tab, you'll see the first form in the list is always the Main Information sheet.

- Click to open the Main Info. Enter the First Name.

- Enter the Last Name.

- Enter the SSN or the Social Security Number. Always triple-check the SSN to avoid complications later.

- Enter the taxpayer's mailing address. After you enter the zip code, the city and state automatically appear. Avoid entering a comma or a period. The software will not accept it.

- Don't forget to enter the client's email address.

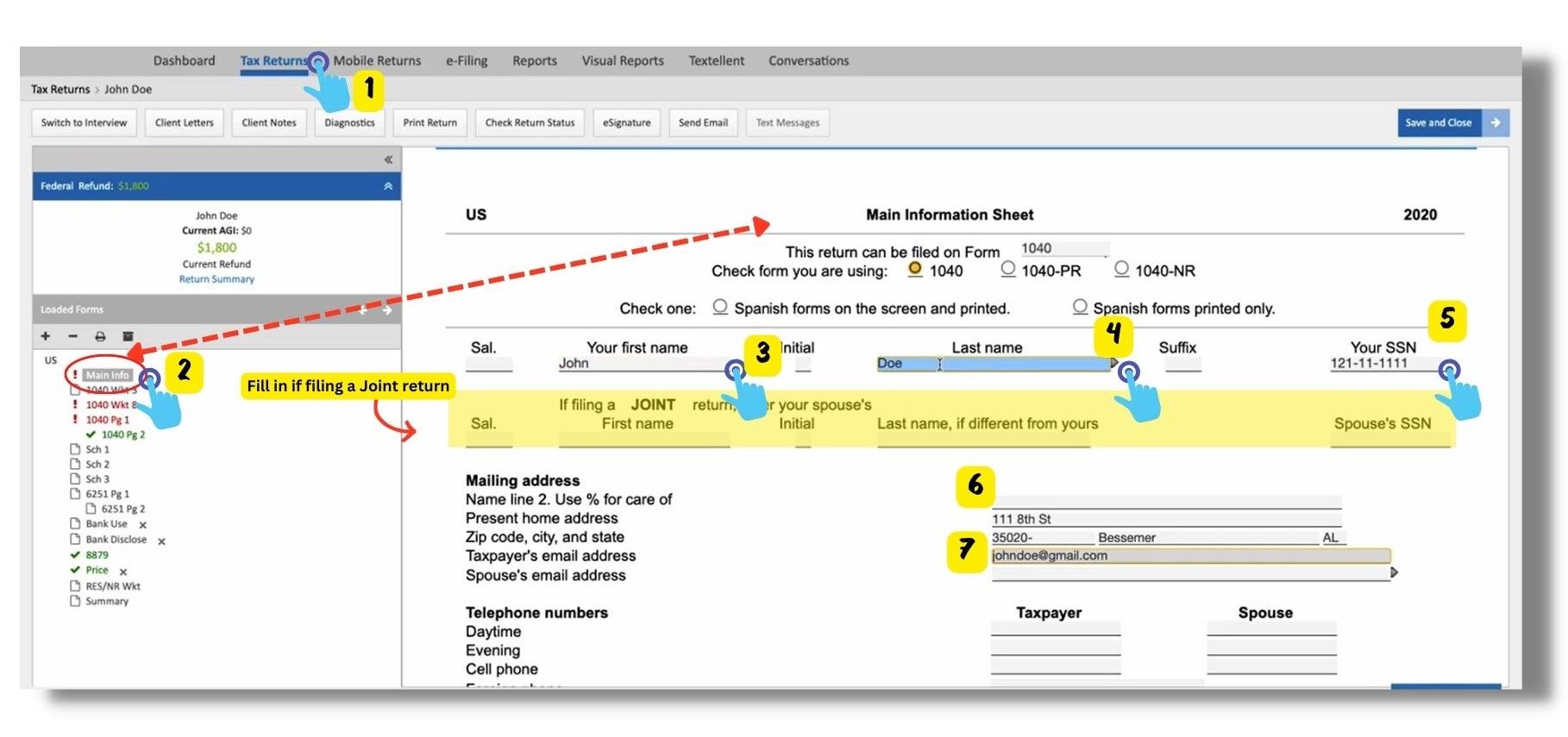

8. Enter the taxpayer's contact numbers.

9. Enter the taxpayer's birth date. The age will automatically be calculated.

10. Enter the taxpayer's occupation.

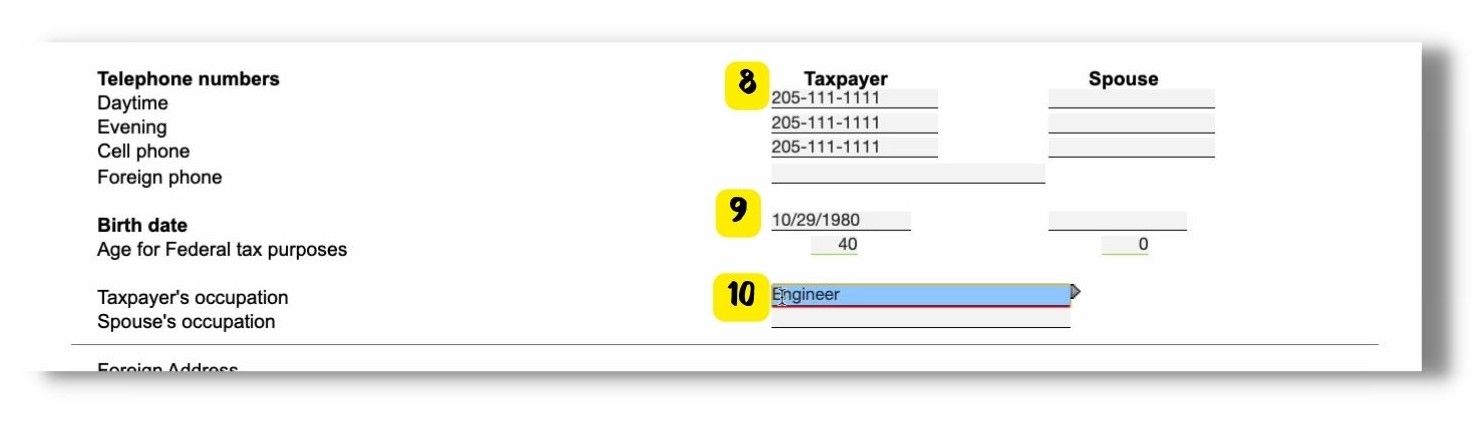

11. For the 'Taxpayer Information,' answer the questions accordingly. If the taxpayer has Form 1095-A, they receive insurance through the Marketplace. So, click" Yes ".

