Entering State Forms: Wisconsin

Empty space, drag to resize

Empty space, drag to resize

Empty space, drag to resize

These are the steps on how to enter State Forms: Wisconsin

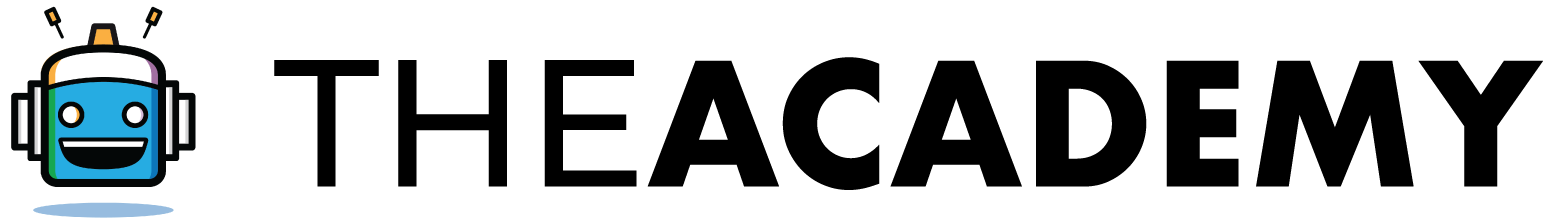

- Under 'State Information' details (from the Main Information Sheet), if you put a full-year resident in Wisconsin (WI), the corresponding state forms you need to fill up appear in red.

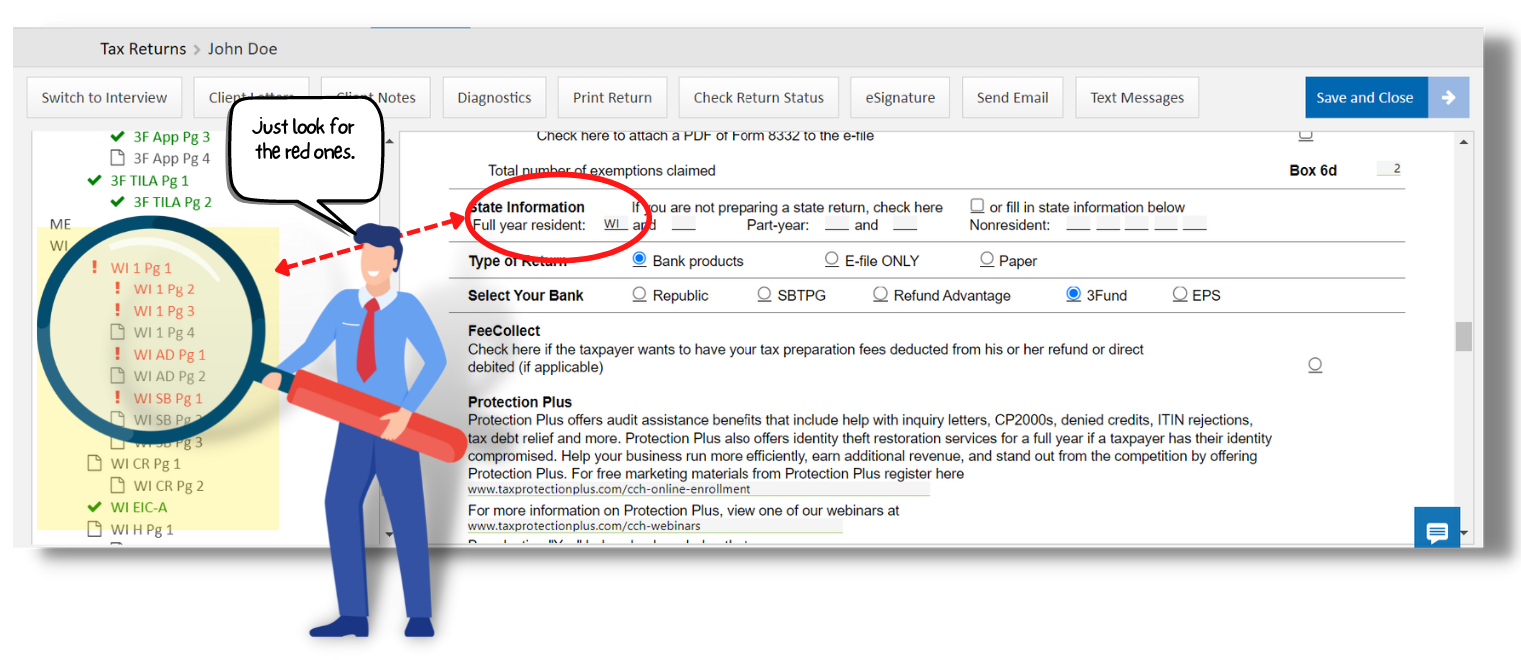

A. Form WI 1 Pg 1

- On this page, here's what you need to do

- We prefer to go paperless, so check that.

