Entering State Forms: Vermont

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter State Forms: Vermont

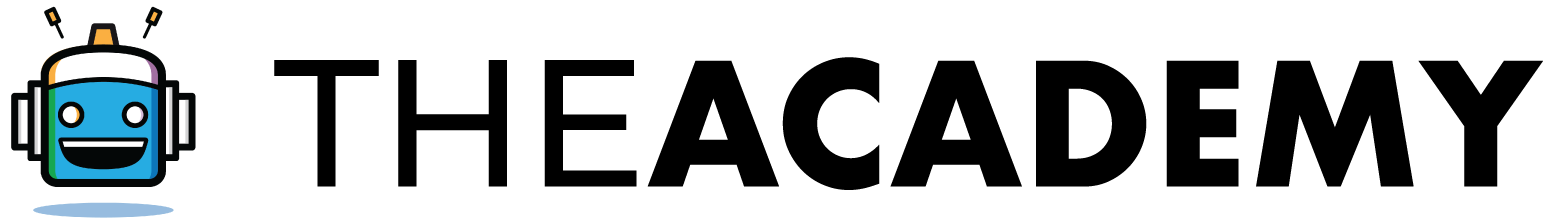

- Under 'State Information' details (from the Main Information Sheet), if you put a full-year resident in Vermont (VT), the corresponding state forms you need to fill up appear in red.