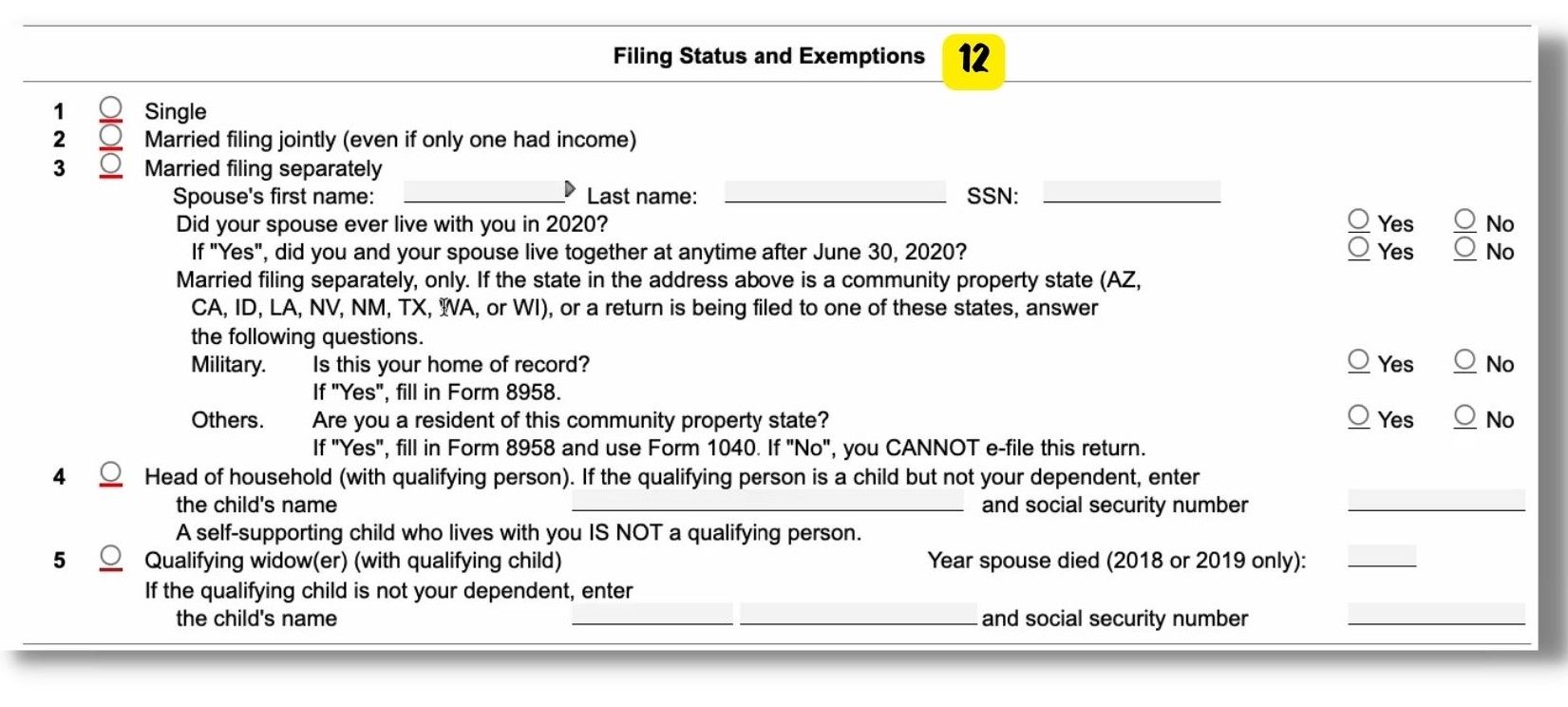

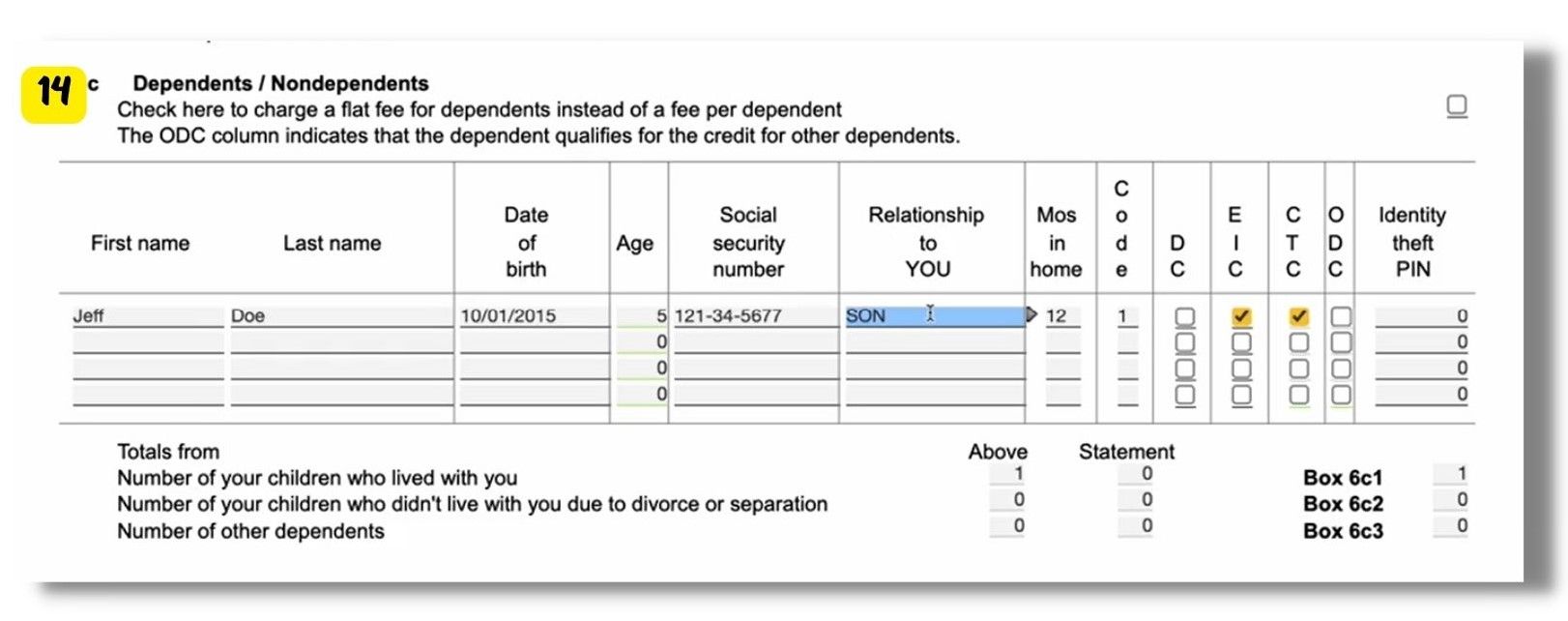

12. For the filing status, choose the appropriate status of the taxpayer. Refer above notes for the definition of each status.