- Fill in the name of the city, village, or town, and county and school district

- Then, click the appropriate filing status of the taxpayer.

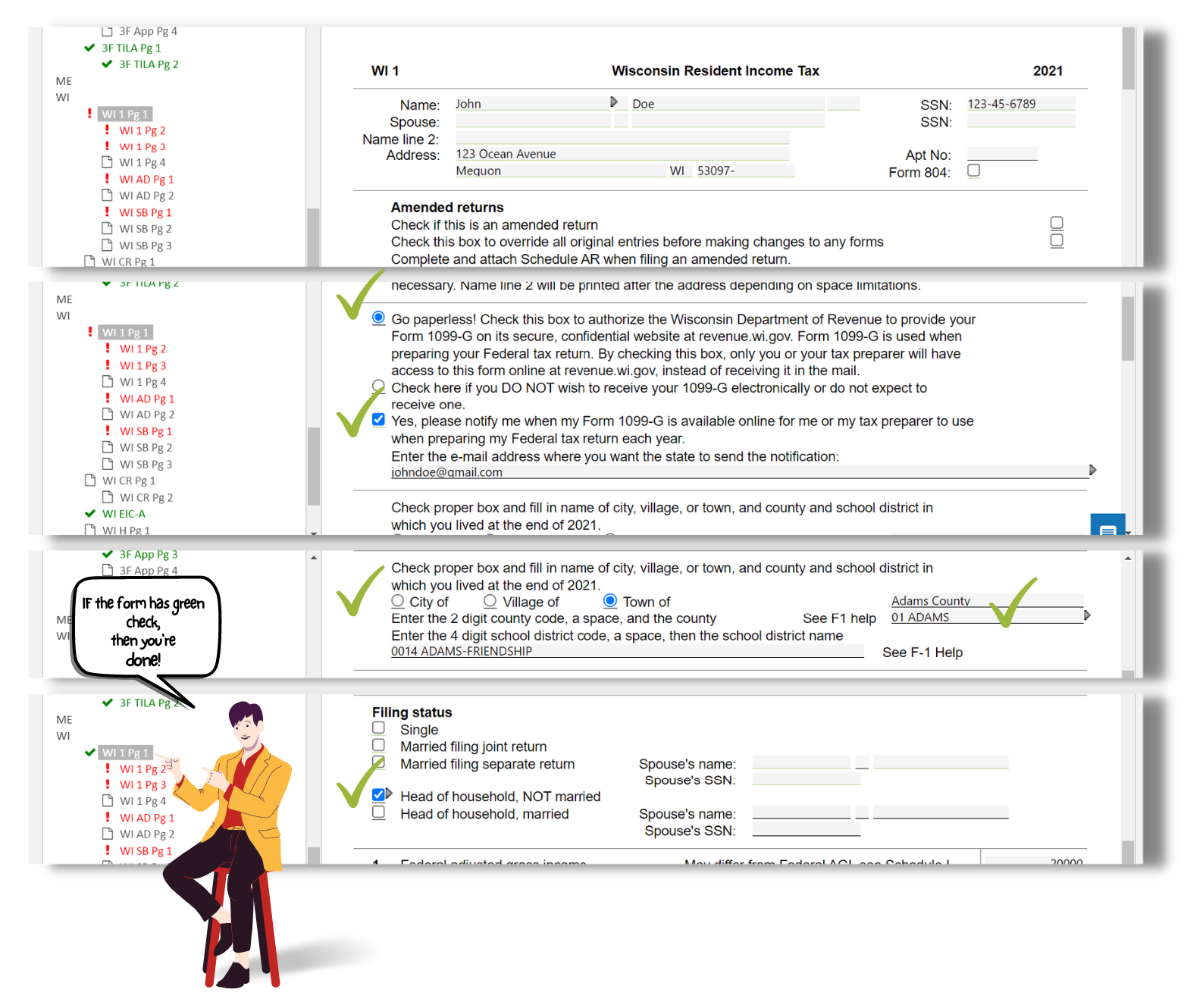

B. Form WI 1 Pg 2

(See below image)

