Entering Form 1098T: Student Tuition Statement

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter Form 1098-T.

Empty space, drag to resize

A. How to add the 1098-T form

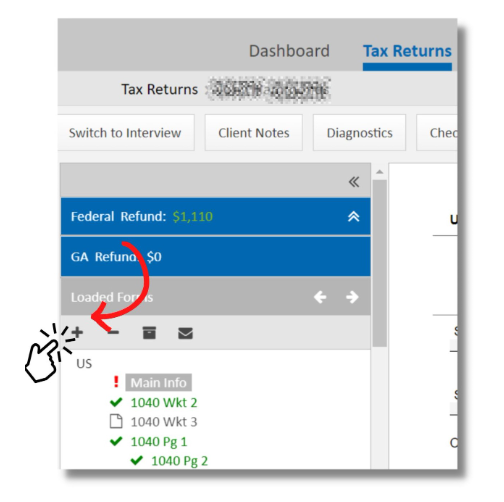

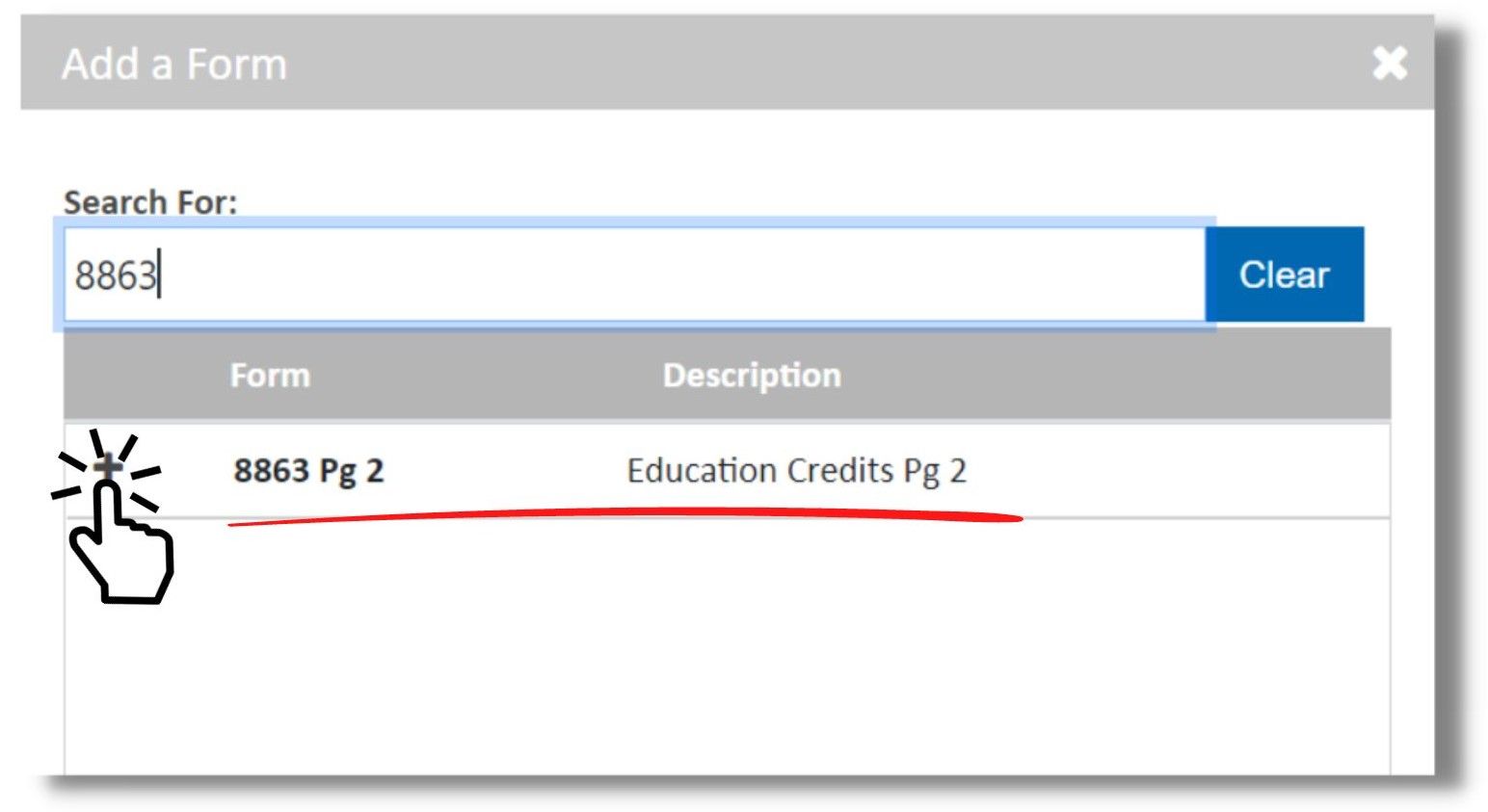

- Under the Tax Returns tab, locate the "+" icon at the upper left portion.

