Entering Form 1095-A: Insurance from Marketplace

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter Form 1095-A

Empty space, drag to resize

A. How to add Form 8962: Premium Tax Credit

Empty space, drag to resize

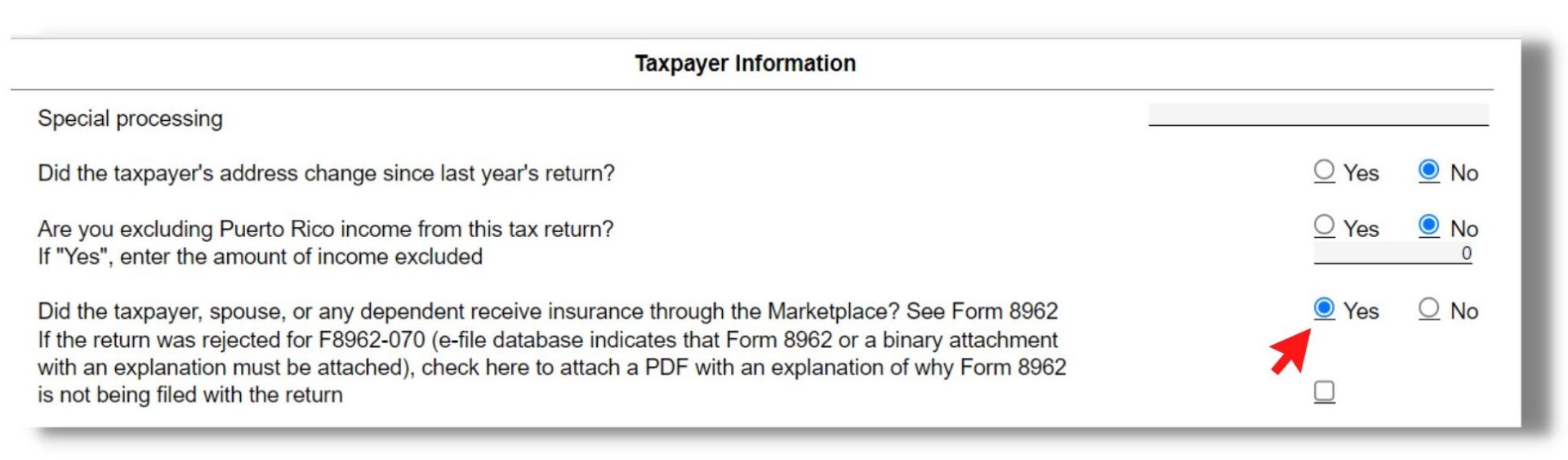

- Go to 'Main Information Sheet' and check under 'Taxpayer Information.'

- For the question, 'Did the taxpayer, spouse, or any dependent receive insurance through the Marketplace?' click 'Yes.' You'll then see Form 8962 show up--then click it.

B. How to Fill-up Form 8962

Empty space, drag to resize

- Under 'Part I 2b', to clear out the cell, click Ctrl+Space. You will do this if the dependents don't have an income yet.

2. For ‘Part II #9,'' Refer to Form 1095-A. If the insurance holder is just the taxpayer or a family group insurance, this is a No. Otherwise, Yes.