(See below image)

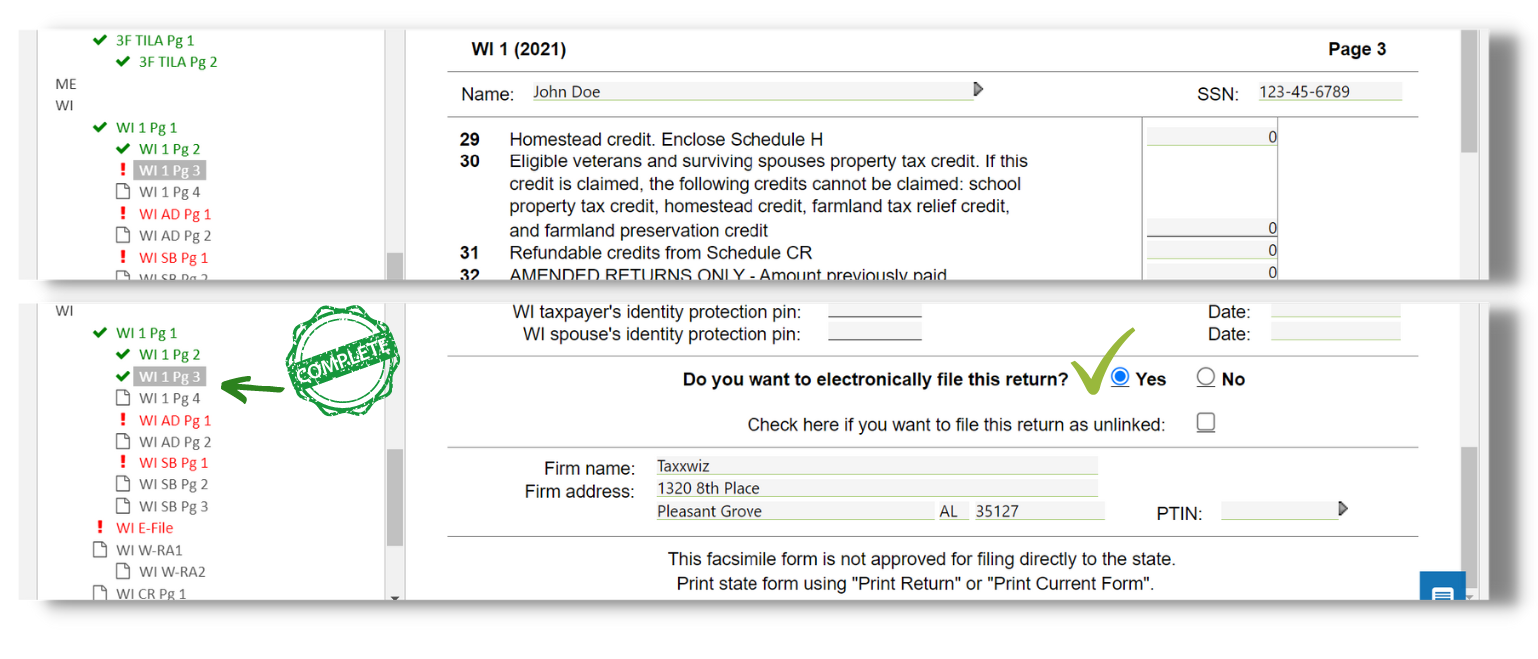

C. Form WI 1 Pg 3

- On this page, just confirm if the taxpayer wants to file this return electronically.