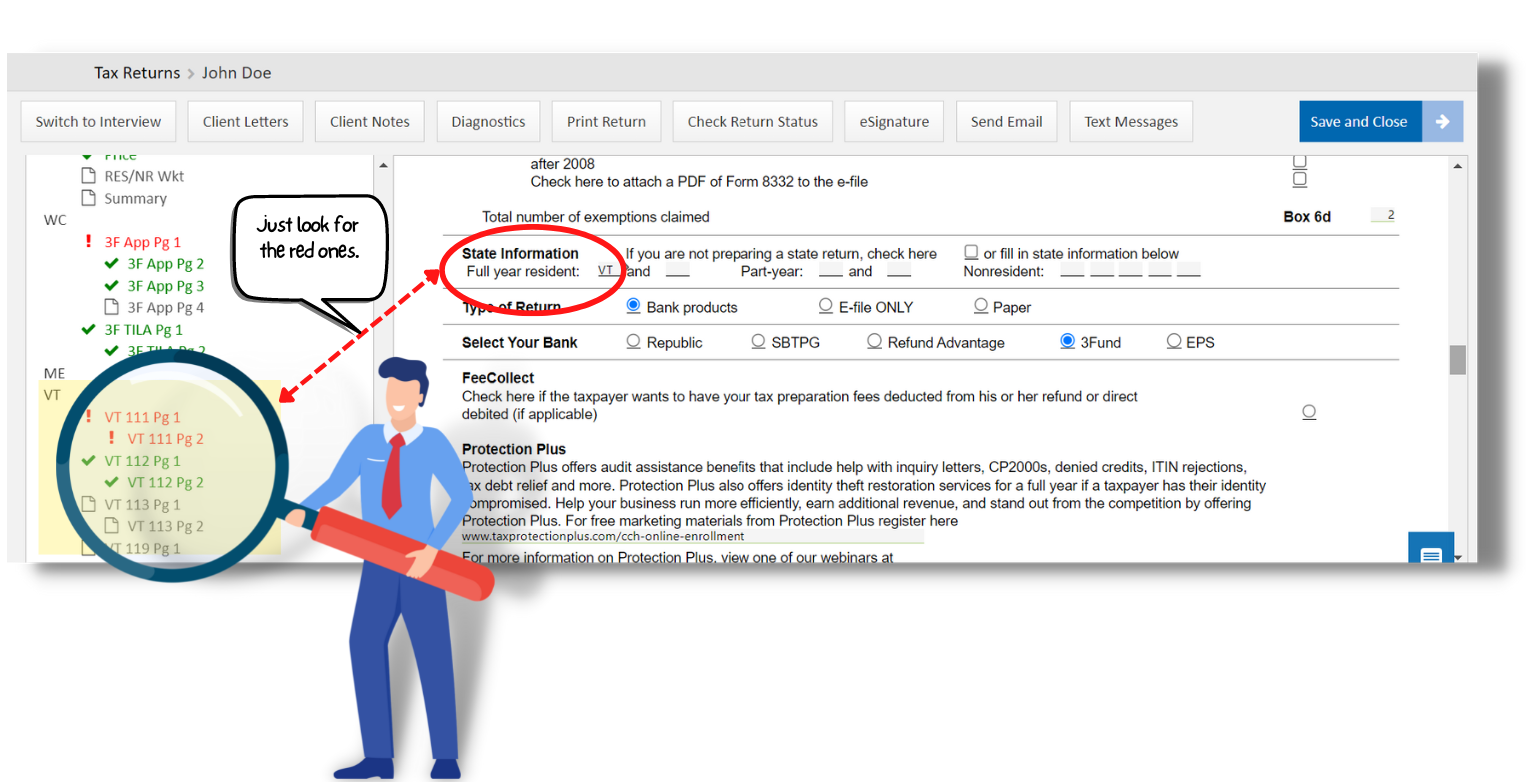

A. Form VT IN-111

- On this form, answer the questions accordingly. Then, you need to enter the Vermont school code and city/town legal residence. See the instructions for the code options. You also need to know the taxpayer's 911 street address.

