Entering Form 1099B: Proceeds from Stock Exchange

A. How to add Form 8949 to the software

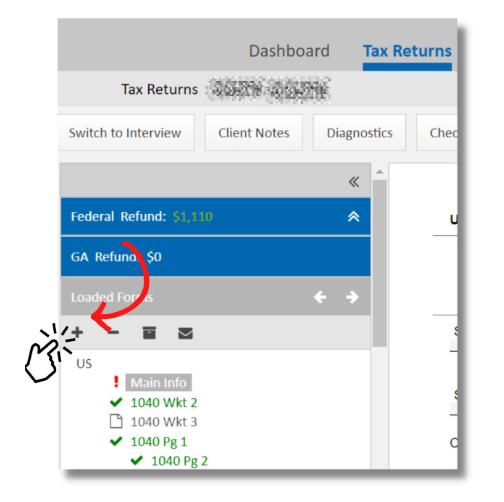

1. Under the Tax Returns tab, locate the "+" icon at the upper left portion.

2. Then type in the '8949' form in the search bar and click the appropriate form you want to open.

(For the example below, click 8949 Pg 1)

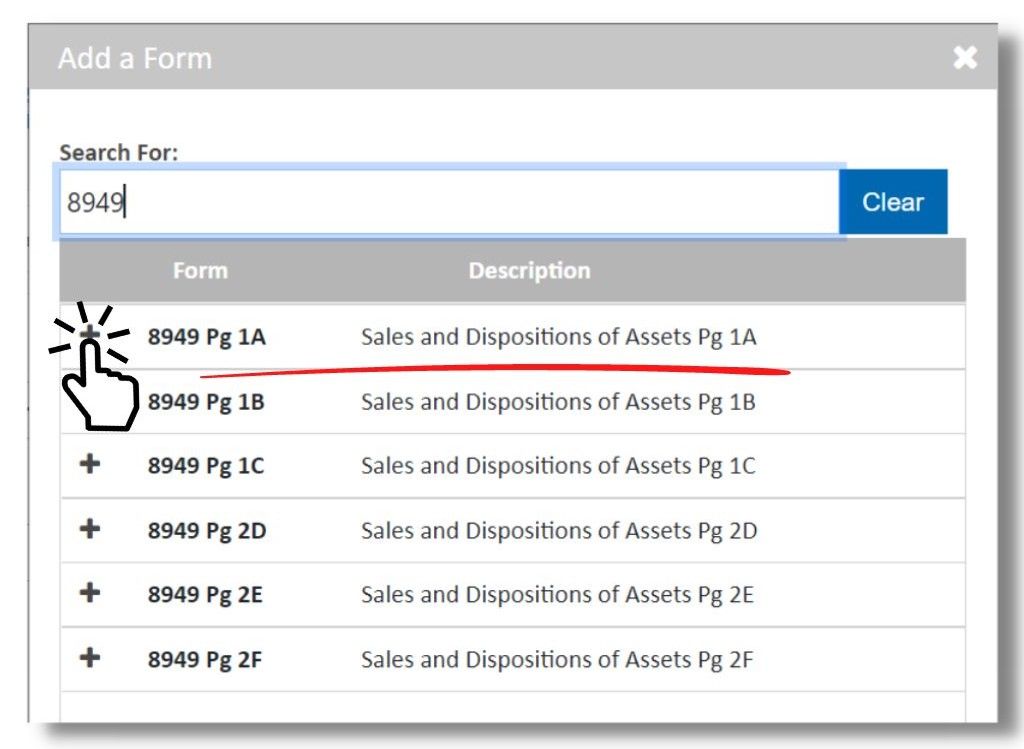

3. In 8949 Form, you'll see that all cells are 'green,' meaning they are all calculated. So to input into the cells, you need to link it.