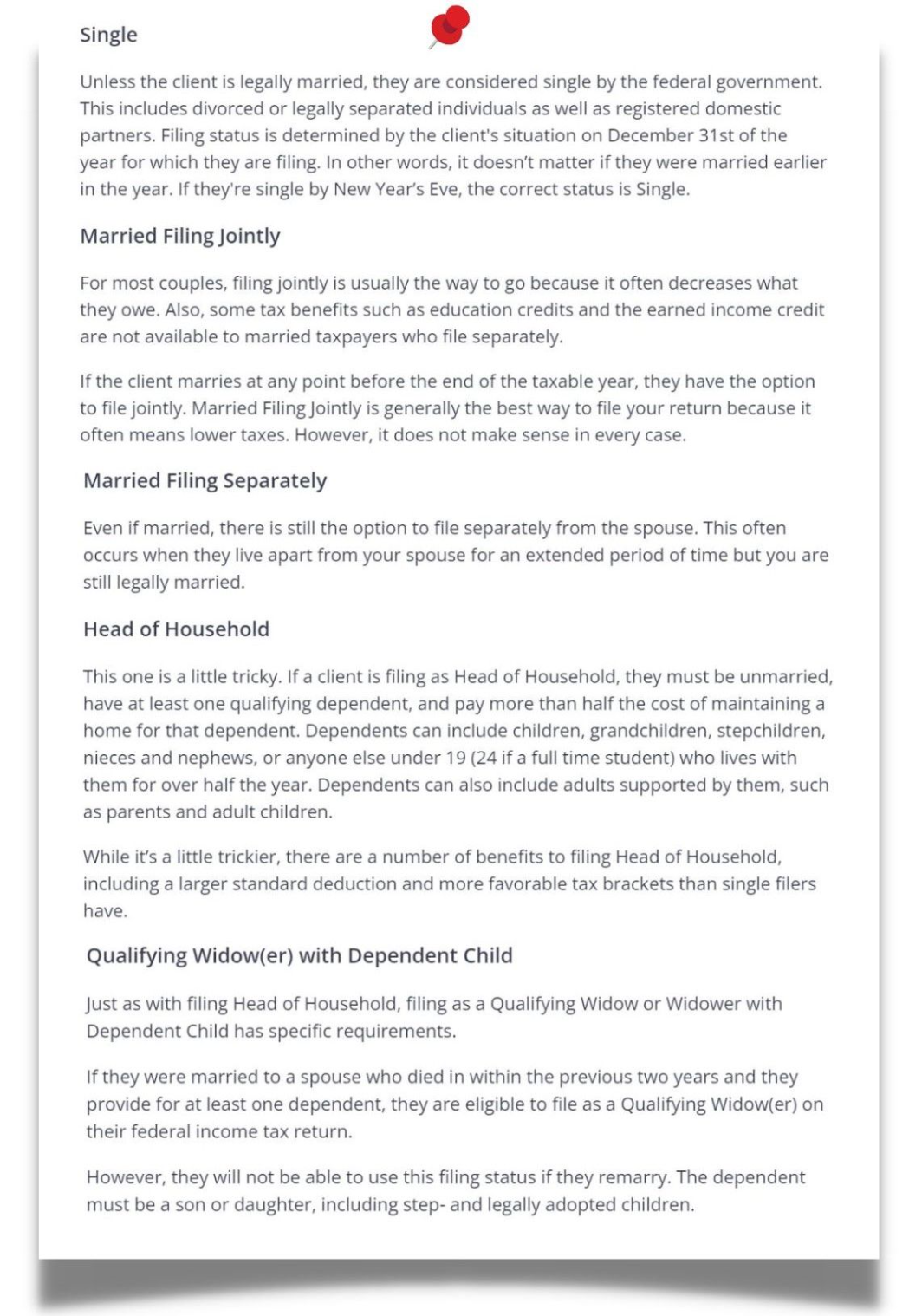

13. For these Exemptions, you need to check letter (a) if the taxpayer wants to claim a dependent return.

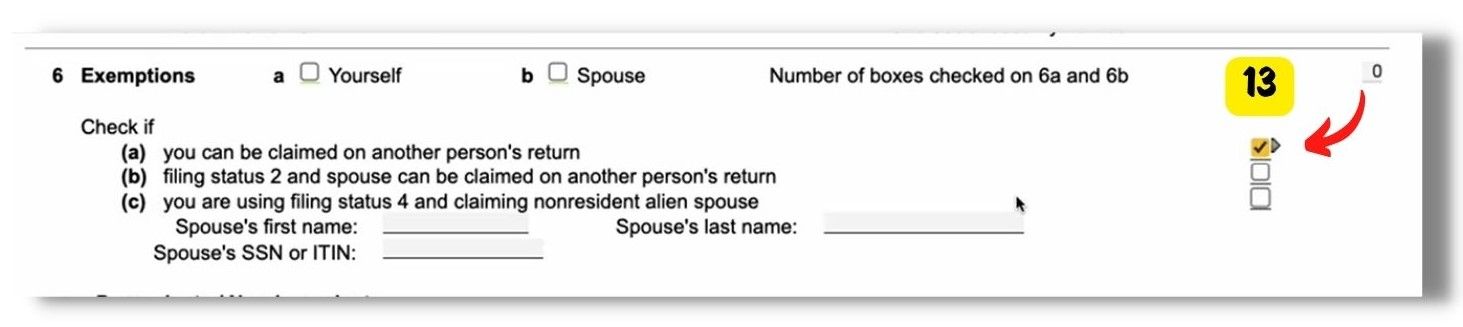

14. For Dependents/Nondependents, you need to enter the details of the qualifying child/children. Input the First name, Last name, Date of birth, SSN, Relationship, and Mos in home (should be 1

Empty space, drag to resize

- For the CTC (Child Tax Credit), you don't need to click it. It will automatically be marked as a check if the dependent is 19 years old or younger.