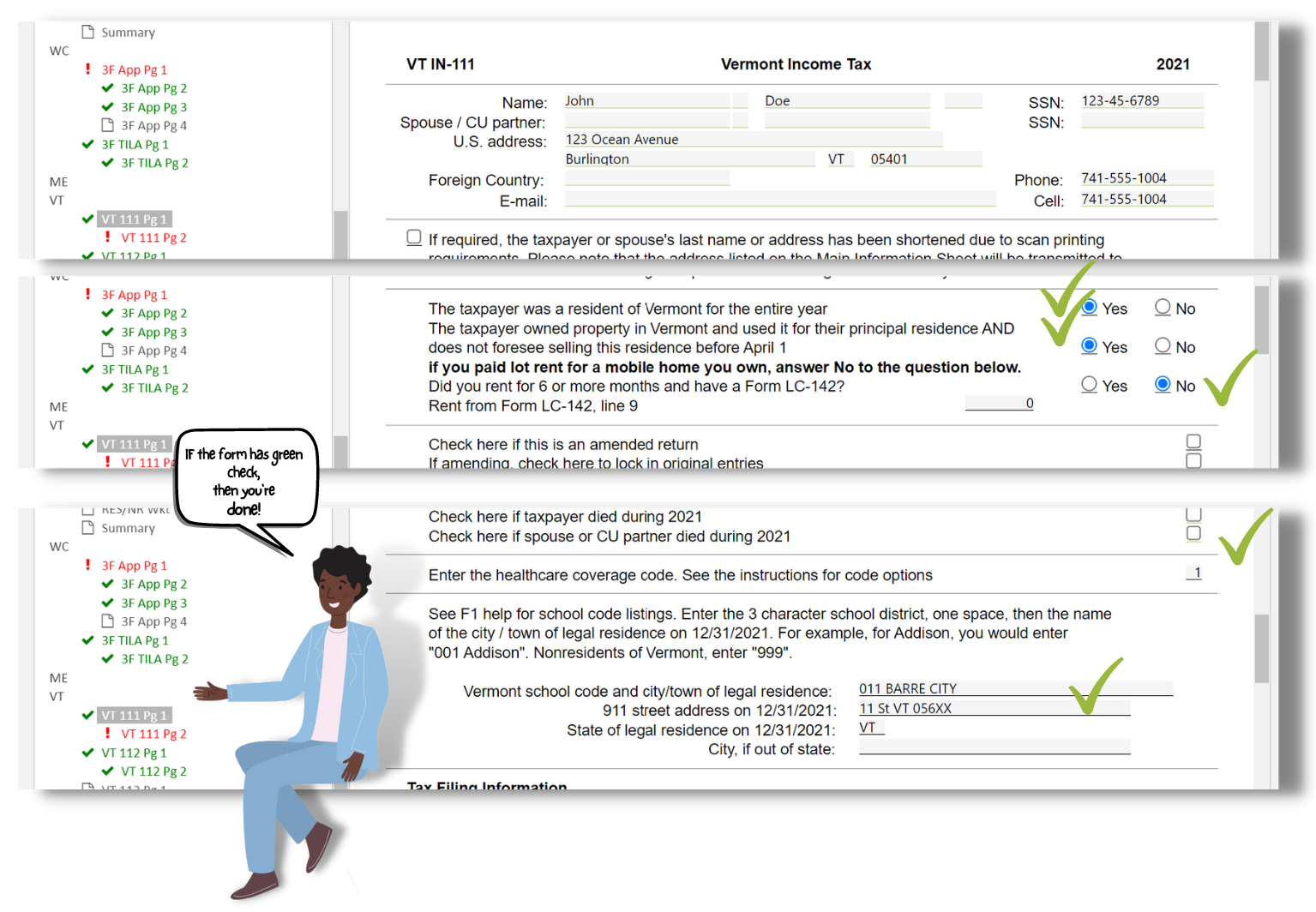

B. Form VT IN-111 Pg 2

- Click the small box in #21 to certify that no use tax is due.

- If the taxpayer wants to file the return electronically, click Yes.