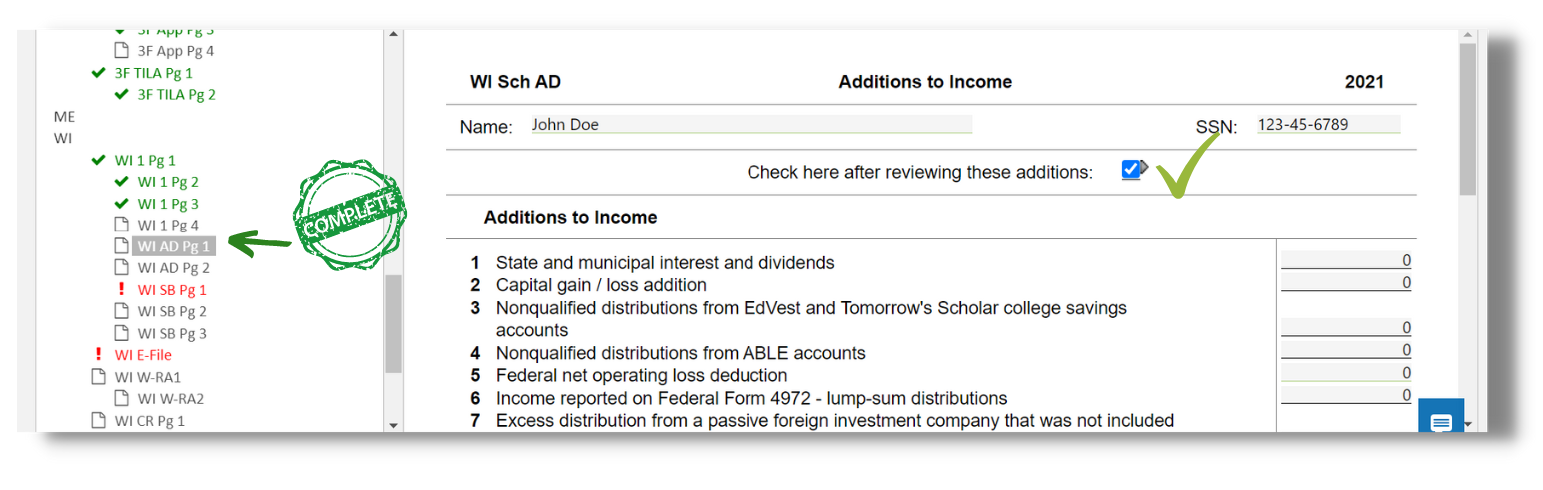

D. Form WI Sch AD

- You can input here the Additions to Taxpayer's Income

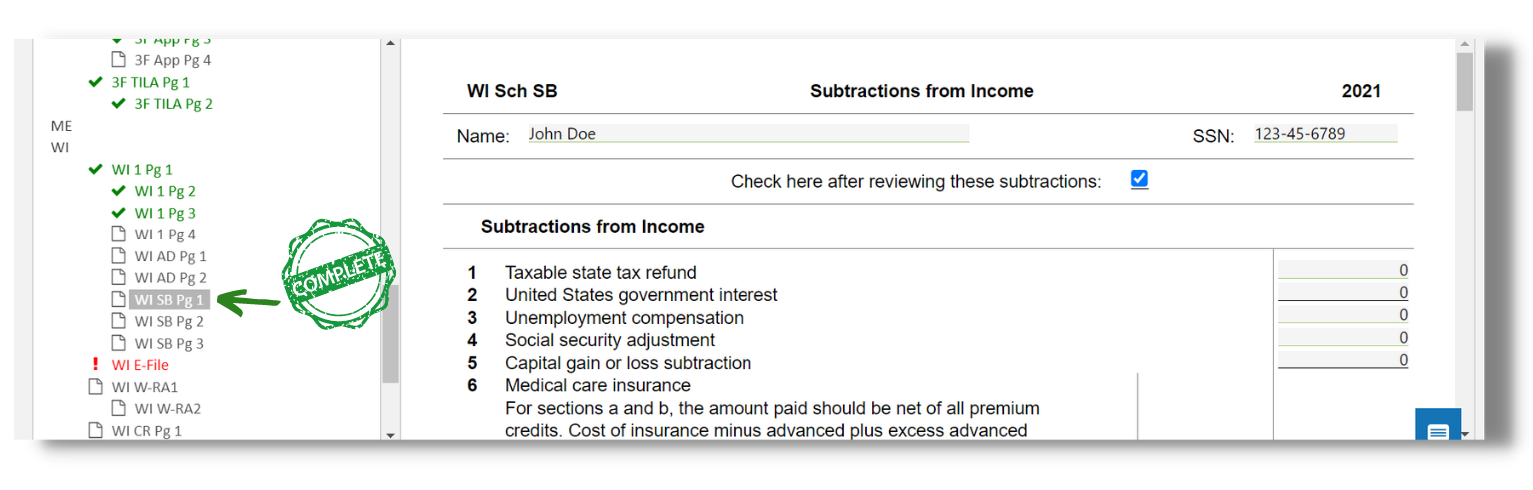

E. Form WI Sch SB

- You can input here the Subtractions to Taxpayer's Income