- But for the EIC (Earned Income Credit), you need to click it manually if the dependent is 16 years old and younger.

- For DC (Dependent Care), you will need to click that if they want to claim a Dependent Care return.

- If the dependent is older than 19 years old, the ODC (Other Dependent Credit) will be marked as checked.

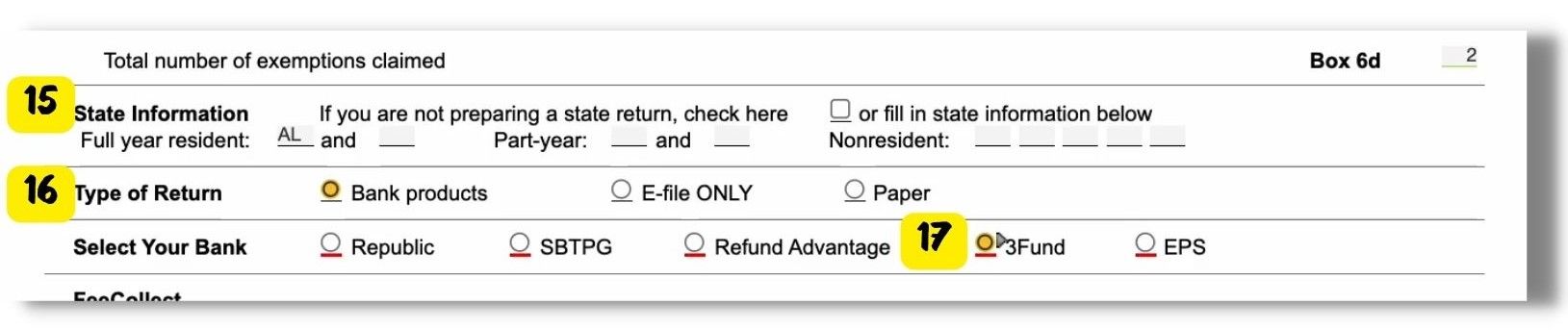

15. Enter the taxpayer's state residency as a full-year resident or part-year. Whichever it applies.

16. Click the taxpayer's choice of the return, either Bank products, E-file ONLY, or Paper.

17. Preferably, choose '3Fund'.

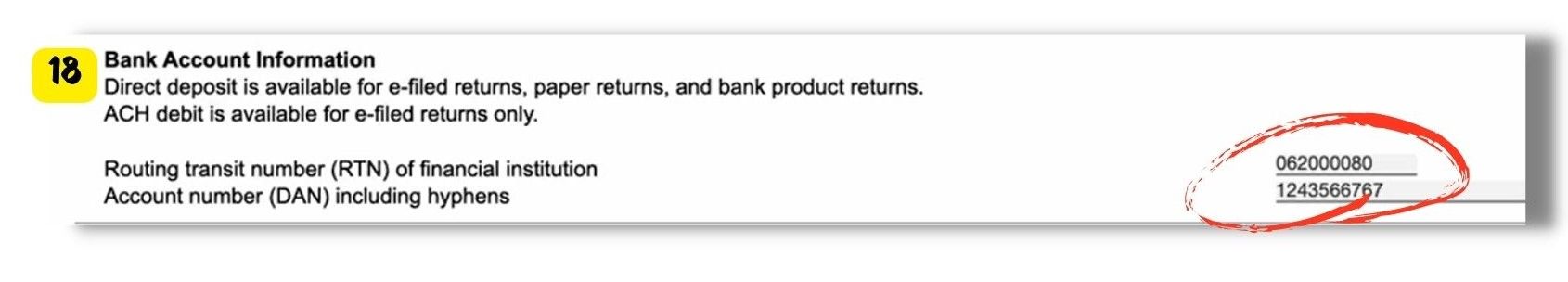

18. If the taxpayer wants the return to be deposited directly into their bank account, then enter the bank account information. Always triple-check if the account numbers are 100% correct.