Empty space, drag to resize

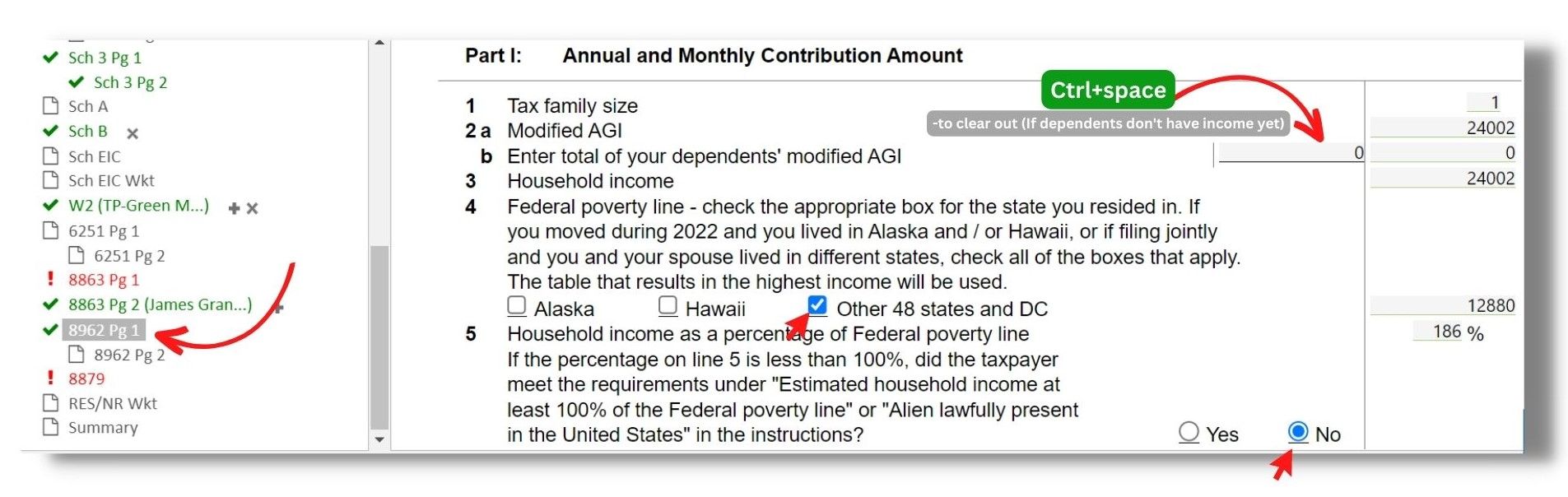

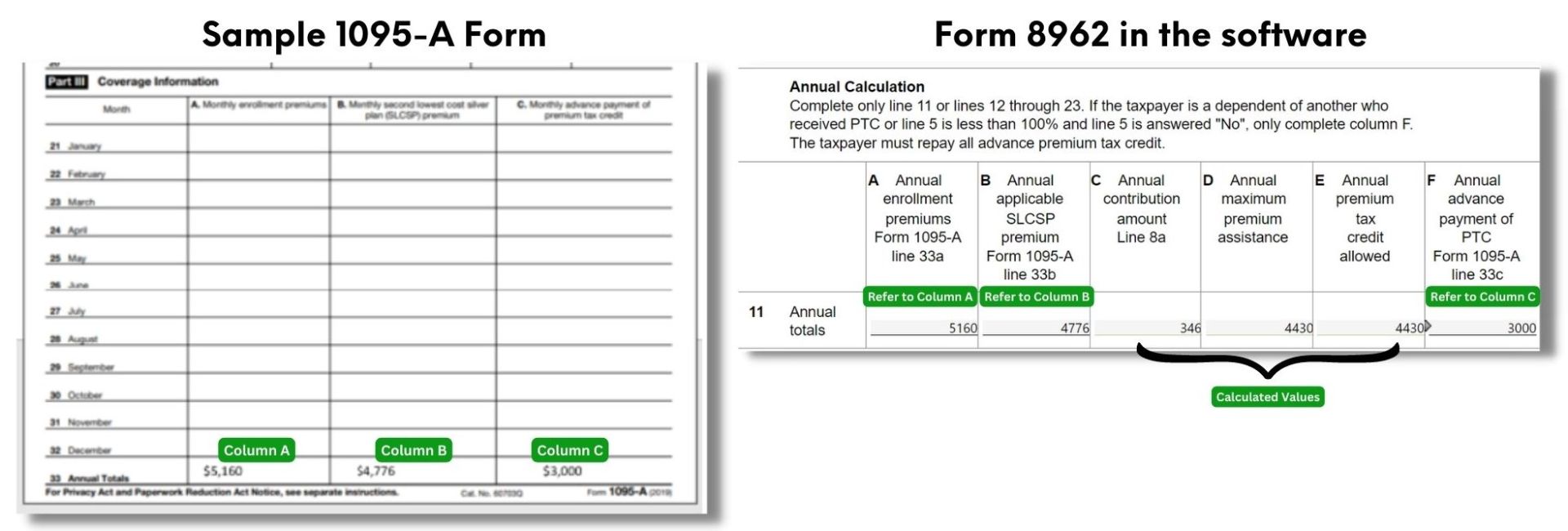

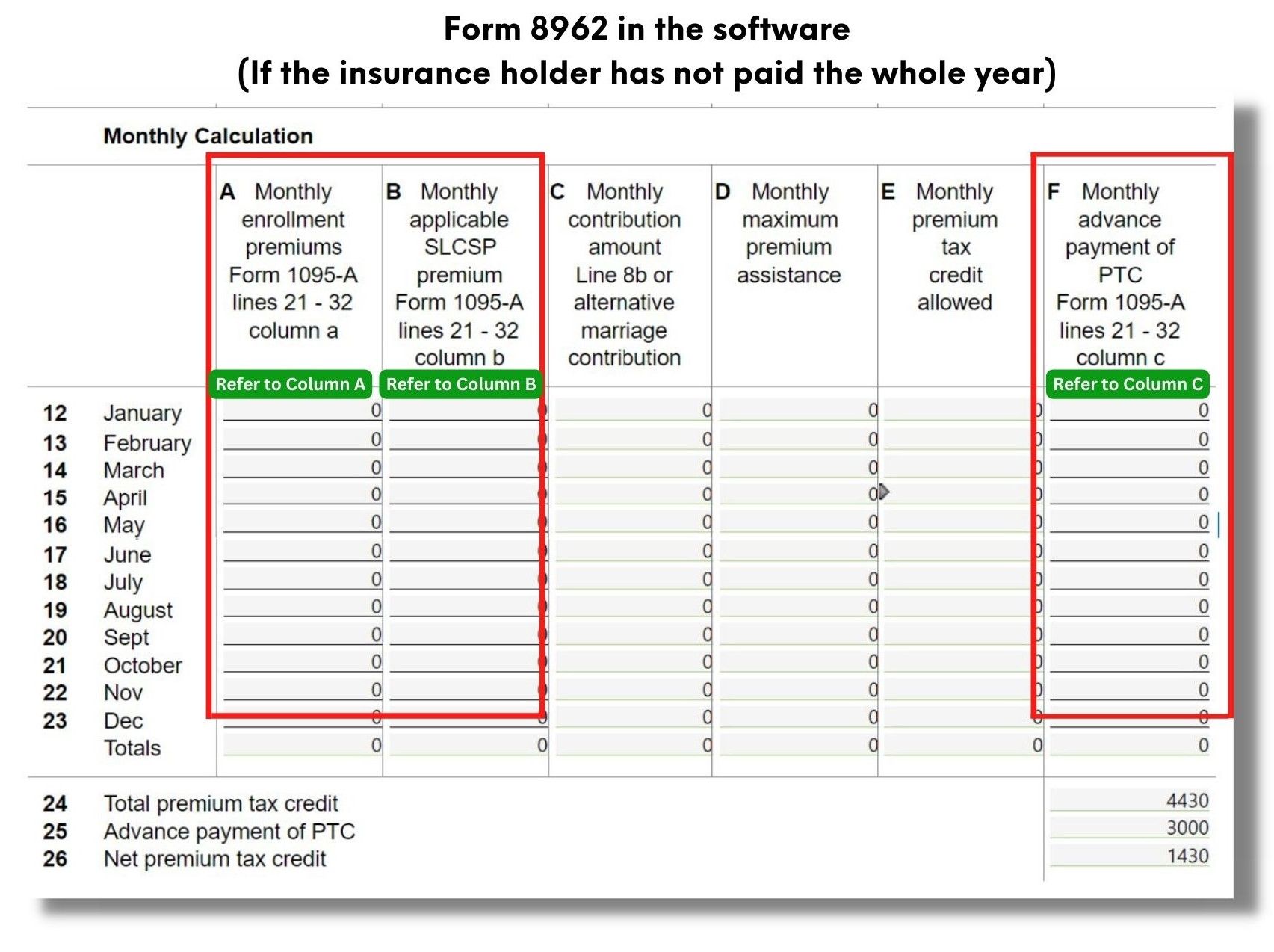

- For Part II #10c, Refer to Form 1095-A. If the taxpayer/insurance holder has paid all 12 months, it's a Yes. Proceed to enter Annual Calculations in Part II #11. If not, click No and fill in all amounts under the Monthly Calculation column. You need to individually enter the monthly payments from Form 1095-A to Form 8962 in the software. After entering all the information, do a quick review to ensure it is correct.

A scenario wherein the insurance holder paid the whole year.

The highlighted columns are where you will input the payments if the insurance holder did not pay for the whole year.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024