Entering Form 1099-NEC: Non-Employee Compensation

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter Form 1099-NEC (Part 1)

A. How to add 1099-NEC form to the software

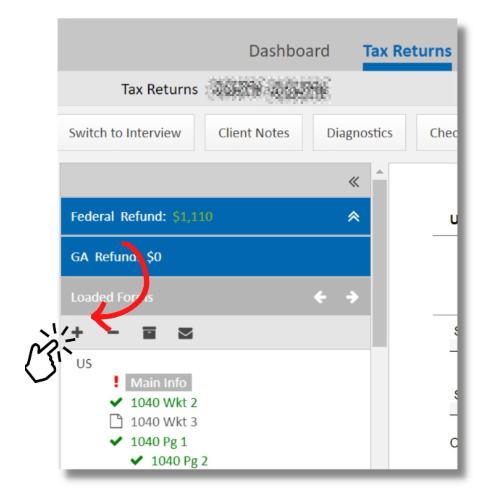

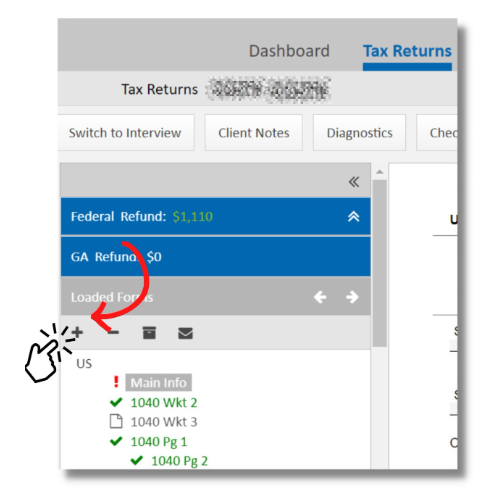

1. Under the Tax Returns tab, locate the "+" icon at the upper left portion.

2. Then, search for the 'Sch C Pg 1' form in the search bar then click it.

B. How to fill up the form

- For letter A, you need to enter the Principal business or profession. Examples are Taxi driver, Car salesman, and others.

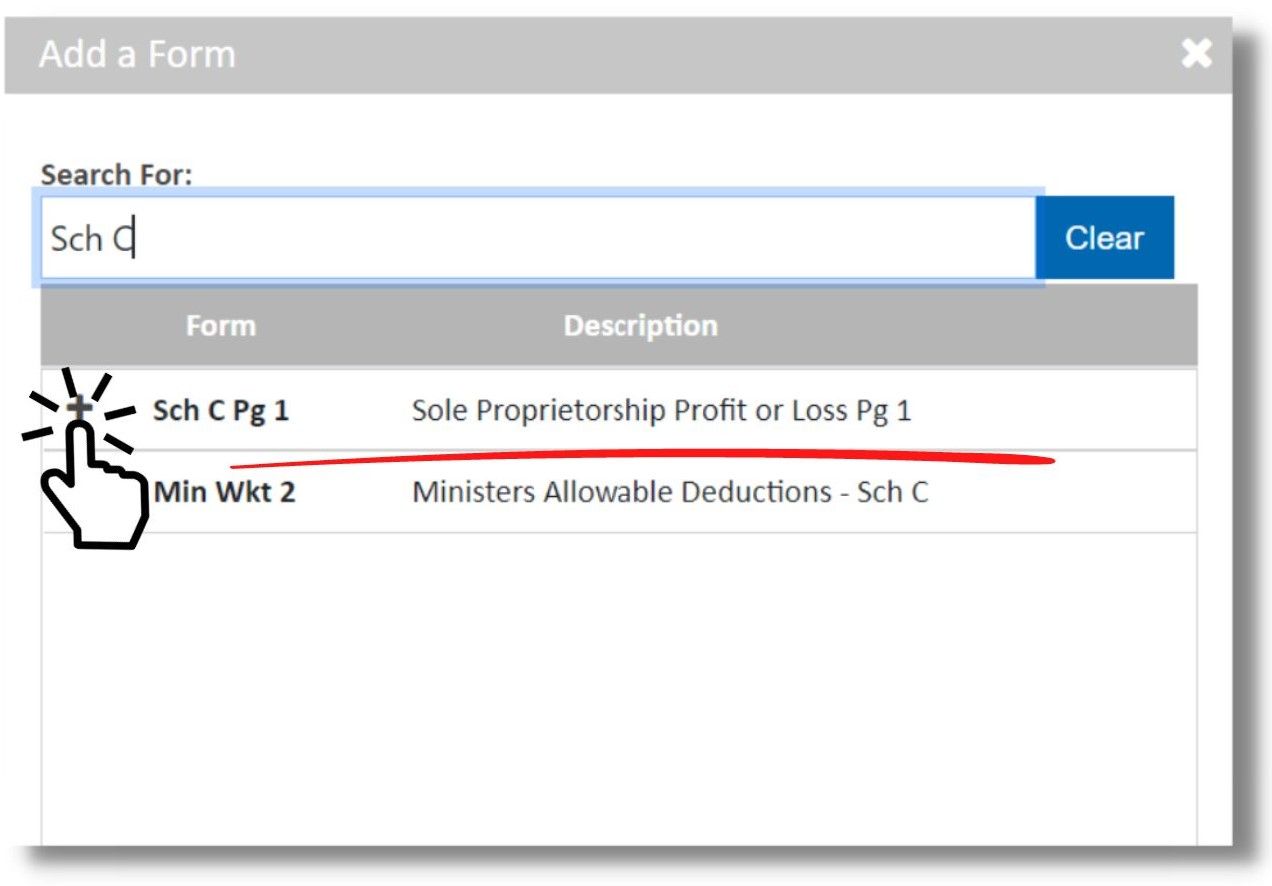

- For the letter B (business code), click the gray arrow to know what information you will use. You can see instructions on how to input it. This is also true for all other cells.

- So for letter B, it says to press F1, then click to open Index, then find Business Codes for Sch C. There, you can find the business codes accordingly.

4. Another option to know the business codes is to ask Mr. Google. Just type in 'Business codes for Sch C' in the search engine, then it will give you a list of codes.

5. For letters C and D, check Form 1099-NEC if the information is given, then type it in. If not, then leave it blank.

5. For letters C and D, check Form 1099-NEC if the information is given, then type it in. If not, then leave it blank.

6. For the letter E, type in the business address. You can refer to Form 1099-NEC. If it is just the taxpayer's business, refer to their address in the Main Information Sheet.

7. In most cases, the answer is on a 'Cash' basis for the letter F.

8. For the letter G, it's a Yes.

9. For the letter H, if it is in the first year of the business, then you will check the box, but if it is not, then leave it blank.

10. For the letter I, it's a No.

11. Proceed to Part 2.

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter Form 1099-NEC (Part 2)

(After Entering Form Sch C, you can now proceed to Part 2.)

A. How to link the form 1099-NEC with Sch C form

1. Under the 'Tax Returns' tab, locate the '+' sign in the upper left portion, then click it.

2. Then search for Form 1099-NEC then click it.

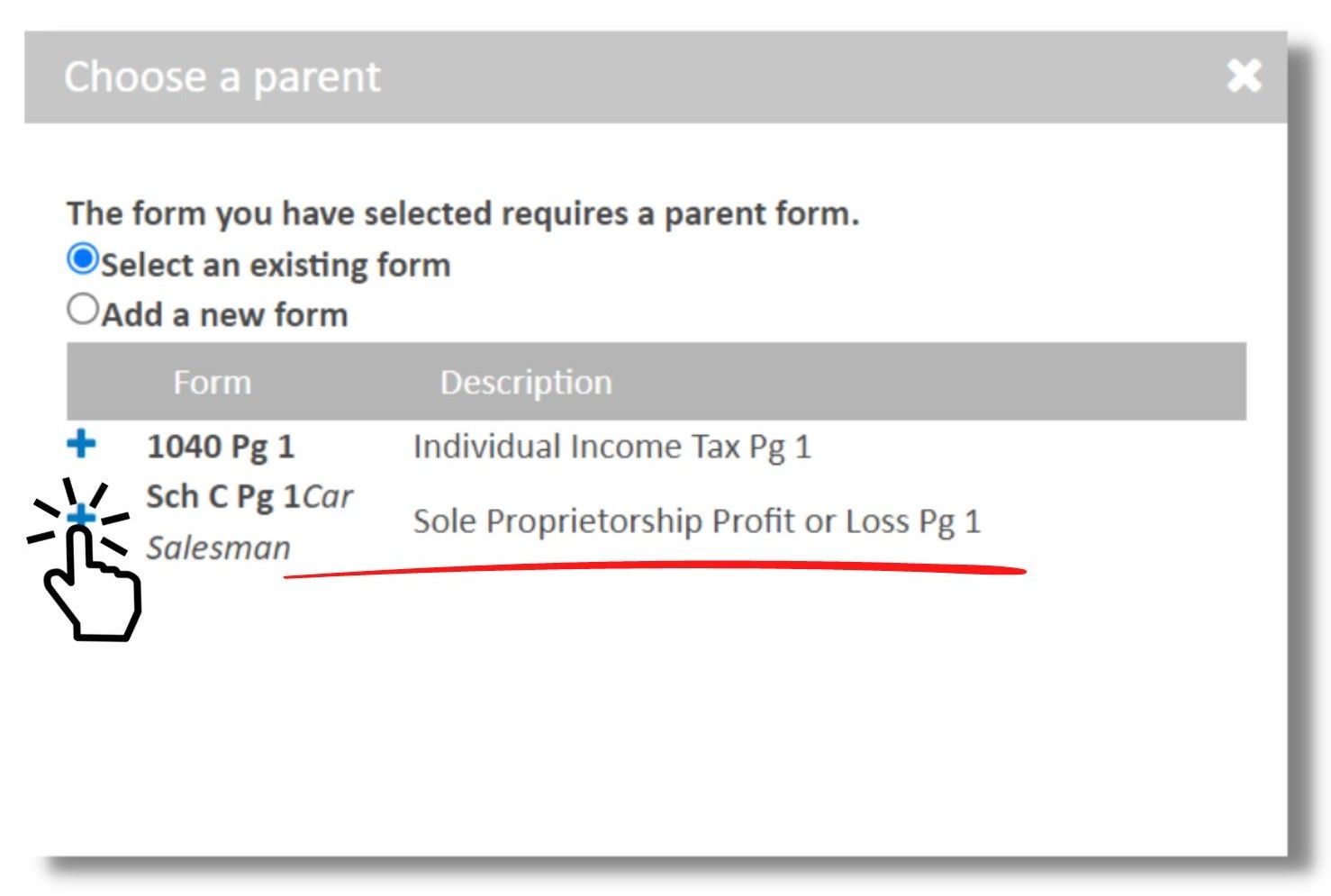

3. Now link it with the Sch C form, as shown below.

3. Now link it with the Sch C form, as shown below.

B. How to fill-up the Form 1099-NEC

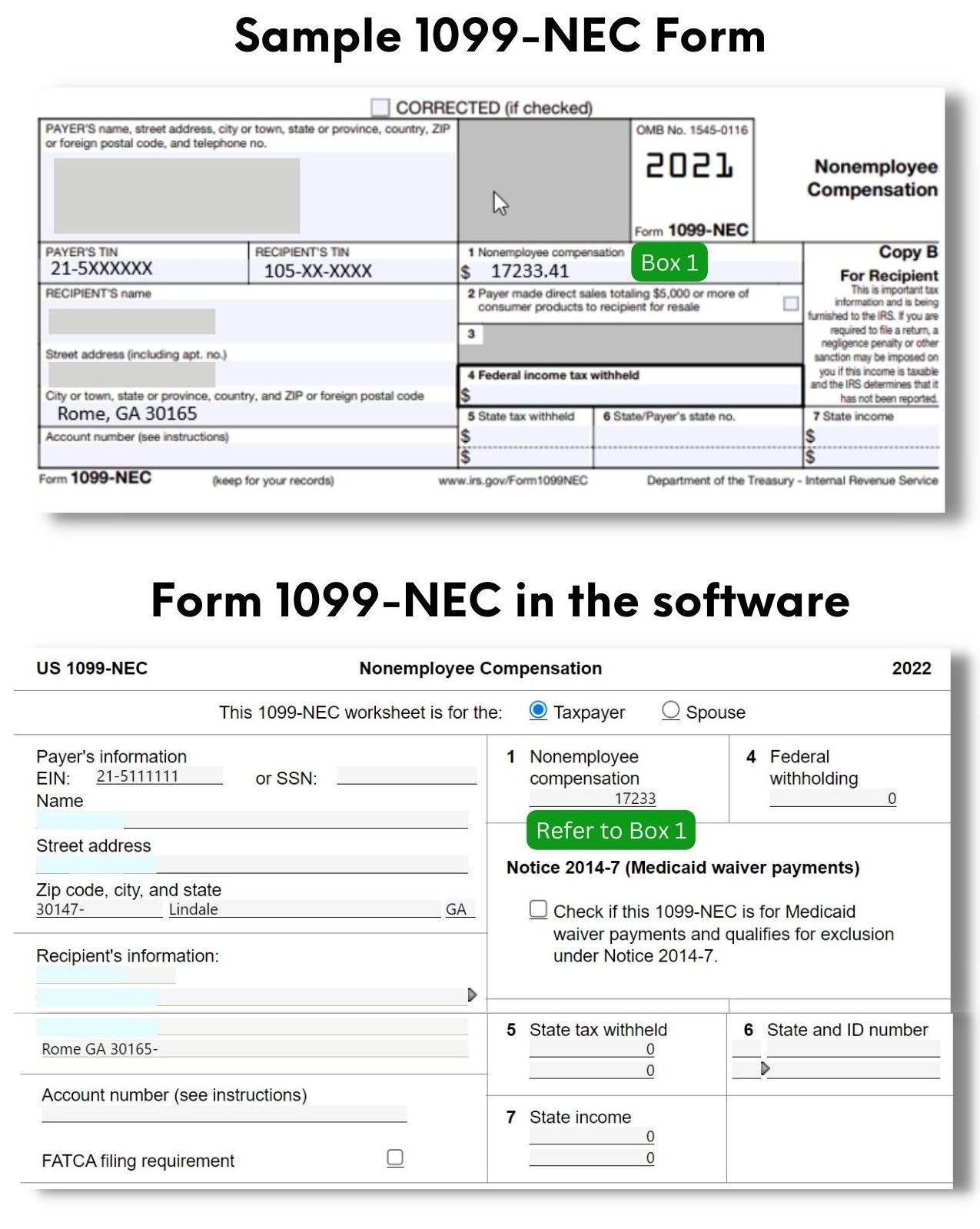

- Click 'taxpayer' or 'spouse,' whichever applies.

- Type in the EIN or SNN first, then the Name and address. (Refer to Form 1099-NEC)

- Then whatever details you see in Form 1099-NEC must all be reflected in the software. Make sure to enter the correct information.

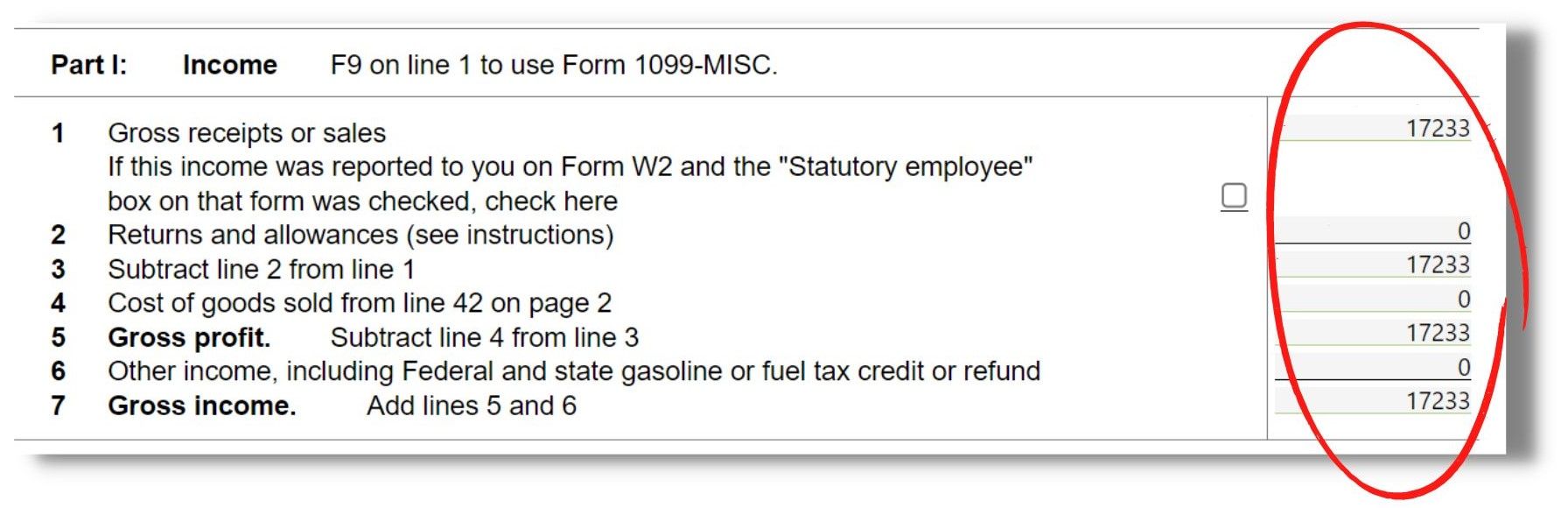

4. Go to the Sch C form and check under the 'Income' details. You'll see that it is automatically calculated based on the amount you entered in Form 1099-NEC.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024