B. How to link to another form (US Schedule D Worksheet)

1. To link, click the gray arrow, then click 'link to another form.'

C. How to fill up US Schedule D: Capital Gain or Loss Transactions Worksheet

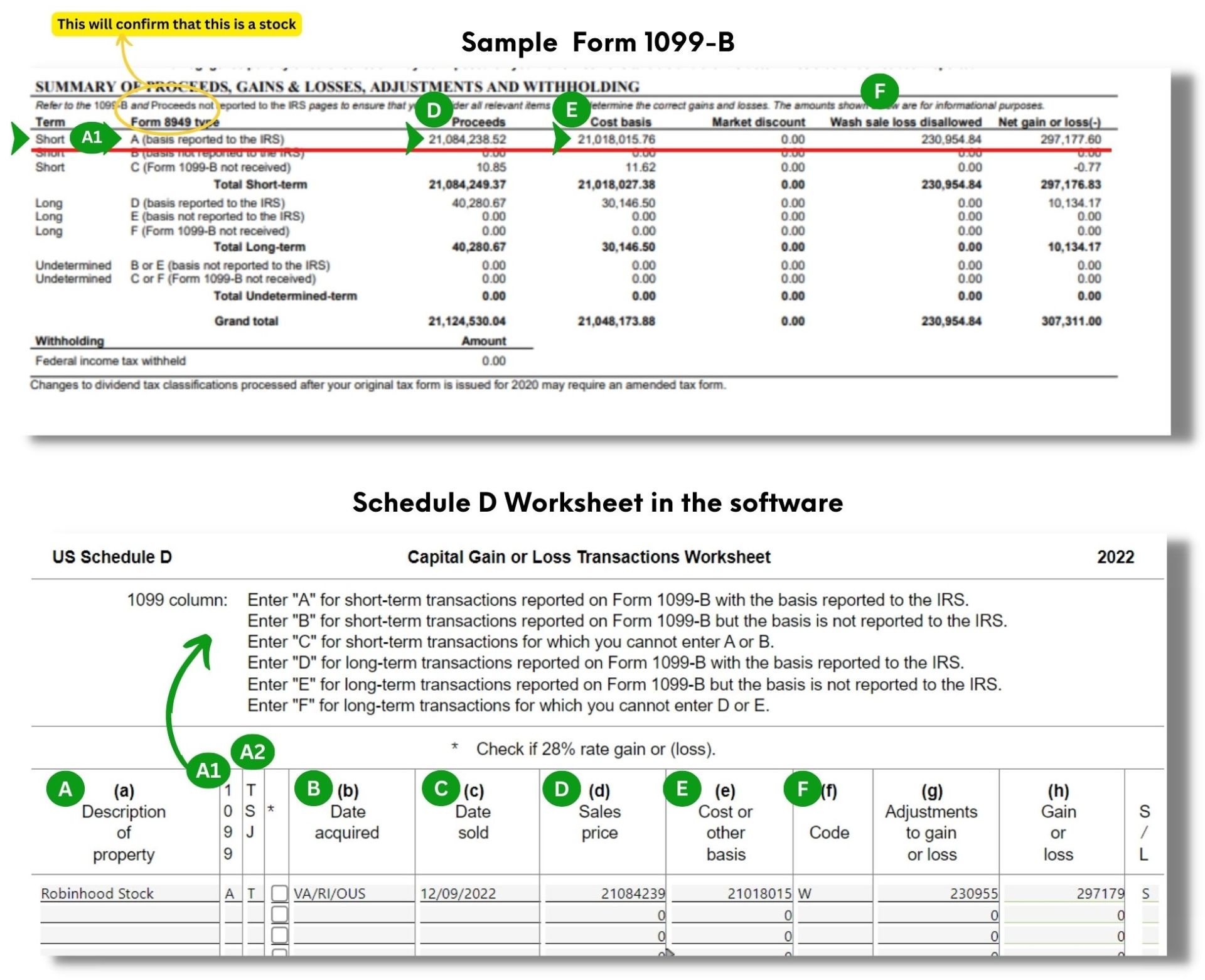

(For the instructions below, refer to this sample Form)

1. In Form 1099-B, look into the 'Summary' table.

4. For A2 or TSJ column, input the appropriate letter.

Important Reminder: Ensure all the details are correct, especially the number values. You need to input all the numbers and let the software do the rounding.

Who we are

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin