Entering State Forms: Georgia - GA

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to fill up the State Forms in Georgia

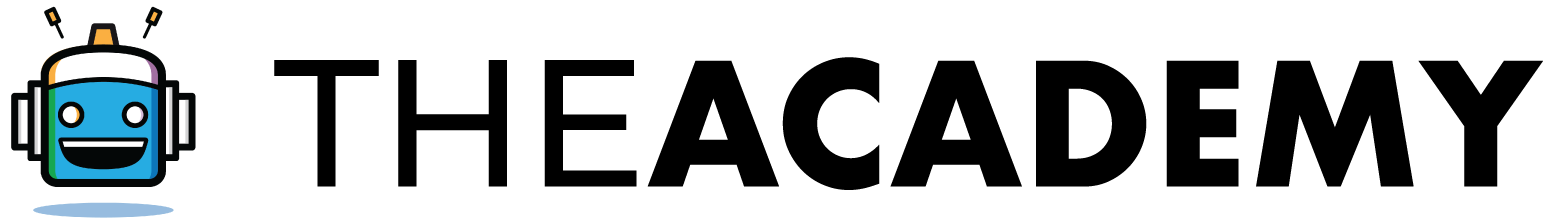

- From the Main Information Sheet, once you fill in the State Information with GA as a full-year resident, you'll see the GA state forms appear. The documents that you need to complete are the red ones.

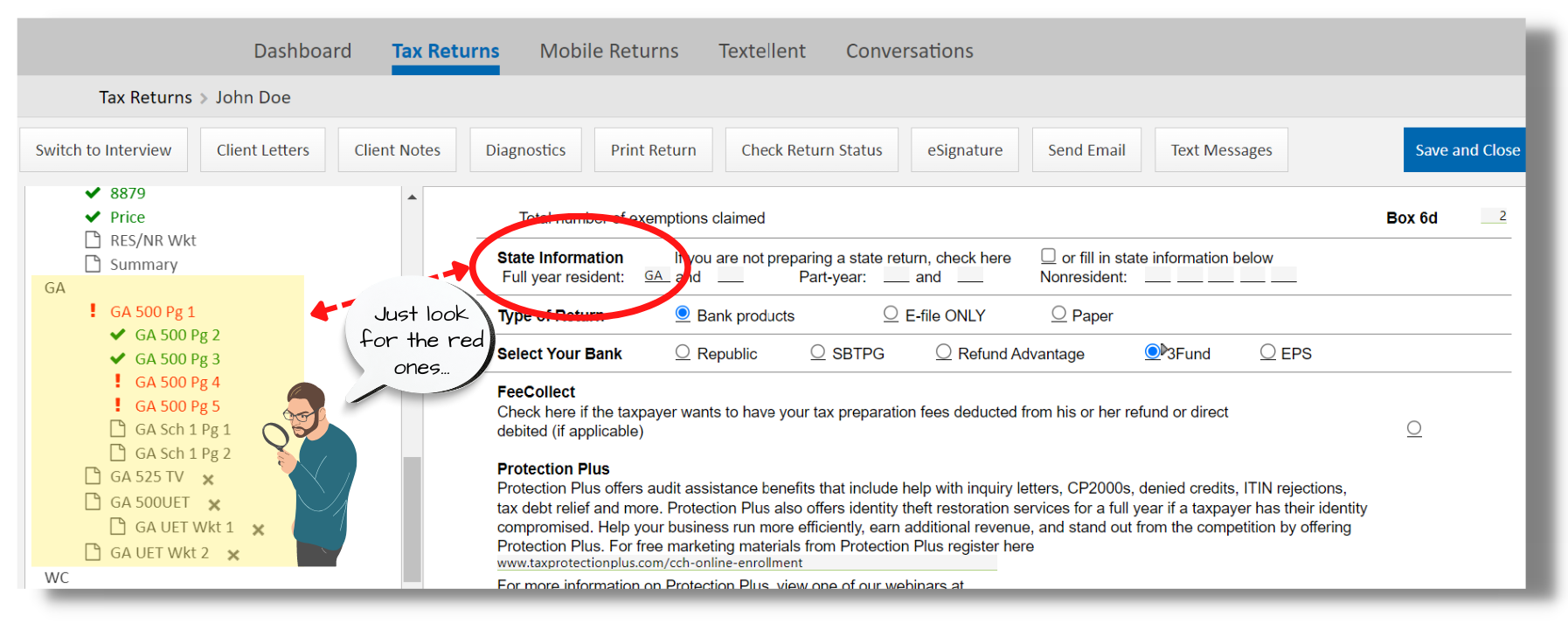

2. The first form in this scenario is GA 500 Pg 1- Georgia Individual Income Tax Return. You need to confirm if the address has been changed or not. Answer either Yes or No accordingly.

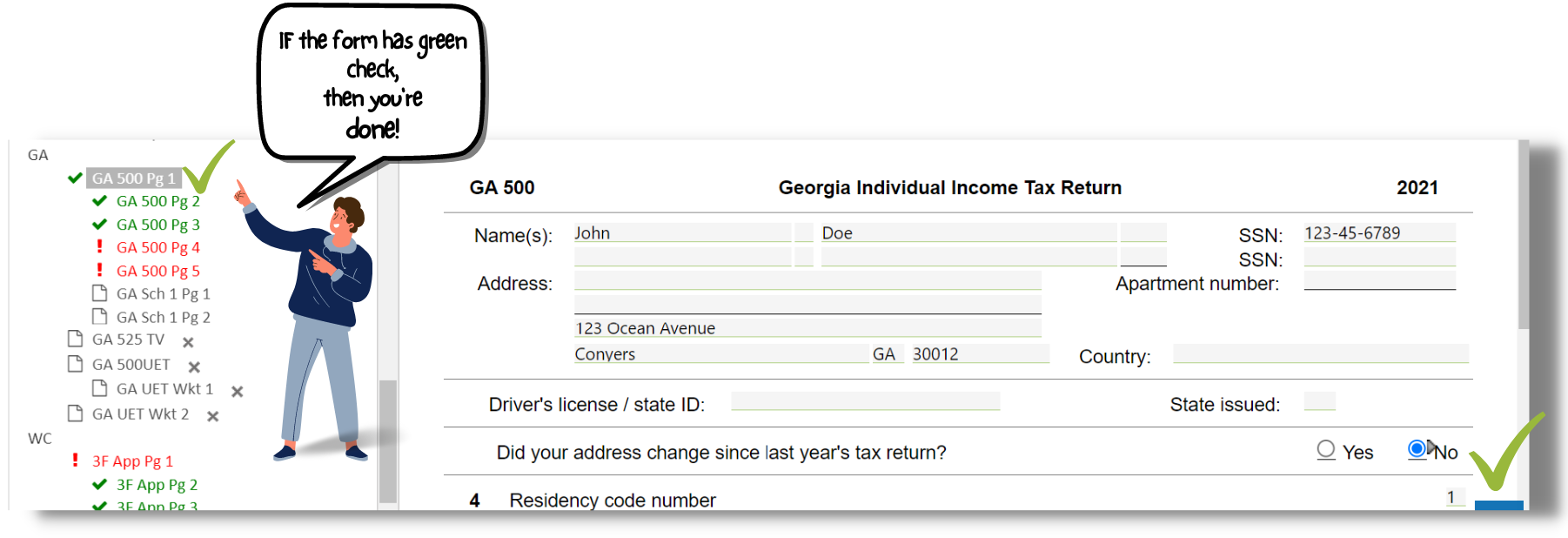

3. The following form that needs to be completed is GA 500 Pg 4. Here you need to confirm #23 for E-filing only. As it says, you need to ascertain and verify withholding on Forms W2, W2G, 1099R, and 1099G.

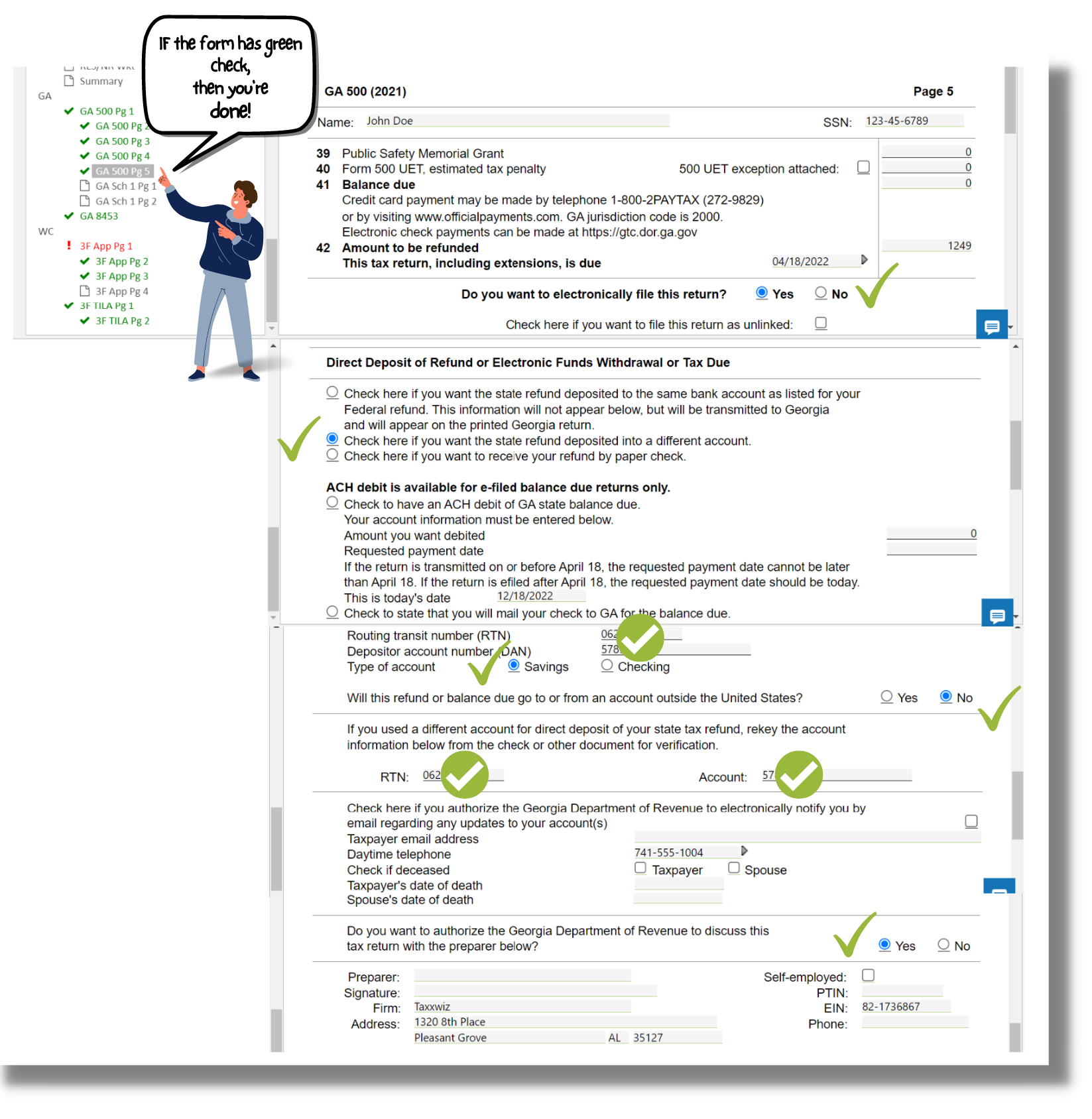

4. The following form is GA 500 Pg 5. If the taxpayer wants to file the return electronically, click Yes. Otherwise, No.

5. Then we always prefer to deposit the state refund into a different account. ( See the below photo )

6. If you click that option, you need to enter the bank details, the RTN, and the Account number. Triple-check the bank details. You have to make sure that it is 100% correct.

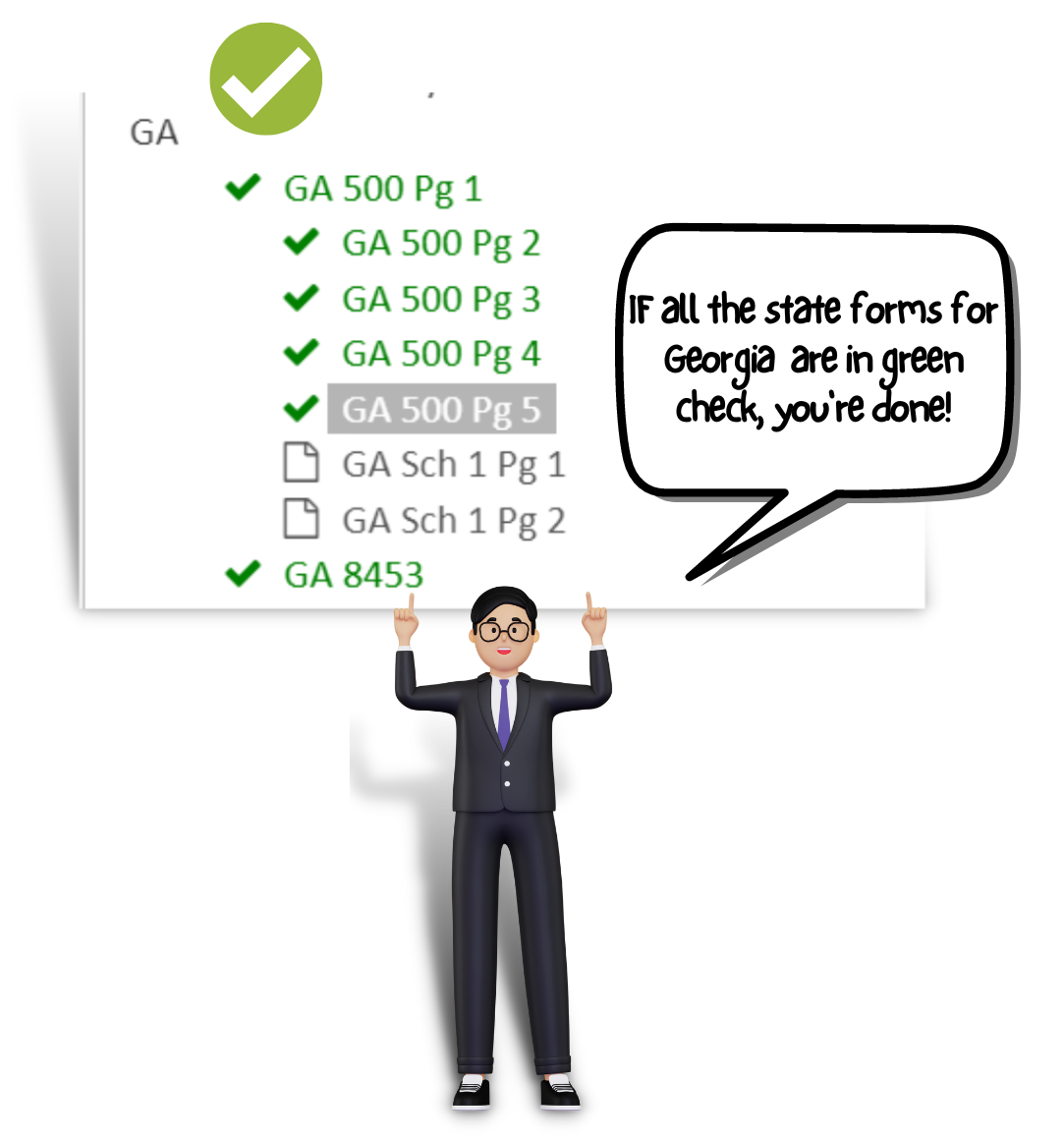

7. If all the state forms for Georgia are in green check, you're done with the state forms.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024