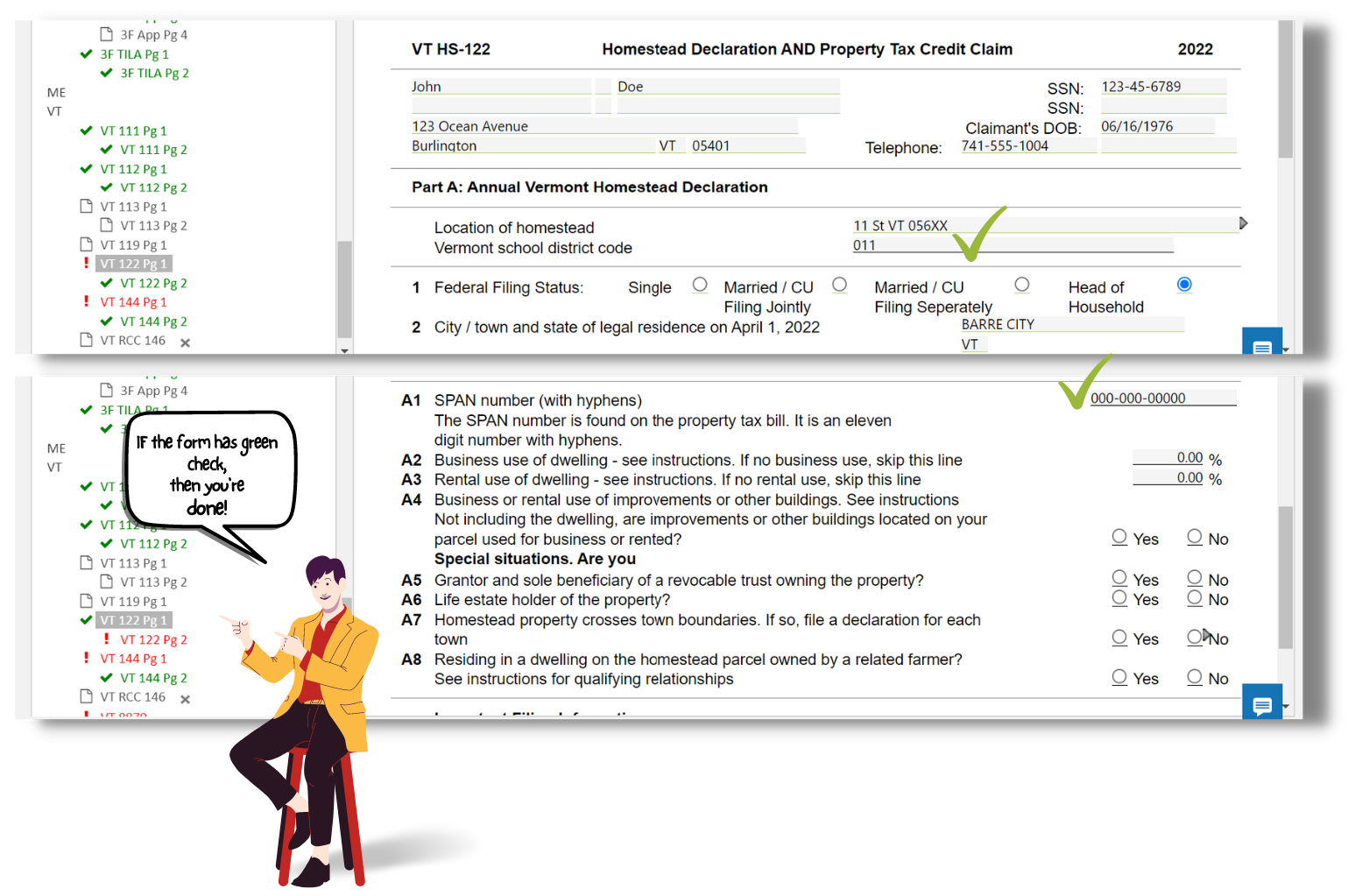

C. Form VT HS-122

- Enter the Vermont school district code.

- Enter the SPAN number that can be found on the property tax bill. In this scenario, the Taxpayer does not rent a house and thus owns a property.

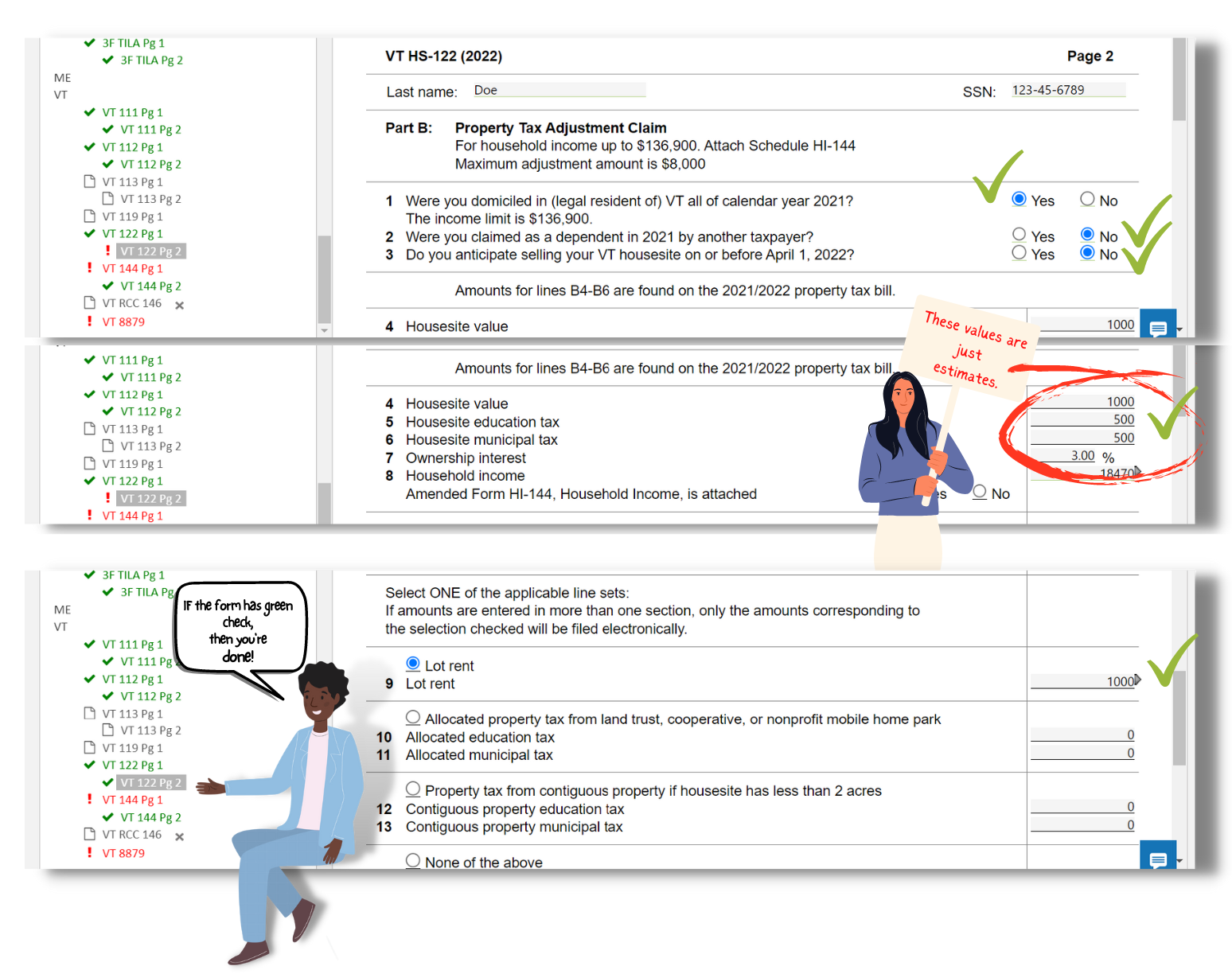

D. Form VT HS-122 Pg 2

- Under Part B, answer the following questions accordingly.

- You must enter the amounts for lines B4-B6 found on the property tax bill.

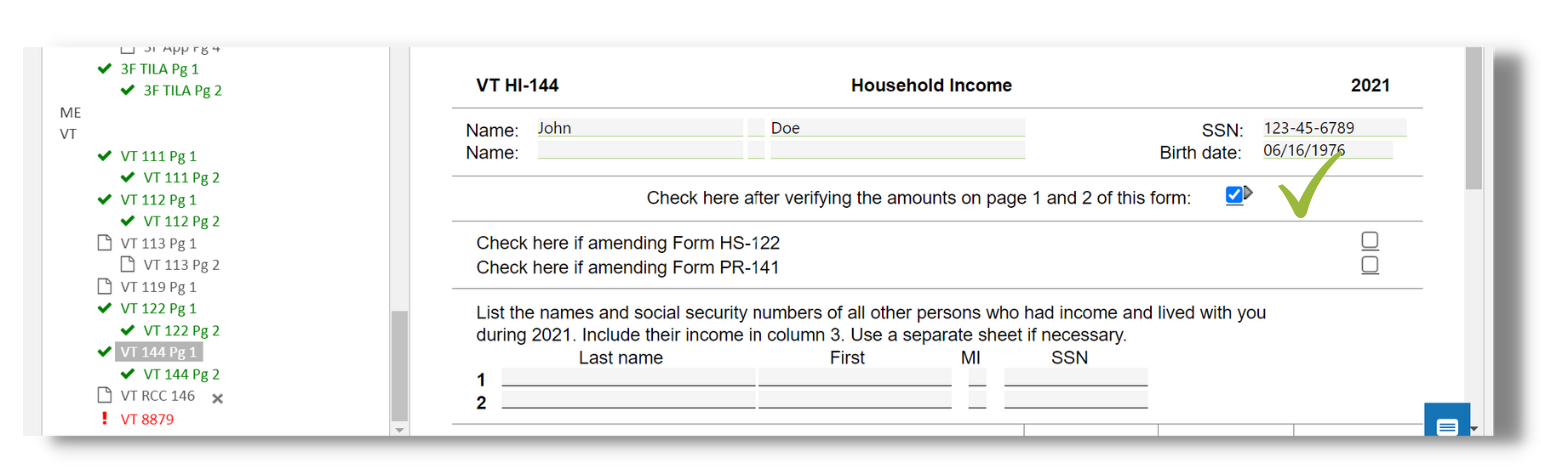

E. Form VT HI-144

- On this page, you just need to verify and confirm if the amounts on pages 1 and 2 are correct.