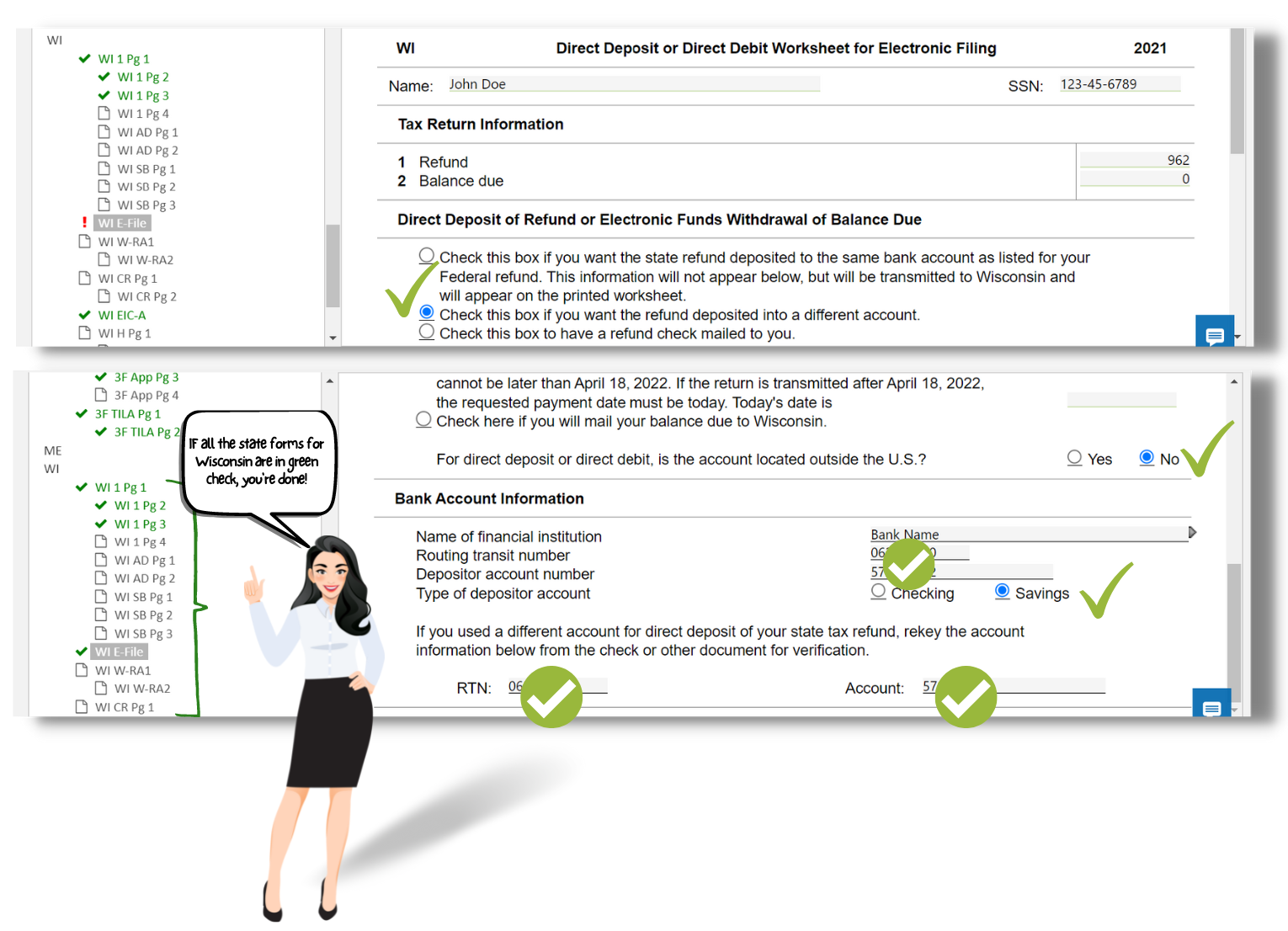

F. Form WI (E-file)

- Under 'Direct Deposit of Refund or Electronic Funds Withdrawal of Balance Due,' we prefer to choose the option where the refund is deposited into a different account.

- Then, enter the bank details as needed. Please make sure they are 100% correct.

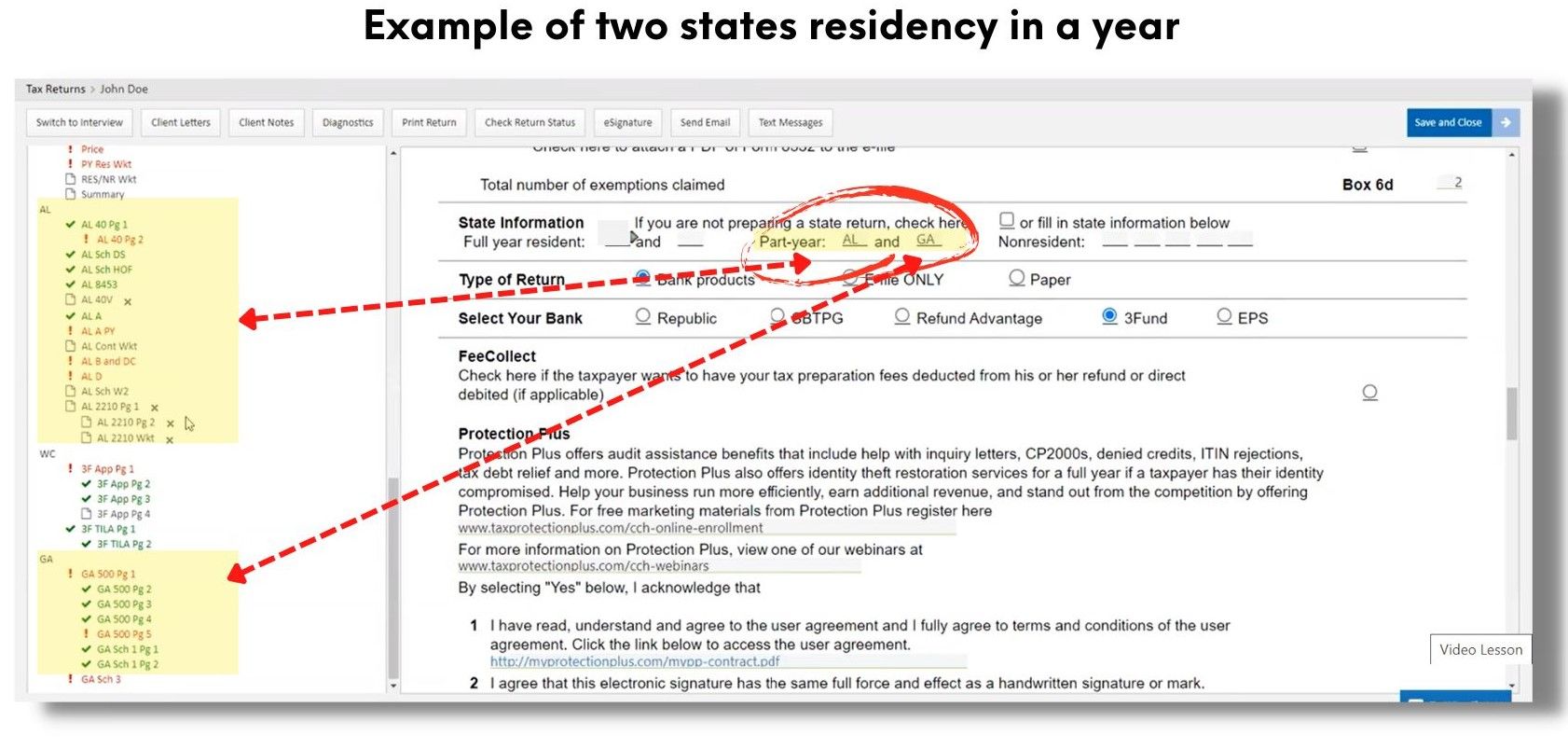

G. If the Taxpayer has two states of residency in a year, you need to fill it up as shown below; the state forms you need to enter will automatically appear.

Who we are

We are committed to building people and creating world class entrepreneurs, communities and technology to make the world more efficient.

Featured links

-

Graduation

-

Courses

-

About us

-

FAQs

Get in touch

-

Your email

-

Your phone number

Connect with us

-

Facebook

-

Twitter

-

Youtube

-

Instagram

-

Linkedin

Copyright © 2024