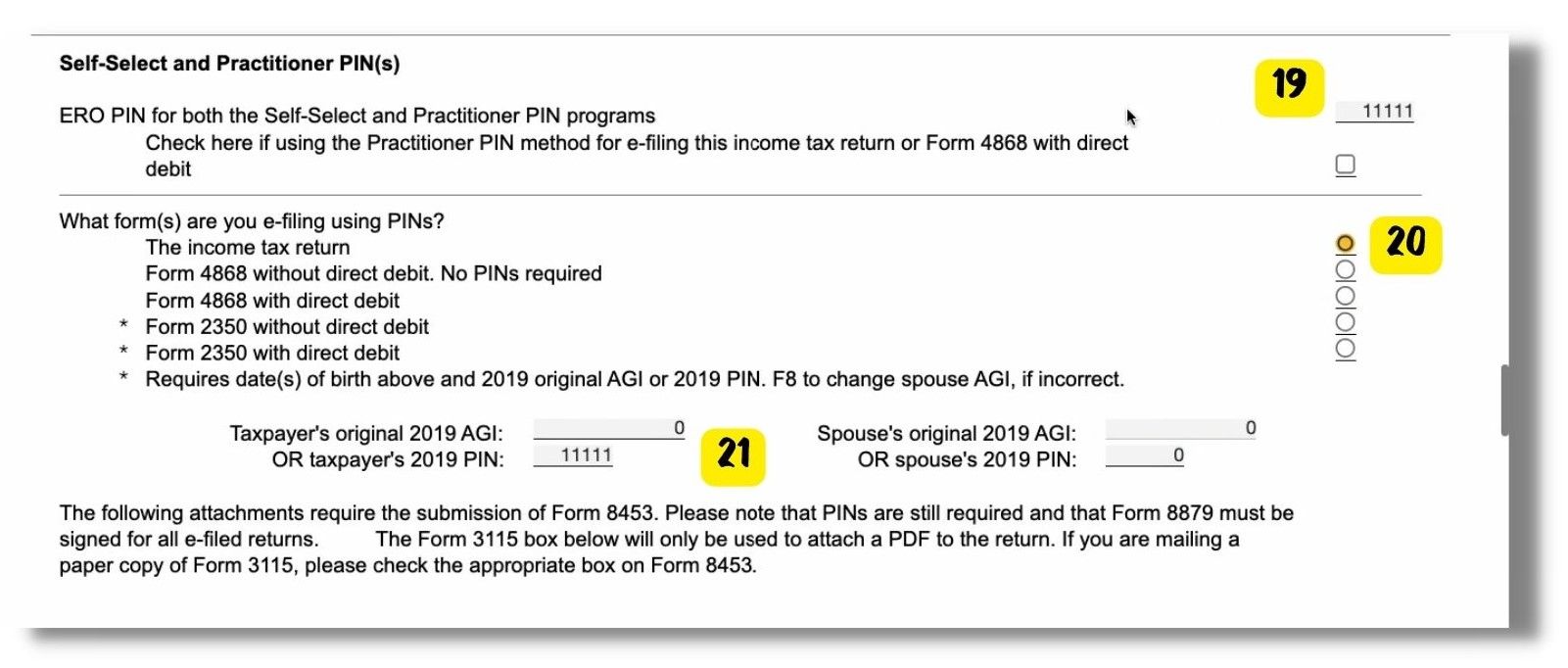

19. Enter the taxpayer's PIN.

20. Click 'The income tax return.'

21. Enter the taxpayer's PIN again.

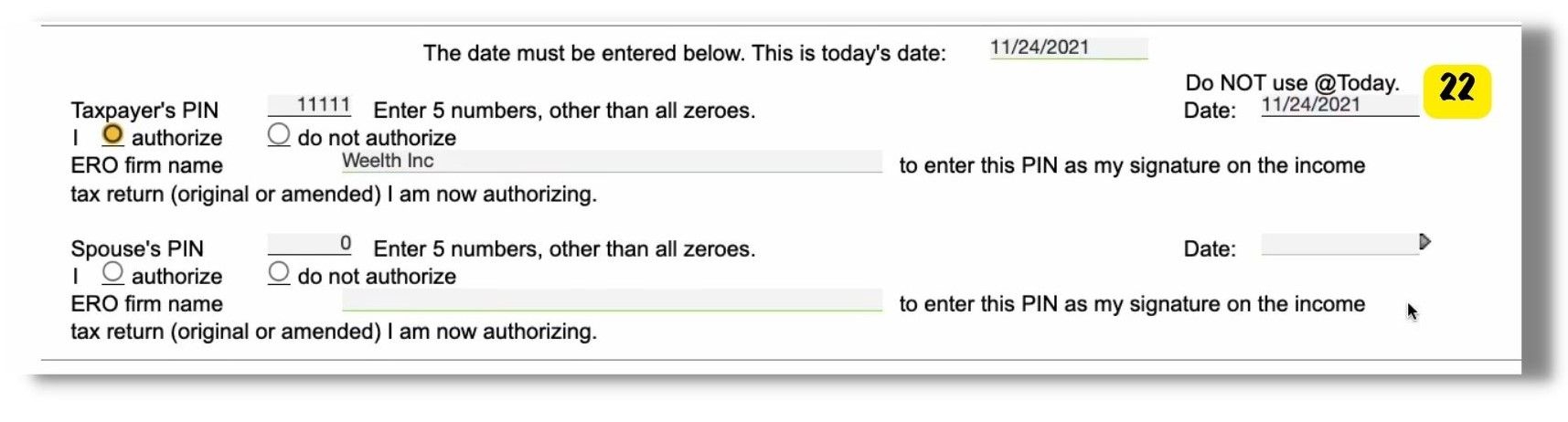

22. Enter today's Date.

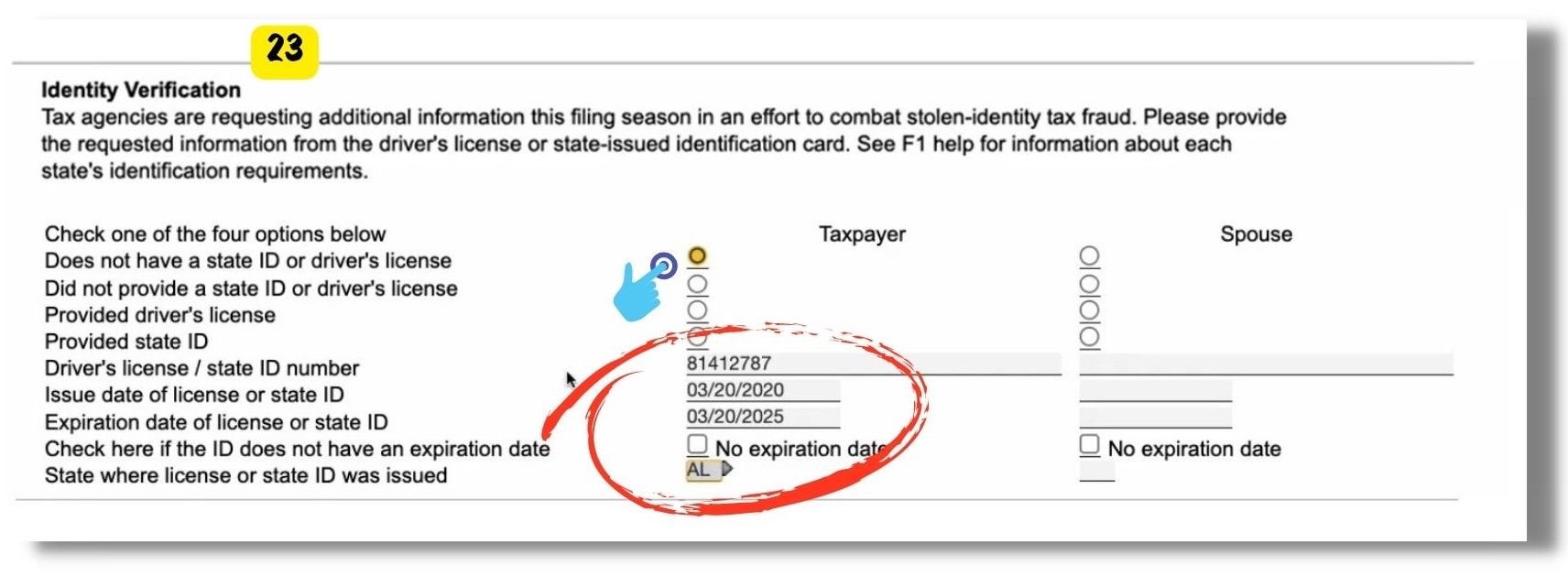

23. Enter the ID details.

24. For Identity Proofing Level, we prefer Level 2.

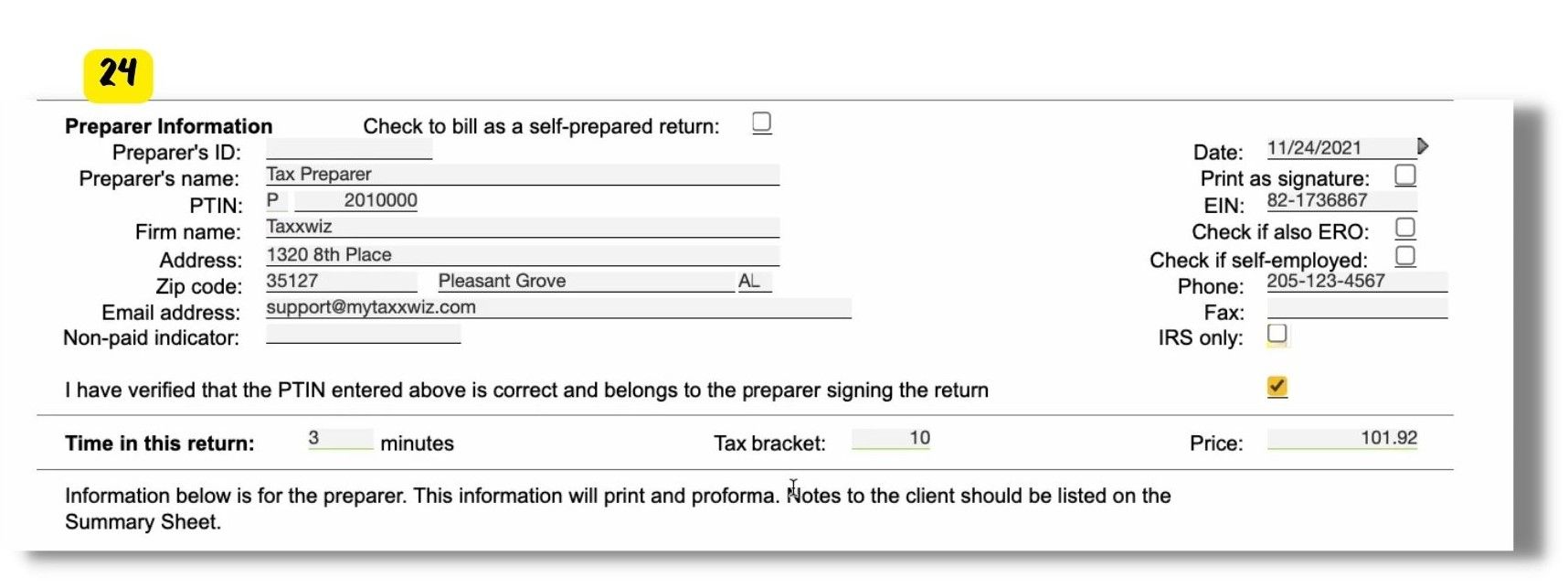

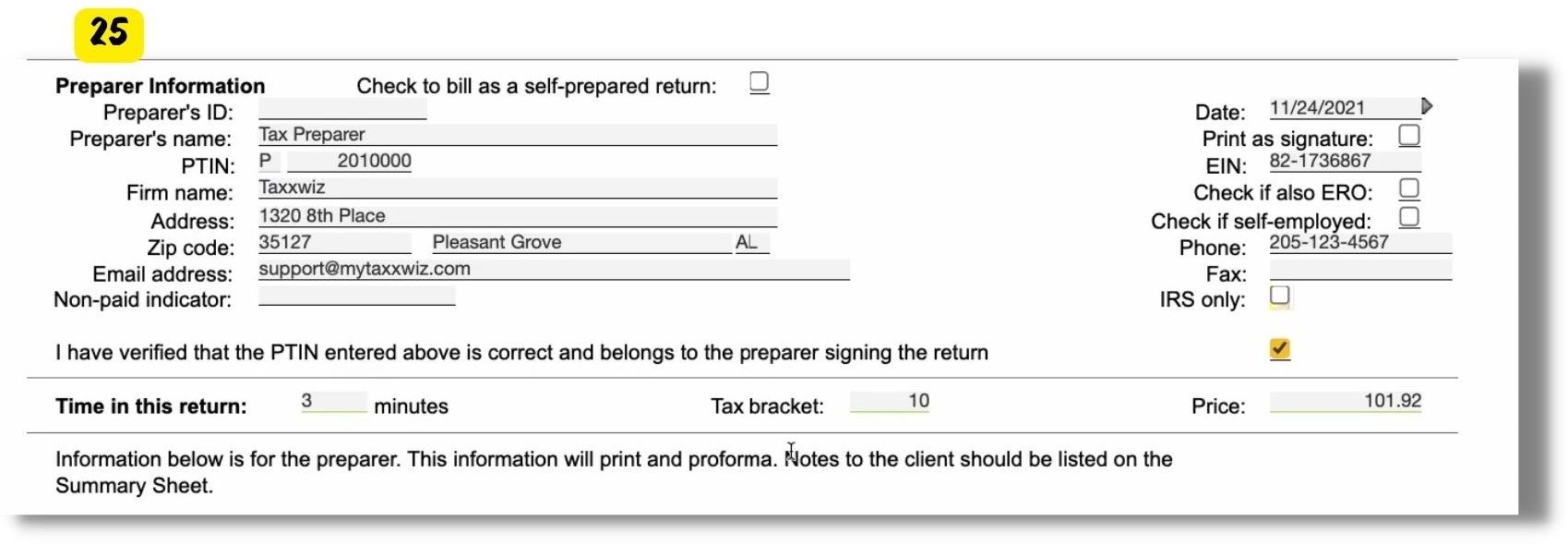

25. Finally, enter the Preparer's Information accordingly.

Empty space, drag to resize

Quick Review!

Empty space, drag to resize

- Make sure that the Last Name is entirely correct.

- Make sure the SNN is correct.

- Make sure there's no comma, period, or semi-colon for the address.

- Fill in all the phone number details.

- Check if the birth date is correct.

- Check if the occupation is correct.

- If you see 1095-A on their return, check the option 'YES’ on the question, "'Did they receive insurance through the Marketplace?'

- Make sure you choose the correct filing status.

- Make sure to click EIC if they have a dependent of 16 years old and younger.

- Enter the State Information correctly.

- Triple-check the bank account details,

- Check the ID information are correct.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024