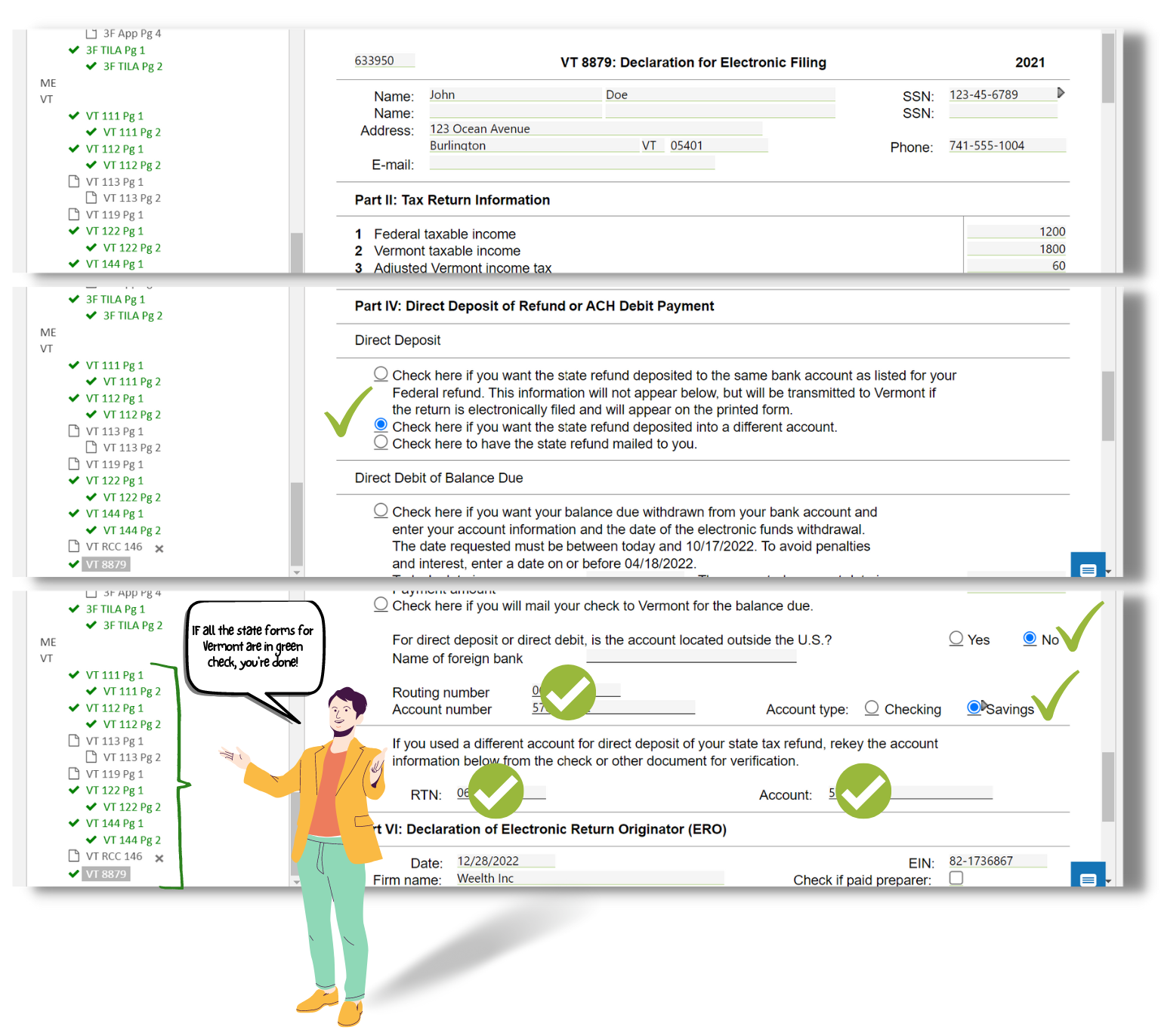

F. Form VT 8879

- Under 'Direct Deposit of Refund or ACH Debit Payment,' we prefer to choose the option where the refund is deposited into a different account.

- Then, enter the bank details as needed. Please make sure they are 100% correct.

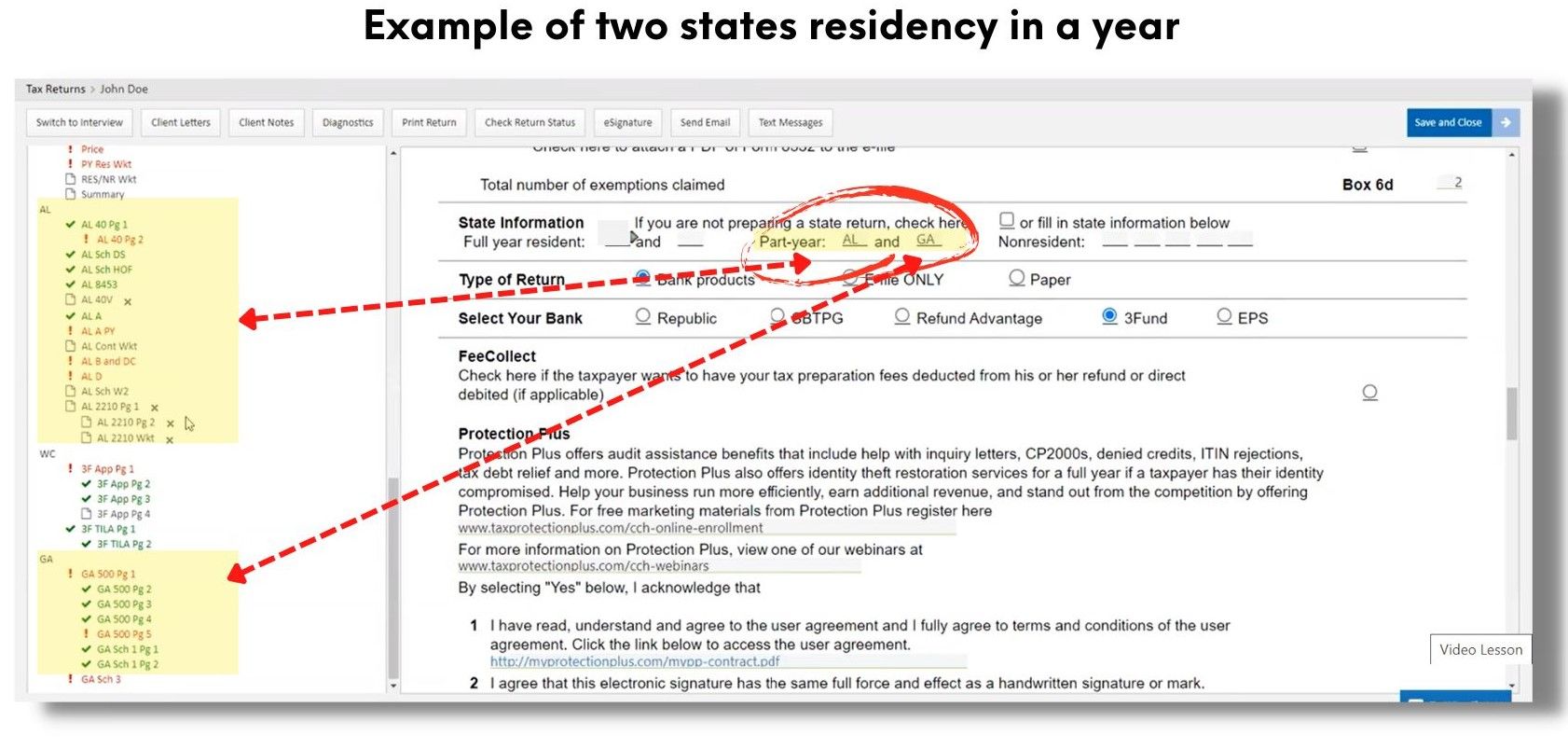

G. If the Taxpayer has two states of residency in a year, you need to fill it up as shown below; the state forms you need to enter will automatically appear.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024