2. Type in ‘8863 Pg 2' in the search bar, then click it.

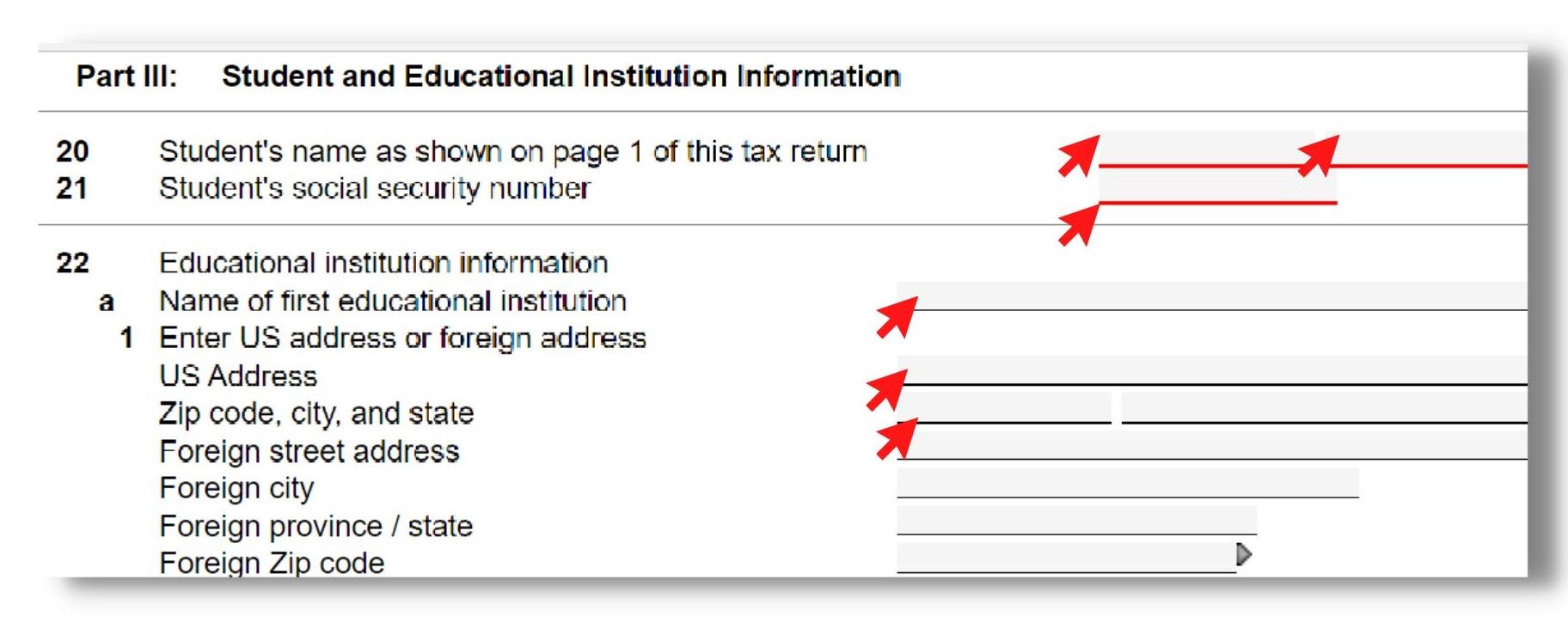

B. How to fill up the form

- Enter the needed information; the student's name (#20 in the software), the student's SNN (#21 in the software), the name of the institution (refer to 1098-T form), and its address.

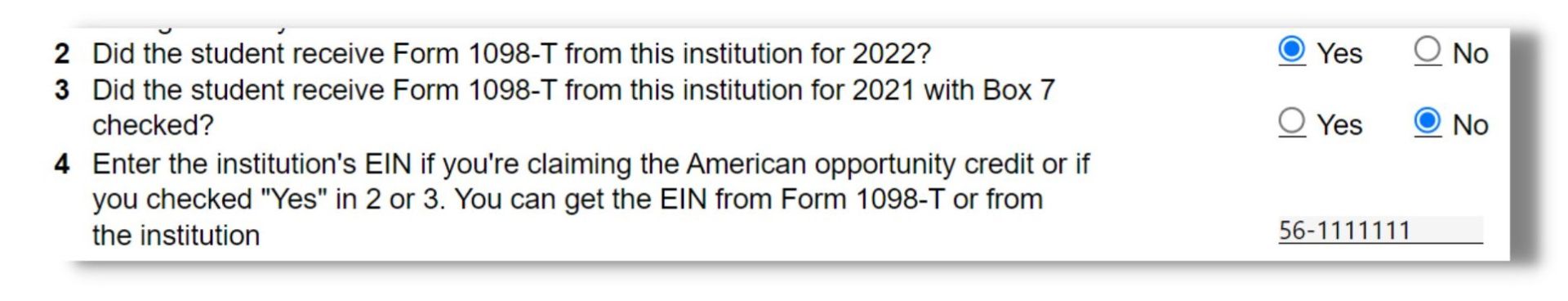

C. Answering questions

1. (#2 question) - Refer to the 1098-T form; if it is 2022, then Yes if not, then No.

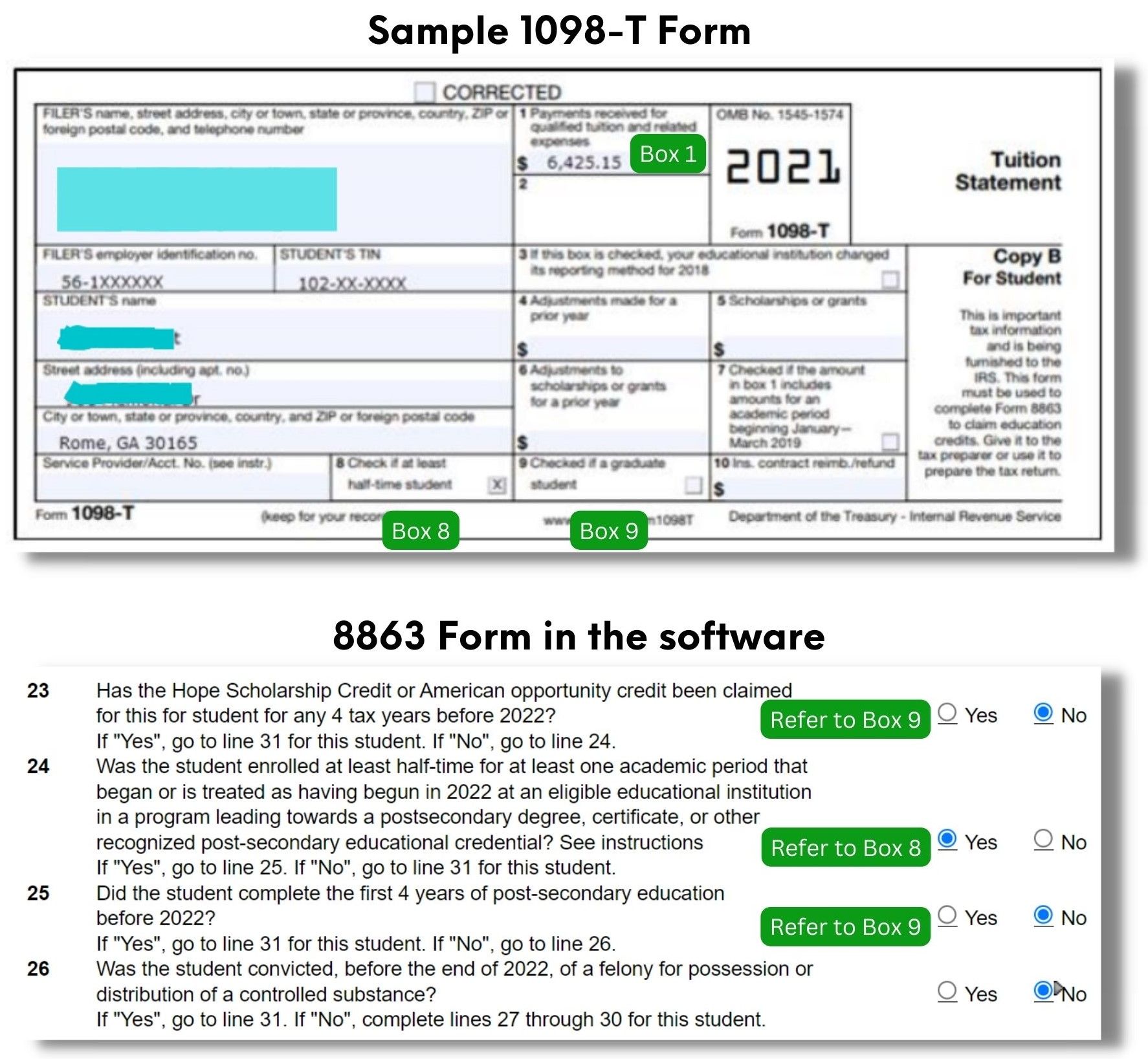

2. (#3 question) - Refer to the 1098-T form (See Sample 1098-T form below). In this case, No.

(Note: For #4, Refer to 'FILER's employer identification no.' in Form 1098-T)

3. (#23 question) Has the Hope Scholarship Credit or American opportunity credit been claimed for this student for any four tax years before 2022?

- If the student is still an undergrad, this is a typical No. Once a student has claimed this credit for four years, they will no longer be eligible for American Opportunity Credit.

4.(#24 question) Refer to Box 9 in Form 1098-T. If it is not marked, it's a No. For this case, Yes.

5. (#25 question) Refer to Box 9 in Form 1098-T. If it is not marked with a check, it's a No. For this case, No.

6. (#26 question) Usually, it's a No.

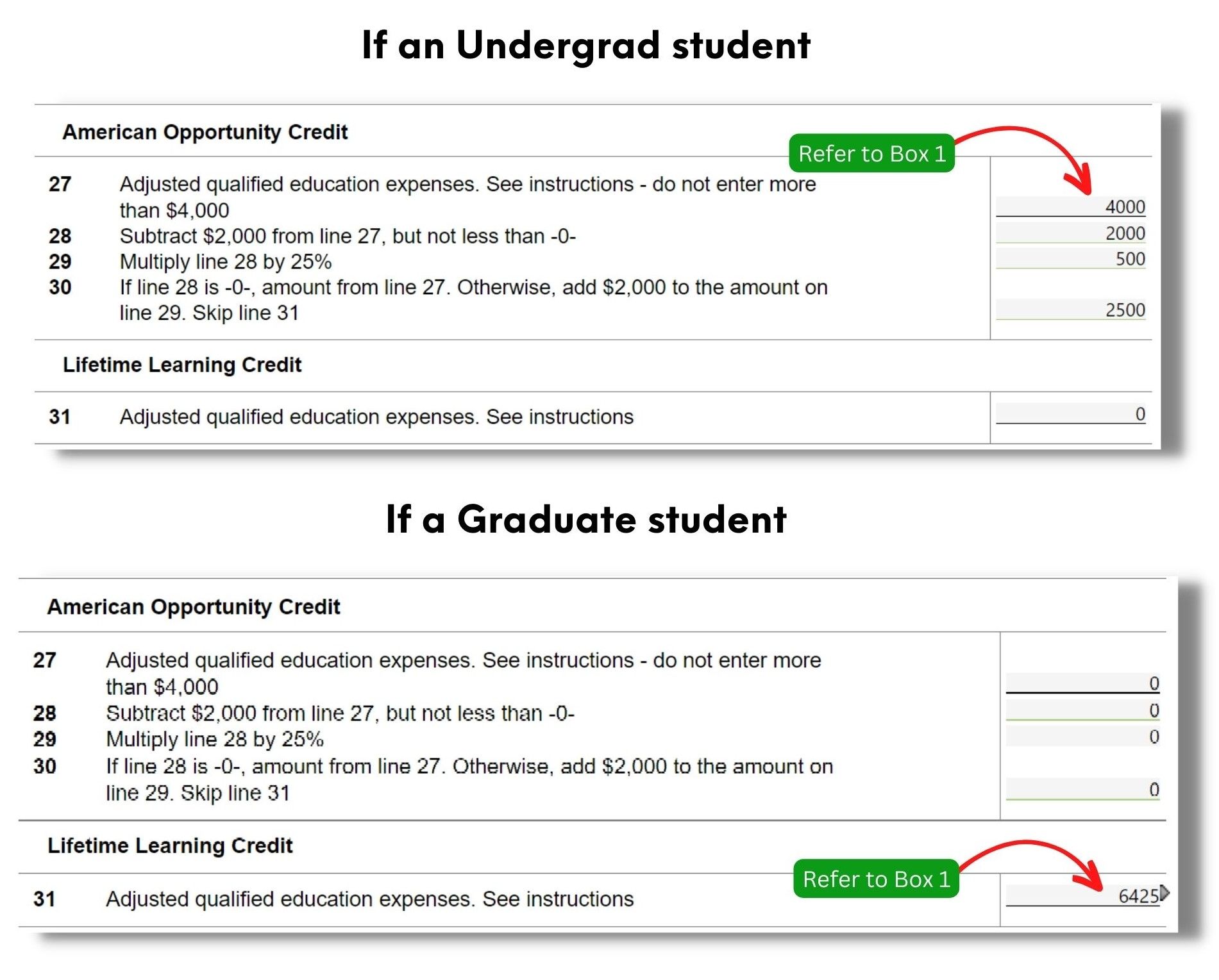

D. Entering American Opportunity Credit

- If the taxpayer is an undergrad student, enter the amount in #27 (Refer to Box 1 from Form 1098-T). Then #28, #29, and #30 are automatically calculated. Take note not to enter more than $4000 for an undergrad.

- If the taxpayer is a graduate student, then go to #31 and enter the amount paid (Refer to Box 1 from Form 1098-T)

Important Reminder: Ensure all the details are correct, especially the number values. You need to input all the numbers and let the software do the rounding.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024